Constituents

In order to understand the impact of constitution and economic policies on the interests of the constituents in the United Kingdom it is helpful to distinguish two groupings of constituents as:

- social constituents

- economic constituents

Social constituents

The term “social constituents” is used in the document to indicate private citizens and their families with those of voting age making up part of the electorate.

Economic constituents

The term “economic constituents” is used in this document to indicate social constituents who as single individuals or groups have formed units of economic activity such as a freelance job or company. Here the main concern is with production of goods and services but the entity or registered organization (company) does not have the vote.

Constitution, economic policies, economic and social constituents

In this article there is a focus on the degree to which economic policies satisfy the needs of the social constituents through the operations of the economic units managed by economic constituents. Put another way, to what degree does economic policy encourage a behaviour and decisions by economic constituents that satisfy stated macroeconomic policy objectives. In a democracy with one vote assigned to all of voting age, it is to be expected that macroeconomic objectives should normally aim to enhance mutually supported acts that enhance the wellbeing of all constituents on an equivalent basis.

Constitutional economics

This is an underlying principle of public choice and a central aspect of what is referred to as constitutional economics. James Buchanan (1919-2013), the leading developer of constitutional economics, set out the basic principles for this approach. According to Buchanan the ethic of constitutionalism is where the individual who is expressing preferences for social and economic conduct, together with others in society, adopts the moral law as a general rule for behaviour. He rejects any organic conception of the state as superior in wisdom, to the citizens of this state. This philosophical position forms the basis of constitutional economics. Buchanan believed that every constitution is created for at least several generations of citizens. Therefore, it must be able to balance the interests of the state, society, and each individual.

The sophistication of Buchanan's analysis related to his making sense of "Political Economy" by making a distinction between politics and policy. Politics sets the objectives and rules of the game, usually in terms of legislation, whereas policy is focused on strategies that players adopt within a given set of rules. Questions about what are good rules of the game are in the domain of social philosophy and political analysis, whereas questions about the strategies that players will adopt, given those rules, is the domain of economics. It is the interplay between the objectives and legal framework rules (social philosophy) and the strategies (economics) that constitutes what Buchanan refers to as "constitutional political economy”. Buchanan, did much to introduce ethics, legal political thinking, and social thinking into economics and therefore set out a more rational canvas upon which to found a better future.

Sources of constituent income

The interests of wage-earners

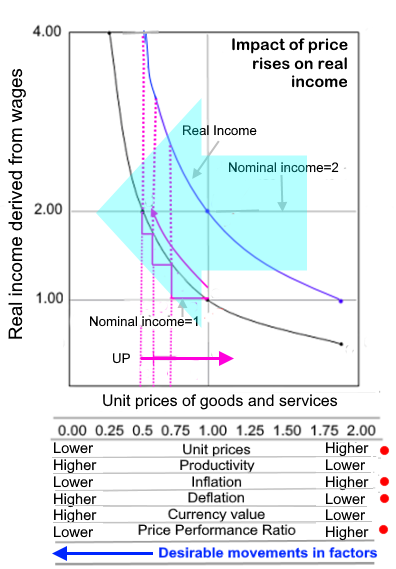

Wage earners benefit from lower unit prices, lower inflation, deflation, enhanced currency value, lower price performance ratios and productivity increases in goods and servics production.

Source: British Strategic Review, 2022 |

|

|

Wage-earner constituent sources of income

In terms of public choice, in the context of constitutional economics, an important aspect of constituent interest in economic policy is the degree to which policies affect the levels of real income of each constituent. Real income levels are very much determined by the sources of income.

Income is what people earn through various activities and this is used to pay for essentials as well as other goods and services. Income is measured in currency units or pounds, and the utility of the currency depends on its purchasing power, or what can be purchased for the amount each person has available.

Income levels calculated in terms of currency units is nominal income but this does not convey much about its real utility. The real utility of income depends upon unit prices so as price rises the utility of nominal income falls because less can be purchased. On the other hand, if prices fall the utility of that nominal income rises. Therefore, unit prices determine “real income”. The relationship between nominal income, unit prices and real income are shown in the diagram on the right.

