Quantitative easing for people

Hector McNeill1

SEEL

One of the least well-explained elements in Jeremy Corbyn's economic statement of 22nd July, 2015 is "quantitative easing for people" (QEP). Any explanation of what it is, or how it would work, was lacking. However, one only had to wait to wade through the usual close-to-hysterical barrage of criticisms arising against an unexplained topic, as well as some more reasoned responses, to be able to recognise the basic logic of Jeremy Corbyn's position.

However, this is a complex topic, not in terms of how it would function, but more in terms of the likely forces that will work to undermine the whole concept. QEP would disturb too-comfortable extra-constitutional relationships that exist between international and national financial institutions, the private financial sector, some corporations, politicians and the media that support them. They are likely to attempt to destroy QEP if the idea gains momentum.

One of the benefits of Jeremy Corbyn's "style" is that it is gaining an energy similar to the SNP's' "conversation" that lasted several years leading up the the Scottish referendum and the electoral success for the SNP at the last election. Corbyn is raising important issues that need to be understood and discussed. If he continues in this mode and QEP is better understood the countervailing powers will be forced to acquiese but there is an urgent need for an effective strategy to deliver QEP that needs to take far more into account that "passionate" but glib attacks from other Labour leadership candidates.

As things stand, if Jeremy Corbyn maintains his conversational - and not set piece - approach probing and elucidating the options before the people of Britain, it is likely that in addition to having gained the leadership of the Labour party he will broaden the vision of the British political scene from its current intense parochialism to something more relevant to the challenges of the modern world. |

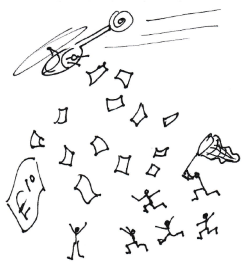

QE benefitted some ...

but not those who really need the support....

|

|

|

Quantitative easing - the aftermathThere are many references on this website to the failure of monetary policy in the United Kingdom and, in particular, quantitative easing (QE). In short lowering interest rates to close to zero caused funds, that should have been destined for investment in business to improve productivity, being diverted into assets and speculation (see:

IMF confirms that monetary policy is an incentive for speculation; see also:

The monetary paradox). In short the policy has been a spectacular failure because funds did not end up assisting the real economy but created asset bubbles and shortfalls in business investment.

Clearly by placing banks in the middle of a process which has very cheap money on one side and allocation options on the other, banks who are interested in "shareholder value" will opt for the lowest risk and highest return options irrespective of the interests of the social and economic constituencies of the United Kingdom. Thus money flowed into bank profit-generating activities at the expense of supporting declared government policy objectives. Just as the financial system leading up to 2007 was very much under the control of loose cannon financial intermediaries, in the very face of the bankbail out, this loose cannon behaviour has increased. Whereas, before 2007 this behaviour was largely under wraps the 2007 downward spiral and the 2008 financial crisis and government reactions have shone the spotlight on the irresponsible behaviour, including fraud and manipulation on the part of people who wish to upghold the pretence that their

"word is their bond".

The new situation with a raft of legal actions yet to be advanced against the financial community is that the behaviour of the banks and the financial institutions, including the bank of England, has raised a broad public awareness of the need for a more

The British political scene is punctuated by false promises, turning hopeful expectations into disappointments ... people are fed up with this and want change. The problem for the political establishment is that the public are better informed but it is more than apparent that the "main" politicl parties do not have the answers but wish to continue to muddle through applying selective dog whistle politics to gain and to remain in power.... |

|

|

practical and transparent solution which should prevent the banks manipulating events, yet again, to their own advantage and at a cost to the social and economic constituencies of the United Kingdom.

Quantitative easing for people (QEP) - an alternative?In basic terms QEP has the same intent as QE only it is delivered by by-passing the "traditional" banks and issuing low interest funds to an investment bank set up for this purpose. The objective is to avoid the corruption of policy objectives witnessed under QE. I should emphasise that the observed bank behaviour is absolutely "normal". Melvyn King intimated as much

2 and, if one admits that the perverse incentives arising from the profit paradox exist (See:

The profit paradox) then we also have to admit this "normalcy" creates serious economic and social problems. So whether it is ignorance, blindness, naivety, stupidity or self-interest that drives politicians to support the current policy is something that should not concern us. What should be of concern is that given that the investment bank will actually make investments in the real economy what will ensure that this investment will secure rises in productivity and real economic growth reflected in rises in real incomes and employment (See:

Why real incomes?). The main challenge is largely one of constitutional economics, that is, to make the system transparent, uncorruptible, effective and efficient. For this to occur policy needs to provide incentives that secure traction and sustainability so as to deliver the intended objectives.

