Real Exchange

A practical proposition for investment for a better distribution of real economic growth - Part 1.

Hector McNeill1

SEEL

This article is Part 1 of a 2 part article. It is not a complete story on the subject it addresses because this is an evolving subject pointing to deficits in the current application of monetary theory in practice. However, it has been posted to set out the prospects for ways to look at how to recover from the Covid-19 crisis but to gain traction through a general system that can continue into the future correcting many of the ills of the current monetary policy of this country. This article is Part 1 of a 2 part article. It is not a complete story on the subject it addresses because this is an evolving subject pointing to deficits in the current application of monetary theory in practice. However, it has been posted to set out the prospects for ways to look at how to recover from the Covid-19 crisis but to gain traction through a general system that can continue into the future correcting many of the ills of the current monetary policy of this country.

Part two will provide more details on the legislative and macroeconomic framework required for the proposed system to operate. This is a subject of importance given the stakes we all face and therefore the proposition made needs to be advanced with care in order to arrive at a practical and beneficial solution. |

Introduction

Kristalina Georgieva |

|

|

Kristalina Georgieva, Managing Director of the IMF declared in October 2020 that our time is the occasion to prepare for a "A New Bretton Woods Moment". In her statement she made clear that action is required to improve the state of the world economy. She highlighted three areas of required effort:

- The right economic policies - Prudent macroeconomic policies and strong institutions are critical for growth, jobs, and improved living standards and one size does not fit all—policies must be tailored to individual country needs. Beyond this, where debt is unsustainable, it should be restructured without delay.

- Policies must be for people - To reap the full benefits of sound economic policy, we must invest more in people. That means protecting the vulnerable. It also means boosting human and physical capital to underpin growth and resilience. Covid-19 has underscored the importance of strong health systems.

- The IMF's Role in tackling poverty - The IMF will continue to address the urgent needs of emerging markets and low-income countries—especially small and fragile states, helping them to pay doctors and nurses and protect the most vulnerable people and parts of their economies. This has allowed us to support our low-income members with debt relief and to triple our concessional lending.

|

She concluded by declaring that there is a need to "Seize the Moment" to build a more sustainable and equitable world. It is notable that Ms. Georgieva referred to finance in the context of basic human developmental issues without referring to the mechanisms required. On the other hand she emphasized "economic policies for people. This is to be welcomed. While not making any direct reference to problems with economic policies, her appeal for "right policies" infers that there are problems with our current policies.

So what are the problems linked to economic policies?

Since the breakdown of the Bretton Woods system in 1971, there has been a persistent problem of increasing instability in the financial system. However, this instability marked by bank crises have been caused by excessive money injection by central banks in shoring up asset prices and this is likely to continue. Money issuance controlled through monetary policy set by central banks and bank credits is the area where the main problems of the financial system lie.

But what is the problem to be solved?

The impact of financialization & quantitative easing

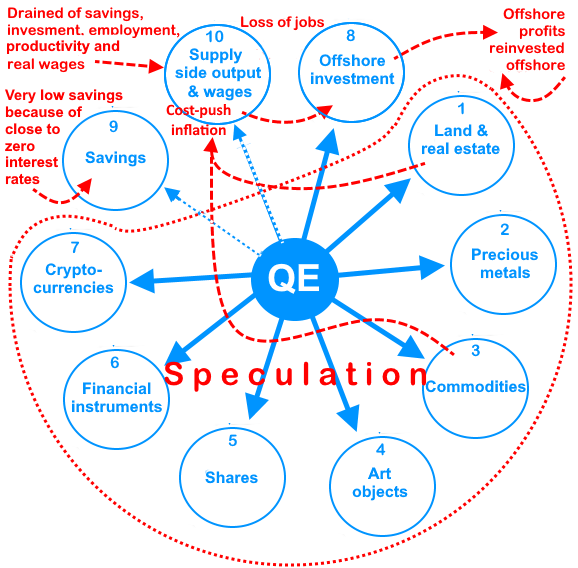

Excessively low interest rates and high volumes of money enter seven encapsulated speculative markets of: 1. land & real estate, 2. precious metals, 3. commodities, 4. art objects, 5. shares, 6. financial instruments and 7. cryptocurrencies. Money also flows an open market of 8. offshore investment. This market can become encapsulated through reinvestment of profits offshore and increasing employment offshore rather than onshore.

