| This is a reposting of an article that first appeared in Emancipation in April, 2013. It has been altered so as to include advances in the Real Incomes Approach that have occurred since that date. A box covering the last three sections explains some of these advances. |

After a period of some 30 years between 1945 and 1975 Keynesianism as macroeconomic policy unraveled rapidly under slumpflation. Now the alternative, Monetarism, in spite of denials by the head of the Federal Reserve in the USA, has, after another 30 years began to unravel under similar circumstances to a deflationary slump.

The form of the current crisis was predicted in 1976

1 in an analysis undertaken by Hector McNeill on the failure of Keynesianism stating that a similar end could face the then advancing policy option of Monetarism.

KM policy weaknesses Another shorter paper published in 1981

2 summarized the main weaknesses of Keynesian and Monetarist approaches referred to as KM policies. Both create policy-induced cycles because KM policy variables affect target variables only in an indirect manner.

Macroeconomic policy needs to support the objectives of a diverse economic constituency ... |

Thus under demand stimulation or suppression the government has no immediate means to prevent overshoots in the direction of price inflation or in the degree to which demand is suppressed. This problem is well known and has been described as a policy string being able to pull the economy in either direction but that you can't push on a string.

The diverse constituency Attention was drawn to the effects of the diversified policy constituency in the United Kingdom.

Policy outcome perversityThus the vast array of specific conditions facing companies and individuals in the economy, the policy constituency, is bound to result in any particular policy move having widely differing outcomes. There exist distinctions between "the general good" as defined by policy objectives and a range of perverse policy impacts which might be called the "sub-group bad". These perverse effects can vary from corporate failure, increased unemployment and mortgage holders losing their houses at one end of the policy spectrum to price inflation undermining real incomes and profits at the other end, and much in between. Thus the direct impact of policy across the policy constituency is highly differentiated and ranges from serious negative consequences to something equivalent to neutrality as well as direct benefits; it isn't at all, all easy going.

Shifting sandsMcNeill pointed out that considerable cross-currents influence the effectiveness of KM policies because such macroeconomic management is run as a supplemental overlay to several parallel processes all of which influence the economy including:

- laws and regulations on accounts and taxation of all kinds

- annual budgets

- warfare

- changes in key exchange rates

- any legislation with economic and financial implications initiated by Parliament

- any legislation with economic and financial implications initiated by the European Commission

- undertakings made within international forums such as the General Agreement on Tariffs and Trade

- bi-lateral development & trade agreements.

These impact the outcome of macroeconomic policies. In addition the unpredictability associated with the "pushing on a string analogy" which applies to KM policies in isolation is exacerbated by considerable additional unpredictability in outcomes relating to:

- policy instruments operating only indirectly on demand

- the policy constituency being very diverse

- the shifting of position of priority target indices

- the existence of many significant economic cross-currents emanating from other domestic and increasingly foreign spheres

KM policies lack predictability and threaten welfare in an uncertain world

McNeill concluded that it was evident that KM policies did (do) not provide a robust form of management capable of delivering the requisite levels of predictability in a world where trading relationships are becoming more complex and in some cases, such as the European Union, regulated. In the case of critical natural resources such as energy, KM policies are ill-equipped to manage the economic impacts from significant price rises. This has important implications for the welfare of the people of Britain now and in the future.

Decoupling of indices disorientates policy priorities

Although aggregate demand is considered to be the "governor" of the economy, at any particular time in the policy cycle different indicators will rise to dominate the current attention of policy makers. Thus unemployment might become something of concern, or attention might be deflected by rising inflation. On the other hand declining investment might be tied to interest rates having been set at too high a level.

Independence of interest rate setting has little traction when indices diverge, in fact policy outcomes can become arbitrary and, in some cases, perversely discriminatory against some economic units...this is a serious constitutional issue. |

Things can get out of hand when several indicators rear up as issues for attention. Thus our experience with slumpflation is a good example of a combination of everything going "the wrong way", that is falling demand, employment and output with rising inflation. By way of contrast currently we have close to zero inflation, low interest rates and widespread recession.

The current state of affairs

Recently, McNeill stated that the same type of division of indices is occurring today with banks being severely constrained in their ability to lend resulting from imperfect information concerning risk, even at low interest rates. This state of affairs has arisen following falls in portfolio component performance caused by failures in cash flows dependent upon several key, largely USA-based, indices. In this case the indices were ratings of mortgage holders (ability to pay), the percentage of asset value guaranteeing loans advanced, general inflation, interest rates, current and asset price futures and exchange rates. The overall risks are higher for foreign holders because indices can move "the wrong way" with respect to inflation, exchange rates, interest rates and asset prices. Since the negative movements tend to move together the impact on the foreign held values of such "derivatives" can be disastrous. On top of this the multiplier effect intensifies interest rate rise pressures creating a demand for higher rates of mortgage payments forcing defaults on already stretched mortgage holders leading to rising requests for repossession. In terms of collateral for failed loans, many such assets are falling in value causing net losses on the associated loan cycles. The outcome is a declining value of portfolios and therefore of the ratings (share values) of those who hold them.