Under QEP, the intent is that a newly formed investment bank would lend on to support large scale "public investments". The idea is sounds attractive but the track record, the evidence we have, provides copious examples of such investment activities, carried out on behalf of utilities, public services, government contracts in the military and other domains often run over-budget and in the end several magintudes over budget. This track record is often used to criticise public authorities but it is important to note that the budget over-runs were all created by the private companies not exercising adequate discipline or competence in their conduct of business on behalf of the state.So somewhat like banks under QE, companies participating in public investments have tended to undermine declared policy intent. In many cases, for example in the case of some notorious software contracts, the performance conditions and lax penalty clauses tended to favour the software companies. There is a tendency for many in the private sector to see public contracts as easy money, a sort of "corporate benefit system" with lax oversight. However, none of these types of condition needs to exist.

People are already delving into the intricacies of the government's options to support QEP operations through such mechanisms as the sale or purchase of bonds and whether or not to cancel them. There are also side discussions on what all of this will do to the so-called independence of the Bank of England (See:

Why Gordon Brown made the BoE "independent").

None of this has much relevance until the current norms of project identification, preparation, appraisal and implementation are radically changed. This is, after all, where QE, in part, went wrong with bank funds going into short term speculation, corporate buy backs of their own shares to augment shareholder value without in fact having achieved any rises in real performance. Other funds were used to purchase of assets and derivatives. That is, the government policy on QE was not associated with any legal requirement that their application be conditioned to service loans for the investment needs of companies in the real (productive) economy. Also there were no appraisal requirements combining high standards of investment identification and design or effective project cycle management observing minimum standards of due dilligence.

Project track recordsBesides my work on the Real Incomes Approach, during the last 40 years, I have spent over 45 years working in national and international investment and development programmes and projects supported by governments, private investors, international development bank loans such as the World Bank usually operating under an IMF agreed monetary frameworks, international aid organizations such as the European Commission and others. These projects were mainly in the EU, Central & South East Europe, South America and Africa. As a result I have become aware of three fundamental facts associated with so-called "public investments":

- The very financing organizations have become extremely cynical about the true worth of investment and development programmes both in terms of effectiveness and efficiency since they can recoup funds via government or by asset stripping private or national assets (Greece being a current example - see image on right) and the overall impacts of funded investment are invariably far less than hoped for.

- Such programmes fail for three main reasons:

- inadequate attention to project design

- the mechanisms deployed for investment cycle management are deficient and fail to keep investment initiatives on track thereby losing the sought-for improvements in efficiency and effectiveness.

- the result is a diversion of funds or their ineffective use in securing their intended purpose

- Combining the above, the sought-for all-important improvements in social conditions are seldom achieved exacerbating the political circumstances by destabilizing future prospects for stable growth

|

Investment projects dont work

In 1992 Willi Wapenhans, the vice president of the World Bank, published an internal report on the performance of the Bank's portfolio of loans1 (a portfolio with an annual growth of around $21 billion at that time). He found that 65% of the loans were not performing and something like 20% of loans were made to give countries the funds to pay back previous loans, that had failed, to the bank!

While I was working at the WB HQ in Washington there was a lot of "discussion" concerning Willi Wapenhans' conclusions but the Bank invested more energy in protecting its image than in solving the problem. According to Bruce Rich2

"The Wapenhans Report .... found that the whole appraisal for preparing projects was in danger of becoming a sham....over four-fifths of Bank staff interviewed felt that "the analytical work done during project preparation" had little to do with assuring an investment's social, environmental, or even economic quality. "Many Bank staff perceive [project] appraisals as marketing devices for securing loan approval (and achieving personal recognition)". It was all about pushing through a loan - fast - not to speak of personal career advancement."

.....