Greatly reduced flows to 9. savings because of close-to-zero interest rates, and to 10. supply side goods and service production paying diminishing real wages to the majority of the working population. |

Real Incomes development research has demonstrated that the quantity theory of money, a core foundation of monetarism, is a figment of imagination and that whereas central banks say they are targeting a 2% inflation rate in wage earner expenses, they simultaneously maintain a proactive promotion of inflation, well in excess of this target inflation rate, in asset markets.

The leakage from the asset markets for land, real estate and some commodities into the supply side and wage earners' costs, takes place through rising prices and rents of land, housing, retail units, offices, industrial units, parking services, port facilities etc which result in economic units having to raise their unit prices for products and services in the supply side or lose margins. This is how money injection causes inflation, it is an indirect impact resulting from asset speculation and NOT as the quantity theory of money states that prices rise as a direct result of the rise in money volumes. This lag or inability of money volumes to impact consumer prices is caused by most funding finding its way into encapsulated markets shown in the diagram on the right.

Specifically, inflation in wage-earner cost of living is caused by economic units setting unit prices in response to cost-push inflation and not as a result of "demand" as assumed under the aggregate demand model based on the Quantity Theory of Money assertions. In fact the result of aggregate demand management is to depress demand.

The dimensions of the asset markets far exceed the supply side and gross national products of most countries and are quite beyond the reach of monetary policy framework policy instruments limited to money injection, interest rates, fiscal taxation and government lending. As a result, on floating interest loans the impact of raising interest rates is now unpredictable. All attempts to do so during the last 12 years were quickly reversed because of the risk of causing a financial crisis.

The quantitative easing disaster

QE has resulted in a massive speculative bubble largely based on close-to-zero interest rate debt and much of the dealing in asset markets is being carried out by banks or closely allied large corporations and hedge funds who pay preferentially low interest rates. The levels of debt, both governmental and private, now exceeds the levels in 2007 and this contagion affects an increasing number of economies. The withdrawal of money from the supply side is exacerbated by prospects declining and therefore interest rates reaching unacceptable levels, justified on the basis of risk assessment, leading to low investment, declining productivity, falling wages and purchasing power and therefore real consumption and demand.

Dualistic economy

As a result, economies have become dualistic with a "successful" range of asset markets and a supply side occupied by the majority of populations in a market segment in a fully-fledged depression, marked by increasing pauperism in the form of increasing numbers of people needing additional help in the form of money or kind (food banks), even although they are employed. Politicians point to "how well" the economy is doing by pointing to the manipulated share prices where price bear no relationship or productivity, prospects or profitability.

Steps towards a "A New Bretton Woods Moment"

The rising controversy surrounding Bitcoin and other crypto currencies beyond the reach of central bank control and the notion of introducing Central Bank Digital Currencies requires that people pause and consider the first objective identified by Kristalina Georgieva as that of establishing the right economic policies. Without this blueprint being established no one knows what the required functions of a CBDC need to be. The systemic problem at the moment is that the IMF and Bretton Woods were nominally concerned with establishing viable monetary system with global relevance to development (reconstruction) and this underwrote monetary policy and monetarism as a growing and dominant component of national macroeconomic policies.

Why do Keynesians and monetarists attack Say?