From confusion to positive tractionIn a recent tutorial

4 McNeill expresses the opinion that, as in the 1970s, economic policy decision-makers now, through their inability to identify policies which demonstrate a high degree of outcome certainty, or ability to avoid possible perverse side effects, only help contribute to confusion and an undermining in market confidence. Their propensity to discuss options in a somewhat hapless fashion by referring to different indices only serves to confuse the public and, in many cases, businessmen.

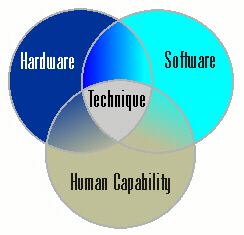

The significance of Technique

Technique: is here defined as the way in which humans apply technology and this involves a learning process through which capabilities in the application of techniques, that is skill, advances to enhance the overall impact of technology.

In real income terms people's experience and skills, beyond applying technology in the workplace, extend to other pursuits and the environment within which such real incomes-enhancing activities occur. Real incomes represent a space within which each person can exercise their individual freedom of expression, formulate ideas and shape their preferences on all aspects of life relevant to them. It is through the refining of technique that each of us learns what we can achieve and what is possible. Real incomes is not just a bare economic statistic but is holds within it, for each one, what can be secured from life itself. Just as the economic constituency needs to be served by economic policies which serve their will, so, as social communities, people are better served by governance capable of providing a responsiveness to their social preferences. |

|

In the 1981 paper

2 McNeill makes a significant criticism in his consideration that the overall KM policy environment weakness arises from what he calls a "lack of traction"; this has a specific meaning. Thus it is stated that, "...

current policy instruments do not gain enough traction over the decisions of companies and individuals within an economy to shift activities towards a mutually acknowledged beneficial state. However, McNeill observed that a transition to this state of affairs should not be accompanied by the current assumptions that macroeconomic policy can continue to operate on the basis of the expensive luxury of monopoly interventions in markets (a subject expanded upon in another paper

5 ). He states that,

"For any policy to gain the level of traction necessary to secure a direct control over a prime index (target variable), this prime index needs to be acknowledged as one which represents a common objective of the policy constituency, the economy and the electorate of the United Kingdom."

Note on theoretical advances

The early manifestations of propositions on the Real Incomes Approach, during the period 1975 through 1981 spoke in terms of a "Real Incomes Fiscal Policy". This analysed the impact of the policy in terms of net of a tax. based on the price performance ratio, on corporate profits. McNeill was never content with this analysis however because of the pervasive distortions introduced by fiscal policy, monetary policy and the profit paradox (See: The fiscal paradox, The monetary paradox and The profit paradox).

In November 2014 McNeill made the following statement:

"In mid-October 2014, I came across an article by Peter Drucker on the Forbes site entitled, "Keynes and Schumpeter" which compares the approaches to economics adopted by Joseph Schumpter and John Maynard Keynes. In one section Drucker describes Schumpter's view on the role of profits as the foundation for future activities and employment. For many, this explantation might be appear to be of no significance but, within the domain of the Real Incomes Approach which has evolved over the last 40 years, it is of fundamental importance. Schumpeter's role of profits, bears little relationship to the current role of practice under the incessant pressure of financialization, the concept of "shareholder value" and government revenue seeking activities within legally founded regulatory frameworks for accounting and audit. The result of these pressures is a de facto impossibility for managers to optimize resources allocation and the creation of a dangerous motivation for proactive labour substitution, an active constraint on wage increases of employees and a growing incentive for corporate tax avoidance already estimated to involve significant financial resources. In the background real wages are declining and profits rising as a percentage of national income leading to a cost of living crisis that faces in increasing proportions of the social constituencies. This in turn is reducing the options for revenue collection by governments to supoport public services. Inadequate attention has been paid to the current role of profits which have become perilously ill-defined and abused and, as a result, we have seen repeated disastrous business and macroeconomic policy failures in so-called free markets within which economic activities whose decisions are orientated by the "profit motive". We have come full circle only to re-enter an age where the role of profits has become so perverted as to take on the role that provided Karl Marx (1818–1883) with the opportunity to refer to profits as "excess production" robbed from the workers.

Schumpter's function of profits represents a "profit paradox" (See: The profit paradox), since Schumpter's view is almost an anachronism but, in my view, correct. The impact of Schumpeter's analysis in terms of the Real Incomes Approach has been to clarify some unresolved issues related to the role of profits in resource allocation at the level of the firm and the impact of this relationship to the macroeconomy. Indeed it points to a more transparent microeconomic model that is used as a coherent component of an integrated macroeconomic model which has always been the objective of the Real Incomes Approach.