"It took Bank management nearly a year to formulate an "action plan" that would address the concerns of the Wapenhans Report. The first version in 1993 "Next Steps" plan was so unconvincing the Executive Board sent it back for toughening. The US director worried that it would be seen as a smokescreen, fueling criticism that the Bank was not taking concrete action. Even so, the changes in the final version were relatively minor. Ultimately "Next Steps" was a charade. It was easy to declare victory in less than a year since more than two-thirds of the 87 "actions" were bureaucratic posturing, forming committees, learning groups, and task forces; holding workshops and training courses; preparing reports (some of which the Bank had already been issuing for years prior to the Wapenhans report!), evaluations and studies, and reporting on reports and studies etc."

In July 1994, right after the Bank management declared that 92 percent of the "Next Steps" had been successfully implemented. I and other colleagues knew that little in fact had changed.

Willi Wapenhans' reaction was that, "It is perhaps noteworthy that the Bank's management response to the Wapenhans Report does not yet address the recommendations concerning accountability. The "cultural change" required is, however, unlikely to occur unless the performance criteria change"3

From my own field experience at and since that time, I know that the situation has not improved much since the indicators of Bank performance shift to keep things under wraps. |

|

|

What has this all got to do with QEP? One of the ruses of politicians is to ring fence public sector activities that benefit the party in power. So the combination of something the public desires with schemes to support political parties are useful candidates to obscure what is really going on using the camouflage of public approval so as to divert prying eyes and the attention of nasty investigative journalists and pesky NGOs. This is all a somewhat cynical Orwellian double-think. So when one sees "ring fencing", for example, of the NHS and Overseas Development one needs to relect on whether this is some moral commitment on the part of the government or, perhaps, is it more to do with guaranteeing a market for the private corporations and consultancy practices some of whom contribute to the party coffers or provide handsome ad hoc consultancy fees for selected politicians and/or their friends. The recent excuse to augment military expenditure to 2% of the national income to "support NATO" is in fact another gravy train initiative.

Naturally, this sort of corruption does not have a political colour, both main parties have participated in this sort of behaviour.

When it comes to public investment and public procurement the same mechanisms greased by self-interest are at work and this is the challenge facing QEP.

The financial intermediation lobbies have not, so far, entered the fray concerning QEP although some media are probing the space, because its very discussion raises too many embarassing questions concerning the special treatment of banks by government. In addition the effectiveness of investments using bank funds is not a topic they want to discuss because in reality banks are not particularly good at identifying and appraising investments (see the box on the right).

It is therefore likey that the tactics to be deployed to undermine QEP will be more indirect and less obvious. One tactic has already included the extension of inclusions in the "secret agreements" being shaped within the negotation forum of the Transatlantic Trade and Investment Partnership (TTIP) where state or government policy decisions or public service activities that can be shown to "depresss private corporate profits" could lead to compensation claims against governments thereby undermining any public service benefits.

| Things don't seem to change

I was first alerted to "goings on" in the economic development field when I went to a reception with my father in Dacca, East Pakistan, in 1956 where he met colleagues from the "development fraternity" working in that country. I was only 12 so couldn't really contribute any pearls of wisdom to their professional exchanges and assorted scandal. But I did sit there, sipping tonic water and listening to the exchanges. What I heard was comments on what today I would describe as failures of projects to deliver what beneficiaries needed and the fact that a government procurement officer, who worked on a large development scheme, had been found dead, lying between crates in the dockside in Chittagong. Since his office was in Dacca this event was considered to be "suspicious" and probably connected to agents with an interest in the development project. This was all a bit traumatic for me but paradoxically this was the period that I decided to work in the field of economic development. This was a constant puzzle to my teachers back home but in the end that is what I did.

In a specific case of a family friend, an American infrastructural engineer, decided to report project failures in East Pakistan to Ford Foundation (in those days there was no USAID). He was asked to withdraw his comments. He insisted that they represented the facts; he lost his job. It was not done, it seems, to embarass development institutions with the truth, even internally. Only rosey reports were accepted from the field. Apparently this was the norm under the Dwight E Eisenhower presidency tainted by an apparent imperative of selling an exceptional image of development efforts.

Today I see that one of the more unsettling aspects of economic development is that the conversation I heard some 59 years ago is of the type one still hears today. The failures and sheer waste are on a larger scale and the status of government procurement officers remains precarious for some in not doing what corporations or political parties desire, they continue to be murdered, while others live a life style quite beyind their pay scales and others do their job and seem to be innocent of any wrongdoing. Staff in development agencies who point out failures tend to be moved on.