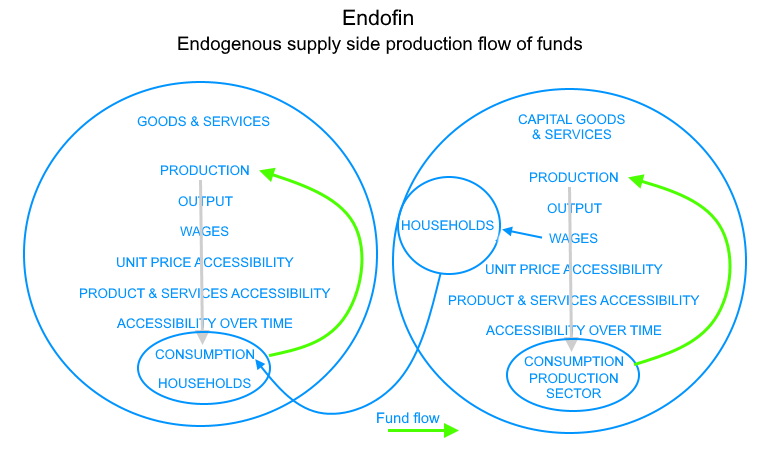

Jean Baptiste Say became the butt of criticism by Keynesians and monetarists more or less after Keynes published his General Theory. With time the reason has become very evident. The Say model places the source of demand as the expenditure of wage earners. Therefore a vibrant economy needs to be organized so as to afford adequate wages. This is achieved through saving from current incomes (endogenous money) and investing in improved technologies to raise productivity to reduce unit prices as well as afford higher wages and generate an overall growth in real incomes. Even without raising nominal wages, increased productivity and lower unit prices will increase the purchasing power of wage earners and therefore overall real economic growth. The Quantity Theory of Money (QTM) is used by Keynesians and monetarists to justify bank loans to inject more money into the economy to raise "demand". Therefore, over time, the objective has been to substitute people's freedom to use their own endogenous money to invest by earning profits through the provision of loans using exogenous money. At first reserve requirements of banks were reduced with fractional reserve banking, these restrictions were removed through money market trading and the growth in alternative financial instruments, many worthless, and then quantitative easing with close-to-zero interest rates destroying savings based on endogenous funds. Now, the long term result, of changes that started in 1971 has been an unprecedented growth in exogenous money injections and the atomization of the economy into encapsulated markets. This has proactively drained resources from the supply side and wage earners. In destroying the Say model, Keynesianism and monetarism have denied society the benefits of sound investment in appropriate wage-enhancing technologies and destroyed demand based on adequate purchasing power of wage earners.

By referring to the work of Jean Baptiste Say raises the danger of the population realizing the degree of destruction wrought by financialization and, for this reason, Say is given short thrift or his rational model is ridiculed.

To review why the QTM is flawed see: A Real Money Theory II |

|

|

The relatively stable supply side model running on endogenous money where personal incomes constituted the main source of consumption or demand was the Say model (see left). However, bankers and monetarists see exogenous funds as the way to drive an economy forwards on a profit-making basis and on the a peculiar assumption that more money creates more demand whereas the cumulative result has been that most exogenous funds flow into asset markets and deprioritize supply side activities as destinations for investment and real growth. This, as explained, leads to depression in the supply side and falls in the purchasing power of wages resulting in a fall in demand.

What do the right economic policies need to achieve?

It is self-evident that the independence of central banks distances their decisions from democratic accountability. On the other hand government can shrug their shoulders and assert that monetary policy is decided by central bank decisions. Under such a situation it would appear that handing a CBDC to central banks will simply undermine further this democratic deficit surrounding monetary policy. Kristalina Georgieva's second objective was to make economic policies for people. Now does she mean people driving up share values or speculating in land and real estate, or does she refer to the majority, most of whom are wage earners? We have to assume she is concerned with the majority and that, as she made clear in her statements, this extends to all in the rest of the world and, in particular, low income countries. The wellbeing of the majority is inversely correlated to the number and size of speculative encapsulated asset markets. These are identified in the diagram above right.

