Why we should not need banks

Hector McNeill1

SEEL

In the article concerning money, "The Real Incomes Objective, inflation and deflation - A note" under the subheading " Saving without banks", I wrote the following: "Under current circumstances monetary policy has liquidated the benefits of bank savings accounts because of close to zero interest rates and inflation eroding the value of money. However, with a steady deflation rate, the value of money rises as it would with an interest rate but without the need for a bank savings account. When interest rates were slightly higher this is not a situation banks would favour since people would have less need to use bank savings accounts or even credit. Which, in terms of consumer risk, is preferable." |

This has significant implications for policies with a real incomes objective. This article explains the implications. |

Inflationary leakageThe article,

"The Real Incomes Objective, inflation and deflation - A note", reference is made to "inflationary leakage". This refers to the rise in the prices of land, real estate prices and rents which are significant expenditure items in the goods and services consumption markets. Therefore, as a direct outcome of the impact of monetary policy on asset markets there is a connection between asset and consumption markets which creates inflation. This is what is meant by inflationary leakage.

The value of moneyThe direct impact of bank funds fueling the inflation in asset markets, and the leakage into consumption markets, has the effect of devaluing the currency because with such price rises less can be purchased with a given number of currency units (nominal disposable income); this is why real incomes decline. This generalized inflation which is the result of monetary policy is associated with two rates of change:

- inflation rates

- interest rates

Since the banks lend out money as a profit-earning business, they charge at least 6% over the inflation rate or base rate. Businesses raising loans usually make use of two estimates of Economic Rates of Return (ERR). These are Cost-Benefit Analysis (CBA) or Internal Rate of Return (IRR) these calculations are made to check to see if an investment generates enough return to outstrip inflation and pay the interest rate. In the case of consumers raising loans, they need to make sure their prospective income over the period of a loan can cover the repayment premiums. Throughout these transactions there is a trade-off concerning the resulting value of the currency held by each party or their resultant real incomes.

A microeconomic example

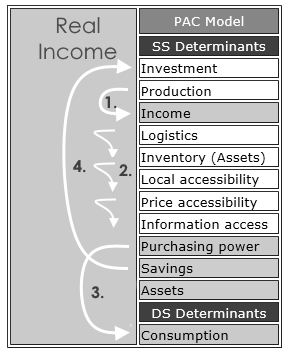

Key:

SS Determinants:supply side factors

DS Determinants:demand side factors are consumption established by incomes paid to the workforce by companies, nominal incomes paid, unit prices and price elasticity of demand. |

To understand the actual dynamics of this situation, imagine that the economy consists of one bank, one sector, and constituents. If the sector invests in processes that raise productivity and the sector reduces its prices by 50%, both the banks and the constituents end up holding a currency that has doubled in value in terms of purchasing power for available goods and services. Therefore without charging interest (the bank) and a consumer without being paid interest on a savings account, have both ended up with more purchasing power. Both the bank and the constituents have gained in terms of purchasing power and real income.

This outcome has occurred without reference to monetary policy since there are no interest rates involved and no variations in money volumes. This is why the deflationary impact of technologies and techniques is so important. This is also a simple way to explain the underlying operation of policies with the real incomes objective (RIO).

It is self-evident that the more rapidly companies can improve their productivity and less dependent we become on monetary management factors since unit prices in the goods and services consumption markets are stable or declining and real incomes stable or rising.

Moving from this microeconomic ideal to the macroeconomic realityAs additional enterprises and constituents are added it is evident that the capability of different companies within different sectors to sustain rising productivity will vary significantly. This only spells out to us that any macroeconomic policy hoping to maximize productivity growth needs to be able to adapt to the specific circumstances of each company. Clearly government intervention of different markets such as money volume in asset markets and centralized interest-rate fixing is going to impose strong differentials in the ability of companies to respond. With inflation raving in asset markets and leakage into the goods and service consumption markets the purchasing power of consumers, who earn their incomes from the corporate sector, are being depressed. There is therefore little incentive to invest by paying in excess of 6% interest rates because market prospects are not clear. 6% p.a. represents a cumulative rise in costs of 79% of the loan over a 10 year period arising from the interest rate alone. The same amount or return to the bank would result if the company paid no interest but paid back the bank in currency which gained value at the rate at which the company lower unit prices. However, this would not work unless all companies talking loans, or not, were raising their productivity and lowering unit prices. It is with this in mind that policies with the real incomes objective operate. As the quality of investments increases the ability of companies to lower unit prices results in a real incomes multiplier within the economy which not only generates an impulse through the economy for growth, this growth is not measured in terms of nominal incomes of monetary turnover (GDP) but in terms of real incomes. For many economists this creates a problem of measurement because real incomes vary according to the contents of the specific consumption baskets each type of consumer and this varies with income levels and other factors. But then, why does this matter? In an economy, which most express, should be promoting freedom of choice of constituents, and not of economists, and safeguarding real incomes, policies with the Real Income Objective come out well ahead of the options available in conventional policies based on the aggregate demand model, QTM and other flawed concepts.

The promise of additional policy optionsA problem with conventional policy frameworks is the threadbare toolbox of policy instruments. However, the encouraging outcome of this discussion is that this re-evaluation of deflation and technological change expands the number of policy instruments available to policies pursuing the Real Incomes Objective (RIO). Currently emphasis is on incentives to companies to invest to increase productivity while reducing unit prices through the price performance ratio (

PPR), linked to a price performance levy (

PPL). It would appear these could work effectively. However, at the same time, the above discussion shows that there is no particular need to make use of "money volumes" or centralized interest rates. The raising of debt by governments could become diminishing requirement as long as policies emphasize productivity in the corporate sectors. In terms of the free operation of interest rates. This could be actioned through regulations that introduce a sliding scale in interest rates charged according to corporate achievement in securing productivity-linked unit price reductions. Since the substantive contribution to the economy in terms of currency purchasing power can exceed the direct benefit to the bank even without the receipt of the interest payments since all of the funds help by a bank will have risen in value without the receipt of interest.

This extension to the range of policy instruments in support of Real Incomes Objective (RIO) policies represents a fertile field for analysis and further development. One of the immediate and evident results is that the RIO approach generates externalities which are generally beneficial in terms of a general rise in real income levels resulting from revaluation of the currency. This has significant implications for foreign trade, the balance of payments, exchange rates and relative levels of independence from dominant international currencies. It might seem that this approach is bad news for asset markets because of the positive impact on the goods and service consumption markets, but since the value of the currency affects all economic transactions the benefits are generic meaning assets could see a price correction without losing real value. Forthcoming articles will cover these issues.

1 Hector McNeill is the Director of SEEL-Systems Engineering Economics Lab.

All content on this site is subject to Copyright

All copyright is held by © Hector Wetherell McNeill (1975-2020) unless otherwise indicated