QE has the effect of releasing cheap money to banks who are normally expected to pass on this benefit of low interest rates to companies for investment to enhance productivity and growth in production and services. However, these funds have not been used in this way but rather the QE policy has been abused and used to enrich bank shareholders and larger corporate client executive and shareholder incomes directly and not through investment in higher productivity production. This is a case book example of an extreme form of the

Cantillon effect.

The Cantillon effect was explained by Richard Cantillon (1680s – 1734) an Irish-French economist and author of

"Essai sur la Nature du Commerce en Général" (Essay on the Nature of Trade in General). In his Essay, Cantillon provided an advanced version the quantity theory of money, however he also dug deeper and perceptively into the relative inflation associated with the introduction, circulation and velocity of money. He explained that the original recipients of new money enjoy higher standards of living at the expense of later recipients. This is because of inflation in asset prices e.g. affecting house prices and rents and as a result of time lags impacted by a disproportionate relative inflation in prices of assets and goods decreasing value of money in the hands of non-asset holding individuals i.e. the majority. These concepts of relative inflation, or a differential rise in prices among different goods in an economy, is now known as the Cantillon effect. The Cantillon effect has two components. One is the impact of new money on differential inflation rates between assets and consumption items and, the other, is the real incomes and wealth effects that result in an increasing disparity in incomes and wealth within the country. Under QE this effect has been extreme because banks short-circuited money distribution largely to themselves and a reduced number of large corporate customers to deal in assets and share buy backs. It is self-evident that if rentiers maintain a growth in income that is inflation proof the state of their real income will constantly rise. However, this is not the case of the state of real incomes for an increasing majority of the population. This Bank of England "policy" has done little to help the conditions of the working population which is becoming increasingly asset-less. This mechanism constraining asset access and accumulation by the majority is a driver of an inevitable future increasing inequality.

Therefore the use of interest rates and money volumes as macroeconomic policy instruments create a significant structural problem of driving the economy towards an unsustainable state of inequality. This management tool is creating a state of affairs that is in contradiction to the constitutional provisions of equality of opportunity, treatment, fairness and the creation of economic circumstances that avoid differential constraints on access to opportunities for people to benefit from their participation in the economy.

The nature of asset-derived incomeThe purchase of an asset is somewhat like gaining copyright or a patent that prevents others from using a resource without the owner's permission and any use is granted in exchange for an income or, in the case of land, a rent.

In times past gaining income on this basis was associated with large land holdings, either urban or rural and political power tended to lie in the hands of assets holders. One reason is historical but one practical reason is that such groups have sufficient financial resources to sponsor studies and political candidates that undertake to represent their interests in parliament.

Thostein Veblen identified the problems we now face, back in 1921, well before the 1929 New York Stock Exchange crash, when he examined trends in financialisation and the growth in the rentier class in manufacturing and industry. Financialization is the process whereby all economic considerations are reduced to a nominal financial quantification usually measured in the local currency or expressed in a common currency by applying exchange rates.

The crucial problem with financialization is that what appear to be distinct policies or even schools of thought, such as Keynesianism or Monetarism, and supply side economics are in fact questions of emphasis on which aspect of financialization is more significant as a policy target. These are aggregate demand (expressed as a quantified monetary aggregate) or money supply (expressed as a quantified monetary aggregate). Increasingly economic activities involve so-called financial engineering where the manipulation of numbers substitutes for real production or services where income is received in return for little effort beyond the holding of some asset which generates an income from those who make use of the asset. This has created a major financial services activity that is made up of über-rentiers.

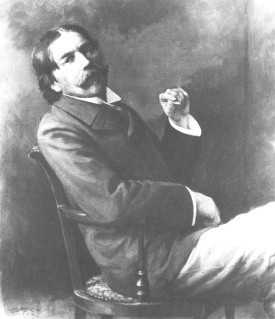

Thorstein Bunde Veblen

(1857-1929) |

|

|

Although many see this evolution as recent, it had already been detected before the Great Depression and, indeed, was to a large extent the cause of the Great Depression, and the crises in 1970s and now. The American economist, Thorstein Veblen

2 wrote in 1921 the following:

"Half a century ago it was still possible to construe the average business manager in industry as an agent occupied with the superintendence of the mechanical processes involved in the production of goods and services. But in the later development the connection between the business manager and the mechanical processes, has on average, grown more remote; so much so, that his superintendence of the plant or of the processes is frequently visible only to the scientific imagination... His superintendence is a superintendence of the pecuniary affairs of the concern, rather than of the industrial plant; especially is this true in the higher development of the modern captain of industry." |

Veblen considered this evolution to be associated with a change in motivation that brought to the fore financial manipulators, who sabotage and retard, rather than advance technological development. He considered success in the business world to wait on guile:

"The successful man under this state of things succeeds because he is by native gift or by training suited to this situation of petty intrigue and nugatory subtleties. To survive in the business sense of the word, he must prove himself a serviceable member of this guild of municipal diplomats who patiently wait on the chance of getting something for nothing; he can enter this guild of waiters on the still-born pecuniary gain, only though such apprenticeship as will prove his fitness. To be acceptable, he must be reliable, conciliatory, conservative, secretive, patient, and prehensile." |

So well before the first major financial crisis, Veblen has described the specific changes that would give rise to such crises. Because nothing in macroeconomic theory has sought to tackle these issues, the schools of economic thought have fashioned elaborate kaleidoscopes that do not dare tackle such basic flaws for fear of upsetting those who dominate the "pecuniary" affairs of the economy and who continue to promote increased financialization. It is understandable why Thorstein Veblen's seminal work is not widely taught in our schools of economics.

Thorstein Veblen pointed out the drift from an emphasis on physical processes to one of financial processes. The important factor, however, is that unknown to Veblen the subsequent evolution of economics saw macroeconomic schools embedding the very same negative evolution by giving increasing emphasis to nominal financial aggregates and paying far less attention to innovation, technology, technique, learning and production performance. Indeed chairs in economics have been endowed at many universities by the organizations that Veblen criticised creating a tendency for an enhanced emphasis on financialization. This problem of bypassing technology and innovation, that is a fundamental technological ignorance on the part of macroeconomic theorists, was pointed out in 1976

3 (See pdf: "

On the Problem of Technological Ignorance amongst KM Economists', Charter House Essays in Political Economy, 1981)

Clearly proposals for growth and escaping from the excessive debt generated by over-financialization are not going to come from Keynesians, Monetarists or supply side economists whose theories possess none of the necessary perspectives on technology and therefore lack the appropriate tools in their policy tool kits.

Constitutional dimensionsThe constitutional dimensions of this counter-evolution are significant. This can be appreciated by asking some simple constitutional questions. Who voted for the current financial crisis? Who voted for the solution imposed upon constituents by politicians? Who voted to become a member of the winners, losers of neutral policy impact groups generated by conventional economic policies? The answer to all three questions is no one! And yet, we consider ourselves to be constituents in a so-called democracy. The question is therefore why does the electorate tolerate this cavalier treatment by so-called representatives. The answer is that the large corporations, and financial intermediaries such as banks have effective lobbies that work so as to prevent the electorate from having any say in the very issues that determine their standard of living. This is done through politicians whose parties benefit from supporting the specific wishes of interest groups by by-passing processes where the constituencies would have some say in policy design. Financialization has led to a serious decadence in the quality of macroeconomic policy which now is geared to the interests of a small minority and political parties, themselves small private organizations with a membership of less than 1% of the electorate doing the bidding of the minority who survive on the back of financialization.

One dimension of the über-rentier characterization of banks is that they receive fee incomes and margins on interest in exchange for renting out funds which have been generated on the basis of entering numbers in a ledger and usually taking real assets as the collateral for the advance. QE killed off income from savings and substituted these funds by banks crediting lenders on the basis of the lender's collateral rather than by reserves arising from savings on deposit. This process of the banks being able to create money at no risk is explained in the Bank of England publication

"Money creation in the modern economy - Bank of England" Quarterly Bulletin 2014 Q1). Therefore bank credit creates deposits which can be used by borrowers, therefore the bank creates money and increases the money volume in the economy.

Economic policy needs to be shaped in response to the preferences of the social and economic constituencies in an equitable fashion. But politicians and influential interest groups prefer to leave economic decisions as a preserve of "professionals" or "experts". Since on the side of economists a flawed macroeconomic paradigm is applied and politicians appear to know no better, whereas other would appear to know full well but do not wish to upset their patrons, we have to endure a situation where no "alternative" policies are proposed that do not include the continuation of financialization.

1 Hector McNeill is the director of SEEL-Systems Engineering Economics Lab.

2 Thorstein Bunde Veblen, (1857-1929) was an American economist and leader of the institutional economics movement. His institutional economics was integrated with a Darwinian evolutionary approach. He made a basic distinction between the productiveness of "industry," run by engineers, manufacturing goods, and the parasitism of "business," which exists only to make profits for a leisure class. The chief activity of the leisure class was "conspicuous consumption" and their economic contribution being "waste," that is, an activity that contributes nothing to productivity. The implication was that the American economy was therefore made inefficient and corrupt by the businessmen. He considered technological advances were the driving force behind cultural change.

3 McNeill, H.W.,

"Price Performance Fiscal Policy - A Real Incomes Approach", Rio de Janeiro, 1976.

Posted November 2019