However, the very different circumstances in each country related to population age structures, income levels and economic activities, cannot be addressed by distant central bank decisions on money volumes. It is governments who need real time oversight and ability to manage how funds are distributed to increase productivity, to moderate prices and raise the purchasing power of the majority of citizens.

The reason monetary policy has no control over the growth in speculative markets is there is no oversight. Even when there is ex-post reporting on such market activities, nothing is done to attempt to encourage a reallocation of money flows towards higher productivity activities. In order to achieve adequate real time oversight and to use this to manage incentives to channel funds to achieve real growth, digital means provide a way to achieve this.

REX-Real Exchange

REX is a proposed digital currency where the name signifies "Real Exchange" in the sense of being the medium of exchange for an economy whose transactions, over time, have the objective of raising real incomes. The other underlying objective is to ensure that transactions and investments yield real returns either in the form of satisfaction of a consumer remaining content that what has been purchased is as expected or in the form of investments leading to a realistic and satisfactory cost-benefit. Put another way, economic activities and transactions need to be guided by realistic price-earning ratios. The overall economic model is not the Aggregate Demand Model (ADM) based on the Quantity Theory of Money (QTM) but rather the Production, Accessibility & Consumption Model (PACM) which approximates the Say Model. Production relates to the use of natural and human resources for the production goods and services for consumption as well as capital goods and services for other economic units. Accessibility relates to accessibility of output in terms of information on products and services available. unit prices and sustained future availability and support. Consumption is the resulting real flow of goods and services that those associated with supply side units can consume as a function of the purchasing power of their incomes and linked to the price elasticity of consumption. REX is a proposed digital currency where the name signifies "Real Exchange" in the sense of being the medium of exchange for an economy whose transactions, over time, have the objective of raising real incomes. The other underlying objective is to ensure that transactions and investments yield real returns either in the form of satisfaction of a consumer remaining content that what has been purchased is as expected or in the form of investments leading to a realistic and satisfactory cost-benefit. Put another way, economic activities and transactions need to be guided by realistic price-earning ratios. The overall economic model is not the Aggregate Demand Model (ADM) based on the Quantity Theory of Money (QTM) but rather the Production, Accessibility & Consumption Model (PACM) which approximates the Say Model. Production relates to the use of natural and human resources for the production goods and services for consumption as well as capital goods and services for other economic units. Accessibility relates to accessibility of output in terms of information on products and services available. unit prices and sustained future availability and support. Consumption is the resulting real flow of goods and services that those associated with supply side units can consume as a function of the purchasing power of their incomes and linked to the price elasticity of consumption.

Tracing and managing money flows

REX has two primary functions. One of to trace money flows in the sense of tracing issued finance by currency objects, in this case units of REX which have unique identification number like index number of bank notes, and then tracing where this money flows such as transactions in any of the encapsulated markets. Normally such financial flows, if they are loans, will be associated with a specific interest rate so the REX sum is split into some principal and interest rates and an agreed schedule for repayment. As is the normal practice under monetary policies, interest rates are used to stimulate or suppress loans as a way to raise of lower so-called demand for finance. In terms of national incentives the same basic principles can be applied but on the basis of a differential loading of central bank base rates. So banks providing finance to purchase shares, depending upon the government policy, might have to pay an additional fee or interest rate levy (IRL) on top of the base rate to discourage such purchases. This might appear to be a potentially arbitrary mechanism but it can also be used to bring share prices in line with price-earnings ratios that reflect the actual state of performance of companies. This would be based on a well-defined due diligence procedure for determining actual performance and corporate prospects. This can also include market P/E ranges linked to a moving average of actual rate and providing a transactional upper and lower range on prices. Other examples, but involving other encapsulated markets, can involve other IRL schedules according to the asset class.