The essential mechanism whereby unit prices can be lowered is refinements in technological processes and techniques resulting from learning and innovation. The actual indicator of whether or not a company is achieving this productivity transition is the Price Performance Ratio a central indicator and business management's guide to the degree to which price performance has been achieved as a result of investment and changes in methods.

Real economy (goods and services) price inflation, deflation and the currency

The purchasing power of the currency is determined by its innate exchange value for goods and services and this is determined by the movements in prices. Thus, if prices of goods and services are in general falling the value of the currency rises because more real products and services can be purchased for a given nominal sum. If prices of goods and services, in general rise, then the value of the currency falls because fewer real products and services can be purchases for a given nominal sum.

Therefore, inflation lowers the value of the currency and real incomes and deflation raises the value of the currency and real incomes. This is summarized in the graph to the right.

Asset economy (assets) price inflation, deflation and the currency

Asset markets are referred to as encapsulated markets in terms of their separation from the volumes of transactions occurring in the production and supply side goods and service markets. These markets also tend to be managed by a small proportion of the constituency and there is usually a reduced number of participants. The interests of asset holders

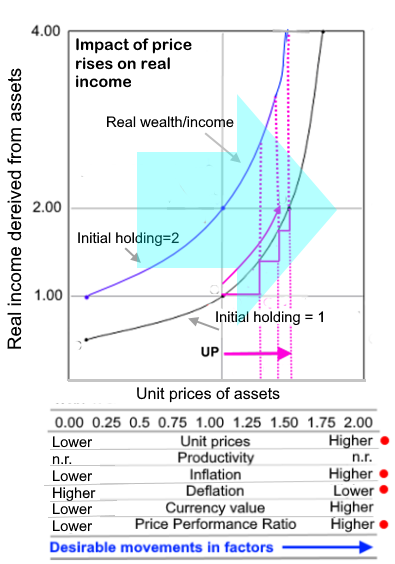

Asset holders benefit from higher unit prices, higher inflation, higher price performance ratios and no particular interest in goods and services productivity increases.

Source: British Strategic Review, 2022 |

|

|

Often these markets are characterized by speculative prices. As a result, the participants in these markets can make significant margins on transactions within these markets or by simply holding on to the assets. The main interest is return on assets held either in term of price rises or the ability extract more rent from those who use the assets e.g. housing or industrial units.

As can be readily appreciated the participants in these markets, gain no advantage from falling prices is assets. Therefore, contrary to the state of affairs in goods and services markets the purchasing power of the monetary value of the asset holding is determined by an inverse relationship between assets and its innate exchange value. Thus, if prices of assets are in general falling so does the income and wealth of asset holders. If asset price rise so does the wealth and income of asset holders.

The real income effects of income sources

Therefore, inflation raises the value of assets-based wealth and deflation lowers the value of assets-based wealth. In the case of goods and services paid for by wage-earners, inflation lowers real incomes while deflation resulting from technology-based productivity gains raises real incomes.

Therefore, the relative benefits of price movements to the participants in the asset markets, on the one hand, and the goods and services markets, on the other, have an inverse relationship. This represents very different sets of interests on the part of these constituents on the objectives of macroeconomic policy and the potential impacts on their relative interests, according to the policy instruments applied. There is, therefore, the fact that the real incomes of the majority of the population, those wage-earners depending on thr supply side production and services sector for their purhases as well as employment, are safeguarded by stable or falling price in goods and services. On the other hand, there is a small , generally more wealthy minority of constituents who deal in assets, whose real incomes are safeguarded by rising prices of assets.

See diagram on the left.

Constitutional implications of income sources

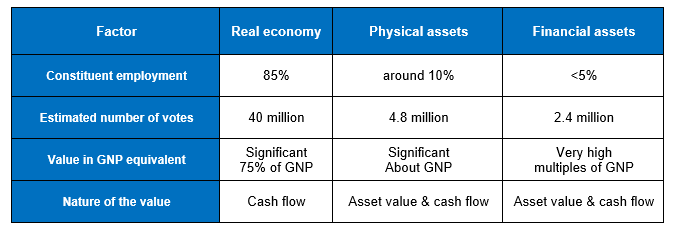

The constitutional implications of income sources are that there are distinct groups of constituents who, as a result of their sources of income, have different preferences with respect to macroeconomic policies.