Unfortunately, little has changed.

|

|

|

Because of the profit paradox, the ill-defined reality of what constitutes profits is in reality a weak basis for justifying compensation. An option for the powerful anti-QEP lobbies therefore becomes the "displacement" argument, that is, publicly owned activities displacing private activities could also be used as a basis for compensation. One tactic that has proven to be successful has been for companies to use damages to brands as a legal basis for compensation. It is therefore essential that any plans to introduce QEP need to include the development of a broad coalition of support as well as prepare formal legal frameworks and regulations that creates a "normalised" operation for QEP that has immunity from any such litigation.

This legal and regulatory approach is complicated but worth pursuing because there are options for organising the management of public investment projects contracts on the basis of private organizations that have mutual structures. Under such circumstances it is more difficult for profit-making companies to compete. This option is reviewed below.

Inperceptibe change strategyIf the tactics deployed by any group are enacted over a period of several generations then the advance of the process can become almost imperceptible. If, in addition, the decision analysis used to design policy is conducted in complete secrecy then this is an intentional denial of public choice and therefore an extra-constitutional arrangement that makes economic policy decisions devoid of any constitutional and democratic legitimacy. A good example of such a multi-generational process has been the transitions in the movement and motivations

that started out, first of all, impacting the General Agreement on Tariffs and Trade (GATT) since 1947 and then the status of the United Nations Conference on Trade and Development (UNCTAD) after 1964. As part of the preparation for my post-graduate dissertation in 1967 I reviewed the whole of the first UNCTAD Conference proceedings as well as a series of publications produced by FAO (Food & Agriculture Organization of the UNO) that covered the field of mutual producer cooperatives both for national and export markets and described proposals for "fair trade". The UNCTAD material contained excellent analyses covering the impact of trade on employment and national income and a range of interesting analyses and suggestions on commodity schemes. Much of this material was quite inspiring making sense of why one would study development economics.

However, with the advent of the World Trade Organization (WTO) one can see how UNCTAD was sidelined. I think one reason was that UNCTAD was coming up with effective inclusive proposals for the people of developing countries and therefore its output strengthened the advocacy resources of such countries. The somewhat brazen treatment of developing and transition economies within the WTO began to surface ending up as bad publicity for the USA and the European Commission.

It seems that the USA and the Europen Commission decided to side step an open participatory approach in order to try and fix legislation and trade regulations by "restructuring" national constitutional economic structures top down by following the Transatlantic Trade & Investment Partnership (TTIP) route where the rationale on potential legislation and mechanisms and procedures are almost entirely prepared by large corporations and banks. There is no accommodation of decision analysis based on even rudimentary elements of public choice. The system is basically extra-constitutional. At the moment it is being "run" outside or alongside WTO arrangements but the objective is that it become the norm for international trade arrangements.

If this all-embracing strategy sums up the story for how world trade will be restructured it will also, if those promoting this strategy are not countered effectively, be the tactical means of attempting to destroy any possibility of QEP being successful.

Making QEP a successMaking QEP a success requires the establishment of a rational forum where its intent and basis for operation can be resolved as opposed to fought over. The last Labour leadership debate showed up a troubling characteristic of UK political exchanges where Yvette Cooper showed some animation, not passion, on the basis of a string of glib baseless remarks about QEP causing uncontrollable inflation, unemployment and a return to the bad old days (I paraphrase). It is odd, although unfortunately typical, that some people who watched the exchanges were impressed by her show of "passion" but did not make any comment on whether or not she was talking any sense or not. It is as if assertion wins the day. But this was all flawed mainstream economics. What was stated as the inevitable outcome of QEP is not in fact inevitable at all. Jeremy Corbyn's response was modest but correct in that he stated that several economists supported his QEP proposals so this is where the issue lies. There is a need to take QEP more seriously so as to analyse counter-proposals to decide on its feasibility.