Where there are appreciations in value in speculative markets a Capital Accumulation Levy (CAL), somewhat like a capital gains tax, can be applied to secure revenue while not discouraging participation in these markets. These could be applied to precious metals, art objects and cryptocurrencies. The table below sets out the different economic segments including the encapsulated asset markets and where IRLs and CALs can be applied.

| Supply side and encapsulated markets |

| Market | Land &

real estate | Precious

metals | Commodities | Art objects | Shares | Financial

instruments | Crypto

currencies | Offshore

investment | Savings | Supply side |

| IRL applied |  | |  | |  |  | |  | | |

| CAL applied | |  | |  | | |  | | | |

As in the case of "cooling" inflation down with higher interest rates this system can do this in a differential manner without harming consumption in the supply side product and service segments.

RBB-Risk bearing balance

Currently many bank loans rely on collateral to guarantee loans while in speculative markets the flow of funds almost have predictable outcomes in terms of the value of assets. Therefore the risk involved is lower than advancing funds to a small company. One way to encourage more funding of supply side SMEs with reasonable interest rates and reduced collateral is to link bank loan portfolios so that IRL and CAL revenues can be transferred to provide a subsidy to lower such interest rates and collateral requirements but based on a complete due diligence Decision Analysis Brief (DAB). A DAB is an independent feasible economic rate of return (ERR) analysis for the application of the loan. In the spirit of Schumpeter's explanation that profits are the guarantee of future operations and of employment, DABs might be extended to include employment impact criteria.

NRP-National revenue portfolio

This system with complete real time oversight does not have to await unfortunate outcomes to adjust IRLs, CALs and the degrees of RBB. A National Revenue Portfolio can be managed on a regular basis to tweak these instruments to maintain investment in high quality technologies with an eye on employment implications which will be apparent from DAB contents.

The objective is to keep required funding in the supply side activities to promote better quality investment, rises in productivity and real incomes.

The ordering of investment priorities is naturally the responsibility of each company and its management working with or without participatory involvement of representatives of the workforce.

How are investments selected to minimize risk?

The selection of investments to maximize short to medium term returns is best based on TARI-time adjusted return impact rankings. These are described in the article, "A constitutional economic policy - Part 7 Designing a sustainable future - Step 1"

Business rules

It is important that to gain headway in redistributing economic activity to the supply side to provide the companies with business rules or guidelines to ensure that their decisions help lever the incentives under REX system to maximize corporate, management and workforce real incomes. This involves a need for transparent procedures to guide decision making. The next part of this article, which will be posted soon, goes into the required legislative and macroeconomic policy framework, structured of make all of this a success.

Oversight and privacy

Although REX system traces REX units and type of transactions and applies IRLs and CALs, it applies these to the REX transactions in real time and therefore does not need to know the identity of the transacting parties. The focus is on where and what the money is being used for. The levies apply automatically as transactions take place, in real time. Therefore there are no privacy issues and no misleading accounts. The actual operational logic for this system is based on locational-state theory (LST).

Technologies

REX would make use of a database that uses immutable record keeping such as an Accumulog or blockchain. A national system, for example for the UK, would be large, but existing database technologies and even open source programs can be used to implement such a system. In terms of operating NRPs, decision analysis techniques, including operations research algorithms, can be used to optimize portfolios to meet specific national performance objectives.

Government revenue

The question of government revenue will be covered in the next part of this article because this needs to be placed in the context of injurious current legislation concerning corporate taxation and the impact of this on wages and therefore sources of revenue. However, under a real incomes policy, the objective is for wages to be at a level that a wide range of government provisions will not be required, or at least public services can operate under the same macroeconomic framework and business rules as private sector operations, while remaining in public ownership. By relating public servant pay to the same business rules, the efficiency and effectiveness of public sector services can be raised. There are services that should remain public sector rather than be private; this topic will be covered in Part 2 of this article.

1 Hector McNeill is the Director of SEEL-Systems Engineering Economics Lab.

All content on this site is subject to Copyright

All copyright is held by © Hector Wetherell McNeill (1975-2021) unless otherwise indicated

|

|

|

|