Hector McNeill1

SEEL

The PPL is an productivity incentive levy whose formula is heavily weighted by the price performance ratio (PPR). Thus the lower the PPR the lower is the levy paid. The PPL is not a source of government revenue and is not a fiscal instrument. The levy provides rebates in proportion to the degree that companies regulate prices through increased productivity so as to stabilize or reduce unit prices and thereby enhance real incomes by increasing the value of the currency. This article discusses some PPL formulae options and their effects. |

Policy - distribution of aggregate real incomes through a Price Performance Levy The objective of the Price Performance Levy (PPL) is to share out the benefits of lower PPRs and therefore the corporate contributions to real income levels between consumers, corporate ownership and employees. The measure of real incomes "performance" is the PPR (see

"Price Performance Ratio") so the PPL needs to respond to the PPR in a equitable fashion by allowing this performance measure to provide a fair net of levy position. This is essential for microeconomic management to gain transparency and predictability of outcomes in terms of their establishing a PPR value according to the expected net of levy real incomes benefit.

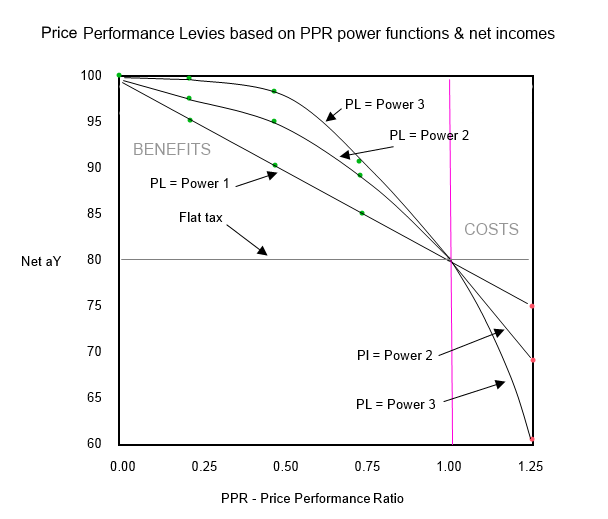

Examples of Price Performance LeviesThe Real Incomes Approach provides for a very large range of options for applying PPLs to aggregate incomes according to the PPR. Below two types are discussed. The basic calculation of PPLs is to apply a corrective coefficient based on the PPR value to a Basic Levy expressed as a percentage e.g. 20%.

Power functions to intensify impactWhen policy makers wish to change the intensity of size of the incentive to lower PPRs a power function can be used to calculate the PPL coefficient. Thus the table below shows the effect of different PPR power functions on the size of the Levy to be applied to operational margins with a basic levy of 20%:

Some PPL power functions applied to a basic levy of 20%

The percentages indicate the levy to be paid according to the respective PPR

For comparison a conventional tax or flat tax can be assumed to be 20%

| PPR power function |

| PPR1 | PPR2 | PPR3 |

PPR | PPL% | net aY% | PPL% | net aY% | PPL% | net aY% |

0.00 | 0.00% | 100.00% | 0.00% | 100.00 | 0.00% | 100.00% |

0.25 | 5.00% | 95.00% | 1.25% | 98.75% | 0.31% | 99.69% |

0.50 | 10.00% | 90.00% | 5.00% | 95.00% | 2.50% | 97.50% |

0.75 | 15.00% | 85.00% | 11.25% | 88.75% | 8.44% | 91.56% |

1.00 | 20.00% | 80.00% | 20.00% | 80.00% | 20.00% | 80.00% |

1.25 | 25.00% | 75.00% | 31.25% | 68.75% | 39.06% | 60.94% |

| Key: | Benefit | | Flat tax | | Prejudice | |

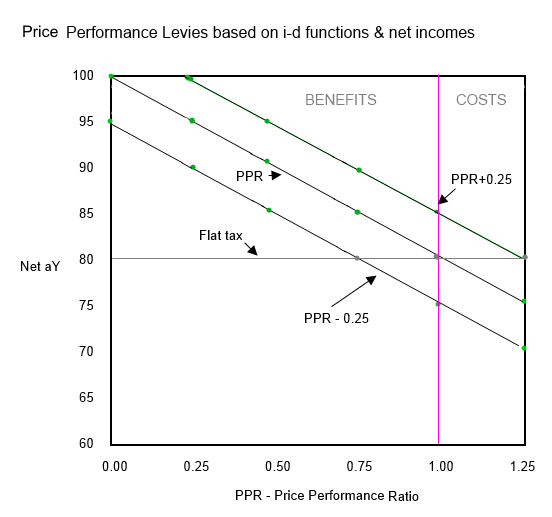

Slide or i-d functions for graduated impact

Some i-d functions applied to a basic levy of 20%

Slide or i-d functions for graduated impact

Some i-d functions applied to a basic levy of 20%

The percentages indicate the levy to be paid according to the respective PPR

For comparison a conventional tax or flat tax can be assumed to be 20%

| PPR | PPR i-c function |

| PPR+0.25 | PPR | PPR-0.25 |

PPR | PPL% | net aY% | PPL% | net aY% | PPL% | net aY% |

0.00 | 5.00% | 95.00% | 0.00% | 100.00% | 0.00% | 100.00% |

0.25 | 10.00% | 90.00% | 5.00% | 95.00% | 0.00% | 100.00% |

0.50 | 15.00% | 85.00% | 5.00% | 95.00% | 5.00% | 95.00% |

0.75 | 20.00% | 80.00% | 15.00% | 85.00% | 10.00% | 90.00% |

1.00 | 25.00% | 75.00% | 20.00% | 80.00% | 15.00% | 85.00% |

1.25 | 30.00% | 70.00% | 25.00% | 75.00% | 20.00% | 80.00% |

| Key: | Benefit | | Flat tax | | Prejudice | |

A note on conventional and flat taxes2

A note on conventional and flat taxes2In order to provide a comparison of the relative impacts of Price Performance Levy formulae and conventional and flat taxes one can assume in the above tables that the flat tax is where the PPR values are ignored and the tax remains at 20%. The Real Incomes Approach sets out to compensate companies for their contribution to real incomes whereas flat taxes and conventional taxes are neutral to performance and pay no attention to the contribution of the company to the increase in real incomes. Accordingly irrespective of the performance of a company the tax rate remains the same. Thus a company undergoing significant growth in nominal terms and generating a high return and profits might also be operating in a non-competitive fashion and in fact be a generator of inflation and contributing to the reduction in real incomes. This company will, under a flat tax regime pay the same tax rate as a company investing and achieving higher performance in terms of contribution to real incomes.

Under a Price Performance Policy the benefits accruing to companies who contribute to real incomes levels can be observed in the tables above and the accompanying graphs. Under the flat tax the net of tax is the remaining 80% of income. In the case of PPP net of tax income can vary from 80%-100% of gross income, that is levies of between 0% and 20% for PPRs below unity (1.00). Where the PPR is greater than unity (1.00) the flat tax remains the same with a net income of 80% of gross but under PPP the levy becomes a surcharge leaving, in the examples above, net incomes of 61% to 80%. Under PPP companies pay a PL at a rate

1 Hector McNeil is director of SEEL-Systems Engineering Economics Lab

2 Under the real incomes policy of PPP where the PPL is deployed there is in fact no corporate taxation so the comparisons with conventional and flat taxes does not really compare equivalent situations but the advantage of PPP is evident. All revenues under real incomes policies would normally come from personal taxation requiring, of course, reasonable rates of pay for employees made feasible by the more efficient allocation of resources and real income generation.

Update: 17th December 2018; correction of single numeric error in table; changed subheadings:04/06/2022.