There is an obvuious need to raise the level of UK political debate by emphasising a review of facts and analyses that seek options that promote the interests of the people of Britain, on the basis of an equitable and transparent system of policy design and implementation. There is a need for the identification and establishment of an effective and efficient public choice model to strengthen a more participatory model strategic planning and policy formulation; characterised by bottom up participation and not top down. This approach, which would demand some changes in how we manage governance as a nation, should be promoted, not only within the UK but also within the European Union, as well as internationally. This movement needs to be accompanied by a large scale public educational and advocacy movement in favour of QEP. What is of importance is that forums concerned with QEP be well-informed by analyses and reports on appropriate mechanisms and relating to developed, transition and developing countries so as to generate worldwide support for the logic of QEP. One only needs to review the long list of countries suffering under conventional macroeconomic policy failures and, in particular montary policies, to realise QEP is probably something whose time has come.

It is better to put efforts into open discussions and transparent exchanges on this topic rather than waste energy trying to expose what is being discussed within TTIP. It is better to let this run its course while the QEP lobby is strengthened since this will only highlight the top down large extra-constitutional and largely illegitimate nature of this process. It is largely a waste of time attempting to "discover" what the TTIP participants are "up to"; this is obvious. It has already been amply demonstrated by the historic twists and turns between the formation of GATT in 1947, and the bizarre 66 year journey involving UNCTAD and the WTO only to end up in 2014 in TTIP and, of course the separate but parallel Trans-Pacific Partnership (TPP-2005) is of significance in this regard. It is more than apparent that the products will be significant retrograde moves in terms of constitutional economics and as a result the proposals need to be rejected on the grounds that the decision analysis leading to the specific regulatory configurations have not been made evident and therefore the transparency is significantly compromised. Within a more constitutional economic framework the negotiators of TTIP would not even be able to contemplate attempting to negotiate the way they are doing since hiding facts and intensions concerning economic decions of interest to the electorate would be illegal.

CompetitionThe QEP nightmare ...

The nightmare scenarios and declarations of doom resulting from QEP expressed by some, even within the Labour party, reflect a complete ignorance of the options avaiable for it to work effectively. |

|

|

One of the powerful concepts associated with the legacy of free trade relates to facts as well as imagination and rhetoric. This is the argument of the benefits of promoting competition. This underlies such considerations as what constitutes dumping as well as unfair competition and the same vector, competition, is constantly referred to as the justification for international investment, globalization and much more. Many large corporation executives and those of a specific political persuasion promote a philosophy marked by a somewhat smug confidence and comfort in their assumption that the free competitive models, driven by aggregate demand and the profit motive, represent the architecture of the best economic system the world has ever seen. The natural corollary from this collection of assumptions is that, almost by definition, public investment or public services are not, and never can be, competitive. They therefore undermine this perfect model. This highlights what people assume to be a default state of affairs, that public services are a lost cause when it comes to competition. The growth in so called Public Private Partnerships (PPP) under the last Labour governments demonstrated that involving the private sector did not augment productivity but raised costs just as in the old public contract scenarios of cost over-runs by private contractors.

Paradoxically, the strongest argument in favour of QEP is that it could promote competition and prices as fundamental criteria for the justified operation of any type of economic activity, including public services.

From Public Private Partnerships to Price Performance PolicyThe quest of the Real Incomes Approach is to minimise or even eliminate the imposition of differential impacts of policies across the social and economic constituencies. In order to achieve this the macroeconomic system in practice and its supporting theory need to adjust to the reality that the economic and social constituencies are made up of very diverse units made up of individuals, families and economic units each with different aspirations, capabiliies, needs and access to, and the means to use, resources.

Under Price Performance Policy private and public companies are more competitive than those referred to as "profit-making". In any case mutuals are already more competitive than profit-making corporations (See:

The benefits of mutualization in mortgage lending) and they have a broad acceptance within "capitalist" thinking. Indeed, mutual banks and building societies survived the financial crisis better than plc banks. The current edition of the Economist Newspaper (August 22nd, 2015) carries an article entitled

"When workers are owners" where it is admitted that mutual organizations are becoming an acceptable face of capitalism and increasing in popularity. A discussion concerning alternative corporate ownerships in the article on Jeremy Corbyn's economic poposals is therefore of some relevance (See:

Jeremy Corbyn's economic proposals).