As a result of this finding all of the essays, notes and briefs published or issued since 1975 under the series "Charter House Essays in Political Economy" and "Leading Issues in the British Economy" are undergoing review to be revised where necessary. This will help link all publications into an overall improved theory as well as policy propositions where the "profit paradox" has been eliminated

Original essays will be preserved in an archive for the purposes of maintaining an accurate record of the development of the Real Incomes Approach"

McNeill introduced a modification into accounting categories by replacing profits by investments in technology and human resources and substituting the profit category as the return on economic activities by the real incomes of ownership, shareholders, management and employees. Corporate taxation was eliminated and replaced by an incentive levy, the price performance levy. |

|

|

McNeill explains that traction can only be obtained, that is the target variable will only move in the direction desired and as far as appropriate, if the economic participants acknowledge that an agreed "prime index" can be used to constitute a basis for establishing economic activity objectives at the microeconomic level. Leading from this, the motivations of microeconomic decision-making would become coherent with agreed macroeconomic policy targets. This gives rise to a completely different approach to macroeconomic management in that rather than being dominated by government monopoly interventions made on the basis of imperfect information, outcomes would be determined by the rational decision-making of the diverse units of the economic constituency. McNeill also explains that it is important not to use multiple indices but rather a single prime index, he proposes real incomes, to measure GNP.

Determining real incomes not as simple as might be assumedMcNeill provides an explanation as to why real incomes are not what economists generally assume them to be but the very fact that real incomes are in reality a very complex domain within which individuals and companies can create their own values and worth causes real incomes to be the most suitable prime index for an economy, such as that of the United Kingdom, with diversity of economic units and interests all with changing preferences. This has important political and constitutional implications as set out in another paper

6.

A proactive policy for developmentThe last step in gaining traction, that is having macroencomic policy achieve what everyone desires, is to get rid of the "overlay" nature of macreocomic policies acting in an interventionist monopoly fashion in different markets and, in particular, on the rental market for money by setting interest rates. To achieve this a real incomes policy, as an alternative to KM policies, is proposed as a basis to integrate the controlling policy variable into fiscal policy, corporate and personal accounts and taxation.

A real incomes policyIn 1981 in another paper McNeill proposed a macroeconomic approach called Price Performance Fiscal Policy

3 which measures outcomes of economic performance in real income terms. Companies who effectively lower the rate of unit price increases over cost increases, and thereby enhance purchasing power (real incomes) end up paying lower taxes. On this basis they end up with higher real net profits (See the box on the right). On the other hand those who increase price rises relative to cost rises pay higher taxes and a net reduction in per unit real profits simply because they are eroding purchasing power and real incomes and generating inflation.

Price Performance Policy can help stimulate innovation directed towards enhanced real incomes, international competition and national welfare... |

Innovation through technology & techniqueThe way the fiscal levy works provides a positive incentive for the seeking out and investing in technological innovation so as to lever the tax regime to create real financial resources helping companies and their work forces progress more rapidly down so-called learning/cost curves. The broad impact is a higher output and low unit prices for goods and services and therefore economic growth resulting from the enhancement in the level of purchasing power in the economy. This approach to fiscal policy is radically different from KM policies largely because of the significant difference between the nominal and real indices applied.

Supply side?If readers suspect that this sounds like supply side economics then they are right. However, in other analysis McNeill explains what was (is) known as supply side was associated with Monetarism and is essentially a fiscal policy and therefore there was no sustainable traction. Its first major application had disastrous outcomes in terms of income distribution distortions and government deficits (See:

Some evidence on the failure of supply side economics) also, in had a poor outcome on income distribution . Indeed, he observes that supply side was moved from centre stage fairly soon following 1981 and it ended up being an appendage to Monetarism in an environment where the Keynesian multipliers persist. According to McNeill the priorities were, and are, inappropriate in an increasingly competitive world economy and this arose from the failure of KM policies to take into account the historic role, as well as the future potential, of technology and technique (see box above) in bringing relevance and traction back to macroeconomic policy. McNeill covers these aspects of KM technological ignorance in another paper

7.

1"Inflation, Its Control through Price Performance Fiscal Policy," McNeill H.W., Rio de Janeiro, June 1976.

2"Notes on Real Incomes Policy - An outline", McNeill, H.W., December 1981, HPC, ISBN:907833-05-5

3"Price Performance Fiscal Policy - A Real Incomes Approach",McNeill, H.W., August 1981, HPC, ISBN: 978-0-907833-00-4

4"Is there a problem?", The Real Incomes Approach Tutorial Series, McNeill, H.W., February 2008, HPC, Real Incomes.

5"Price Fixing, Quotas and Restricted Markets - Free and constrained markets", McNeill, H.W., December, 1981, HPC, ISBN: 978-0-907833-15-4

6"Moral Philosophy and Political Economy - Individual preferences and the economic motivations", McNeill, H.W., December, 1981, HPC, ISBN: 978-0-907833-20-8

7"On the Problem of Technological Ignorance Amongst KM-Economists", McNeill, H.W., December 1981, HPC, ISBN: 978-0-907833-10-9