In the context of this document, it is pertinent to understand the significance of universal suffrage, where all people over a specific age have the vote and, in theory at least, voting leads to a public choice of those policies, including economic, that the majority deems to be of mutual interest in advancing the wellbeing of the population. In this context, the components of the economy set out above, can be identified in terms of their value in terms of determining the economic interests of participating constituents and their power in terms of their numbers to votes to influence the outcome of elections and therefore policies pursued by governments.

In terms of their relative significance these economic components in the overall economy, they can be characterized in terms of their nominal values measured in nominal pounds sterling and in terms of their levels of employment of members of the constituency and who have the vote.

Employment, electoral significance & the nature of economic value across economies

Therefore, in the context of these different types of economic activities each involving different economic constituent groups, to what degree does our constitutional practice enable the management of economic policies to distribute the advantages of policies through social constituents on an equal basis?

The financial sector growth strategyFor over 50 years monetarism has created a bias towards the interests of those who earn their income from physical and financial asset transactions. The main reasoning behind this trend is that banks require assets as collateral for advancing loans and therefore by "strengthening" the asset base they can continue to expand and generate profits for the financial sector. However, the degree of fraud and unfair practice was exposed in 2007 leading to the 2008 financial crisis. Since then, for 13 years the response was to introduce and sustain quantiative easing (QE) which has resulted in asset prices rising by a factor of around 10% each year on average and investment being withdrawn from onshore supply side production of goods and services leading to a decline in productivty and wage compensation. Of late leakage from the asset markets that have undergone a considerable inflationary spiral has led to rises in the prices and rentals of land and real estate raising costs for house buyers and renters as well as on offices, retail units, warehouses and industrial units. This has created a pressure of cost-push inflation and squeezing of production margins and reducing the ability to raise wages in the supply side. The rise in incomes in the asset trasactions sector over the last 13 years has been a cumulative average growth of around 200% benefiting this minority section of the electorate while the majority have seen their average wages fall in real terms by around 20% over the same period.

The more recent changes under QE have been to destroy the alternative financing source in the form of personal or corporate savings and imposing loans as the main source of investment funds. The banks, financial sector and those holding the main physical assets have become the barons of the day.

Our glorious march to universal suffrage ..

The Magna Carta and all that... It should be understood that although the principles behind the Magna Carta were important they only applied to the barons of the day and were not agreed to benefit the population. The population was considered to be there to work the resources owned by the barons as the labour laws, from the 13th Century to date, confirm. Even the Great Reform Act of 1832 which increased the voter base to about 7% of the population, who were property owners (asset holders), was considered to be the final act in advancing suffrage amongst the "people" even by those who introduced it; it was enacted more to quieten down those advocating change in a "disruptive fashion".

In spite of universal suffrage being introduced in the early 20th Century, the early advocates for universal suffrage did not count on the formation of political parties. The Levellers, for example, in their 17th Century written proposals for English constitutions, cautioned against the formation of permanent power groups amongst politicians and civil servants since this would give minority factions disproportionate and growing power over the majority and a rise in corruption related to political parties in government favouring the interests of benefactors and known supporters. The Levellers advocated having annual parliaments and not permitting politicians to stand for election in the following year's election also leading advisers and civil servants would change with each parliament.

The problem was that the reference to this danger alerted some to the fact that such power groups, now referred to as political parties, could be created and funded by wealthy minority factions, including financiers, to gain control of the whole political agenda of the country. This is, indeed, what happened.

Existing policy tendencies in an absence of a constitutional economic framework The policy tendencies described above are the result of our tiny political parties with a total membership of less than 1.25% of the electorate, having too much sway over the electoral processes of this country. Since all political parties are easily captured and controlled by their benefactors, or today's barons, we find that inevitably policy, and monetarism in particular, favours the interests of physical and financial asset holders as opposed to productivity and the real wages of the majority of the electorate. This is the model designed to support the financial sector championed by the Bank of England (BoE).