Mutual corporate organization is complementary to QEP because the operation is potentially more efficient because there are no shareholders demanding "shareholder value". The issue becomes one of orientating loans using funds raised through a QEP mechanism towards projects whose outcome will be competitive operations. This can be achieved by economic policies that provide positive incentives for companies to sustain investment in technology and human resources thereby maintaining an advancing productivity frontier. One of the risks attributed to QEP by several people is that it will result in runaway inflation on the basis of the theory that pumping more money into the economy will stimulate inflation "justified" in terms of the Quantity Theory of Money. To date, no economist has ever explained or established why money volume increases lead to inflation (See:

Real Incomes & the Quantity Theory of Money). This includes the high priest Milton Friedman whose "explanation" on this matter was pure bluster and assertion.

So where does inflation come from?The reality is that inflation is caused by corporate price-setting. It is true that if input prices rise so then will unit output proces to maintain "profits". Also if some companies sense that there is a lack of their type of product in the market, they might take advantage of this fact to raise prices since some consumers will be prepared to pay the higher price. None of this has anything to do with money volume. However, the mechanism for companies generating or passing on price rises (inflation) can be summarised in an index known as the price performance ratio (See

The price performance ratio). The actual relevance of controlling inflation through policy can be better understood if we step back and try and identify what it is that is important to the social and economic constituencies. What is of importance to all is stable or rising real incomes since inflation alone does not indicate the actual ability of people to maintain their standard of living (See:

Why Real Incomes?).

In 1975 I initiated an economic research programme dedicated to the identification of economic theory and policies that would not have prejudicial policy-induced impacts on the social and economic constituencies and by 1976 has identified real incomes as the key policy indicator and objective and this is why the programme gained the name the "Real Incomes Approach".

From the standpoint of Jeremy Corbyn's desire to introduce some form of QEP, the Real Incomes Approach provides important vectors to provide a stable foundation which discount most current "criticisms" and can also undermine the forces that would like to prevent this from coming about. These are that the Real Incomes Approach, in the form of Price Performance Policy (PPP) can:

- Control inflation

- Augment the value of the currency

- Raise real incomes

- Raise competition through unit price setting

- Support mutual organizations and companies in a way that makes them more competitive that so-called profit-making companies

- Progressively reduce the reliance of economic growth on finance

- Make public services as competitive as private operations

In terms of "competition","displacement" or "imposing loss of profits" or even "damaging brands" of private companies, one of the most significant characteristics of PPP is that public services run under the same policy as private corporations and as such the incentives for competitive operations are the same. The playing field is level. Under such circumstances public service can be as competitive as mutuals and mutuals and public services can be more competitive than profit-based private corporations (See:

Public Service provisions - a note and

Private & public goods). The question therefore becomes what is the social and economic contribution of such corporations when they are in fact less competitive? Within society whose economic affairs are based upon a more constitutional economic framework, the achievement of a better distribution of real incomes should be based on the provision of positive incentives to encourge the maintenance of a more rational and competitive modes of operation. The current perversities created by the interacions between the profit, monetary and fiscal paradoxes and the objectives of conventional KMS

3 policies end up generating losers, winners and those unaffected. PPP however can help eliminate such unacceptable differentials and encourage economic activities that approximate a state of positive systems conststency.

Since this site carries all of the necessary references to the workings of the Real Incomes Approach and PPP, the reader is invited to explore these resources to review the possibilities.

I remain convinced however, that it isn't just a matter of making performance criteria for QEP investments more relevant it is a matter of revolutionizing how public investment projects are managed over the whole "project cycle", that is, how they are identified, options generated through a process of design, the basis for selection of the most appropriate option, implementation and operations. There is a need to introduce a legal and regulatory framework to establish criteria for due dilligence to be observed by all involved in public investment so as to protect the interests of the public by ensuring the effective and efficient use of public funds.

This microeconomic dimension has fundamental implications for the effectiveness of so-called macroprudential regulations which currently have no teeth.

An article on this specific topic can be found here:

Macroprudential regulation.

1 Hector McNeill is director of SEEL-Systems Engineering Economic Lab.

2 Mervyn King stated in his Mansion House annual speech in 2009 with respect to bank excesses that,

"Warnings are unlikely to be effective when people are being asked to change behaviour which seems to them to be highly profitable,..." 3 KMS is

Keynesian,

Monetarist &

Supply side economics, also referred to as conventional or mainstream economics...

Updated: 7th September, 2015: alterations and typos not picked up by spell-checker. Sense maintained.

Updated: 8th September, 2015: unscrambling some confused statements in final paragraphs. Sense maintained.