It is instructive to listen to the very confused and often garbled explanations of BoE representatives from staff members through to the governor before parliamentary committees. They remain incapable of explaining the direct benefits of their policies to wage-earners other than referring to "financial stability". The recent Lords Economic Affairs Committee evidence on quantitative easing (QE) did not instill any confidence in monetarism. The BoE admitting they were still "....trying and understand the impact of QE", while others stated that QE is a policy with no theory and yet others applying an undisclosed theory to predict future trends! This is a completely unacceptable state of affairs given that the country has been exposed to the QE experiment for over 13 years with disastrous consequences.

A summary of the prejudice imposed by monetarism and QE in particular, has been set out in the pdf format paper,

"Why monetarism does not work".

Potential policy tendencies within a constitutional economic frameworkIt is evident that political parties are the main constraint on the people of this country being able to be represented and presented with more rational manifestos. Constitutionally, political parties need to be required to enact manifesto undetakings rather than using any parliamentary majority to impose any new ideas they come up with and which tend to benefit their benefactors but, of course, couched in terms of benefits for the country and "prosperity". There is a dreadful assumption on the part of leading politicians that if they have been elected they have a cart blanche to decide and implement just about anything without reference to the electorate or anything resembling a participatory process of genuine public choice. This is why politicians don't like referendums because the power of decision making returns to the people.

Advocacy for reformWhat is very apparent is how neither political parties nor the system provides any means for the national constituency, the people, the "demos", to have any substantive say in the decisions of most importance to their wellbeing. In particular educational policies, macroeconomics, foreign affairs where the people of Britain are represented abroad and shaping welfare provisions to the evolving needs of the population.

The 6 year stretchThis is not a new topic in Britain. Very reasonable proposals were developed and presented between 2004 and 2010, on how to change the involvement of the people in the decisions that affect them. These proposals came from individuals who were not on the fringes of either the fanatical obsessed left or right wings of British politics but rather by groups and individuals with a genuine objective of improving the lot of all. However, the political party establishments rejected all of these proposals and yet they are supposed to be the "representative of the people" of this country.

The Power Commission

Helena Kennedy |

|

|

|

The general signs of a serious malaise with British politics were highlighted by the reaction of the Labour government to the 2006 report of the Power Commission. The Power Inquiry was established in 2004 and looked into the reasons for falling membership of political parties, falling turnout at elections and a general decline in the image of politics in the United Kingdom; something of potential interest, one would have thought, to all political parties.

| | ISBN 0 9550303 1 5 |

|

This inquiry was ably Chaired by Helena Kennedy who asked politicians to treat democratic reform as a

non-partisan necessity. The recommendations in the Power Report included capping donors, voter-initiated legislation, lowering the voting age, monitoring lobby activities, restricting the power of part whips, replacing the first-past-the-post election system by a better system, eliminating election deposits and closed party lists, the realignment of some constituency boundaries and the decentralization of power to local government.

This truly outstanding work touched on most of the burning issues as to why there was a loss of support and confidence in political parties, but these reasonable recommendations were not accorded a serious consideration and response from government or political parties.

Tony Blair as prime minister, all but ignored this Report; this was to become a bad habit for most independent reports submitted to this government for the duration of is existence. On the other hand, the most significant report actually published by that government was a dossier to justify an illegal war and this contained misrepresentation which "misled" parliament.

My own assessment was that the Power Commission placed far too much faith in political parties to be the agents of reform. After all the Power Commission concern was with diminishing support of political parties. However, my own analysis initially expressed in a book, published in 2007, entitled,

"The Briton's Quest for Freedom .. Our unfinished journey.." set out a series of arguments as to why the operation of democracy in the UK would be more beneficial and productive if political parties were done away with. Although I covered some economic aspects in this argument, the experience with QE has crystallized these arguments into a more rational form. The Power Commission did not concentrate enough on the ease with which minority factions capture and drive political party agendas. I should add that what I laid out was not some anarchistic extremist rant, there was no leaning either to the right or left, but rather a reasoned logical analysis that identified some 49 significant constraints on the freedom on the people of Britain. All of them were introduced over time and are currently sustained by political parties.

Related to this was an explanation of why and how the Labour party intentionally changed its strategy to transform itself from being a party of conviction to a machine designed to gain and remain in power.

| | ISBN 978 0 956 196422 |

|

Sir Paul Judge |

|

|

|

Although I proposed an operational system without parties the practical follow up to this theme came three years later in a more proactive and daring fashion. Sir Paul Judge formed the Jury Team as a campaign to transform politics by operating without political parties. He also published a justification in 2010 very much in line with my own analysis and also listing many of the points raised in the Power Report of 2006.

The Jury Team initiative did not gain sufficient media support and therefore coverage was inadequate. One reason for this was the inherent bias by all parties against this initiative. In addition the initial "primary voting" system using texting which was open to abuse and therefore unreliable. An additional reality that created a significant issue and undermined Judge's intent, was the fact that in order to register to receive votes in a General Election the Jury Team had to register as a political party which caused the notion of "politics without parties" to have no basis in fact.

In this case, the person proposing politics without parties, was someone with more direct experience in British politics. Paul Judge had served as the Director General of the Conservative Party and as a Ministerial Advisor to the Cabinet Office.

In my own work I pointed out the many Catch-22 traps facing those wishing to run as mass movements as opposed to political parties and the legislation covering general elections is one of these. The constitution does not support, in reality, a free movement of people to move to become community representatives without being tied to a political party. There is the option to register as an independent candidate but there needs to be a category for "movements" to allow them to field several candidates under a recognizable banner.

However, there is no doubt that Sir Paul Judge was on the right track and it is disappointing that the Jury Team proved to be unsuccessful in gaining a seat in Parliament. This was an impressive and pioneering effort and the idea was not as preposterous as many might now wish to make out; it was and is an idea whose time has come. However, the forces amassed against any initiative that is associated with non party politics is countered by corporations, the financial services industry and therefore the media. The reason for this is that unstructured organizations are more difficult to control through corruption or compromise. Indeed, the significance of Sir Paul Judge's initiative becomes increasingly clear when one delves more deeply what has been happening currently in British politics.

The success of politics without political parties depends upon the development of mass involvement in politics as opposed to mass movements. Political parties fear mass movements, even although these should result in a better balance in representation.

Heading off mass movementsIn July 2021, the government voted to pass the Policing Bill, the Elections Bill was introduced, and the Home Secretary’s Nationality & Borders Bill was published as well. The Elections Bill contains some details of concern including clauses that criminalise things which are fundamental to free and fair elections in the UK. It reduces the role of the Electoral Commission and hands unprecedented powers around elections to ministers. As a result of the shock outcome of Jeremy Corbyn's effective campaigning resulting in an unprecedented election result in 2016, the Bill allows ministers to change the definition of "campaigning" knowing that there are elections somewhere in the UK every year, so as to curtail "campaigning" 365 days before any election. This bill facilitates political donations from tax exiles increasing the scope for illicit money and vested interests to influence party agendas. The Bill imposes limits on groups, unions, charities and even individuals doing anything considered to be "intended to achieve a common purpose". This phrase is open to interpretation and could effectively exclude charities and voluntary groups from the electoral process and make it impossible for political parties with broad bases of support to organize effectively. This could result in the act of booking a meeting room being designated a criminal offense; a significant impediment to opposition so vital to democracy. These measures will undermine the prospect of a progressive

alliance at the next election to make all votes count and help sidestep the first-past-the-post system and destroy cynical tactical voting.

The struggle of political parties to prevent a more rational basis for constitutional decisions and a move towards a constitutional economy, represent actions of people willing to exacerbate the state of the economy and wellbeing of the majority in exchange of the status they gain by serving the interests of a small faction rather than the majority of the electorate in this country.

1 Hector McNeill is director of SEEL-Systems Engineering Economics Lab

All content on this site is subject to Copyright

All copyright is held by © Hector Wetherell McNeill (1975-2021) unless otherwise indicated