The concept of irrational debt

A note

Hector McNeill1

SEEL

This article is concerned with what is being termed "irrational debt" as a specific status assigned to interest-bearing advances of money to individuals, companies and governments. Irrational has the connotation of implying an absence of objective logic or reason or incoherence of the act of lending with the stated purpose of application of the funds raised.

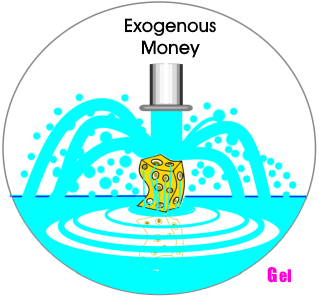

This exploration is linked to what is referred to as exogenous money or funds that have not been generated organically from within the supply side such as in the case of savings.

|

Irrational debt defined

Irrational debt is provision and acceptance of a loan for which there is no logical evidence that the funds will be applied in a productive manner to achieve the stated objective because of a lack of adequately detailed evidence-based decision analysis to establish the likelihood of the feasibility of achieving stated objectives while satisfying specified social, technical, economic and sustainability criteria.

The existence of irrational debt is the result of a lack of due diligence on the part of lenders and borrowers to complete adequate decision analysis.

Objective failures

Something like 35% of investments and projects fail resulting in an inability of those who have funded these activities on the basis of debt, to pay back this money. This can result in the lender having to call upon guarantees or collateral provided to secure the loan, to pay back what is outstanding. Action-related debt, that is, debt raised to accomplish some stated objective can lead to failures when objectives are over-optimistic or not feasible because inappropriate information has been used to determine the likely return to the project owner to use some part of this return to repay the loan. There are two fundamental aspects to this process. One is managing the design of the project and the second is managing the project though to completion.

The ability of individuals companies or governments to design feasible projects as well as to manage the financial, physical and human resource inputs in an effective manner to accomplish the activity's objectives varies from complete inability through to a supreme capability.

Competence, scale and experience

Highly experienced project managers know that competence in the carrying out of specific tasks relates to the specific experience anyone has of operating at a specific scale of operation. So an artisan can perfect the production of a hand made product to a degree that challenges others to even attempt to try and produce an equivalent product. No matter how skilled in technique the artisan is, in order to increase output beyond the level found to be feasible as a one person effort, the ability to maintain the quality of the output becomes a challenge because it is necessary to rely on additional people who do not possess the capabilities of the artisan. Over time, the training of apprentices can result in a small percentage of these trainees being able to emulate the artisan to produce output of equivalent quality.

More generally, scaling up of any activity involves risks and requires time before the operational qualities achieved at a reduced scale can be achieved on a larger scale.

Therefore, what can be appreciated from such facts is that any activity involving people and the use of technology and resources has a limited absorptive capacity for funding. No matter how much money is handed over to a company or individual, if the intended scale of operation being funded is larger than current levels of operation it is important to work out the "absorptive capacity" of the enterprise. Excessive funds cannot be applied effectively in a rapid manner and while the capability of the enterprise is being expanded, which can involve a considerable amount of time, and there will be no substantive improvements in the quantity, quality or productivity of output of products.

From theory to practice

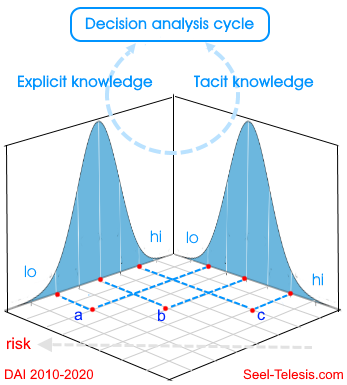

A decision is an irrevocable allocation of resources to a specified course of action. The identification of the most beneficial decision requires decision analysis procedures that have access to good quality explicit knowledge. When it comes to the delivery of the course of action, the knowledge domain transitions from explicit to a predominant dependence upon access to the appropriate types of tacit knowledge.  The graph above represents three cases of companies as follows:

- With weak explicit knowledge, decision analysis capabilities and average tacit knowledge in the domain in question. Risk status: High Rationale: Unlikely to optimize decision and to implement on time;

- With reasonable explicit knowledge, decision analysis capabilities and above average tacit knowledge in the domain in question. Risk status: Medium Rationale: Likely to encounter implementation problems, delays;

- With good explicit knowledge, decision analysis and well established tacit knowledge in the domain in question. Risk status: Very low Rationale: Likely to optimize decision and to implement on time;

|

|

|

Automation

Clearly mass production techniques and automation have had a role to play in standardizing production processes which with refinement can end up with output where the quality of output varies very little between large production batches. However, as soon as one moves from the core of the automation cell and information technology components, both of which secure amazing gains in productivity of the physical and information processes, the problems of overall performance in scaling up are encountered in the competence of the people, technologies and techniques to be found in the supporting activities, supply chains and logistics.

Absorptive capacity

A considerable amount of international development funding, as well as corporate investments in expansion schemes and change, fail as a result of inadequate development of absorptive capacity. Across the board of all social and economic constituents the range of absorptive capacity ranges from zero to 100% depending upon the scale of expected rise in operational levels and the current internal constraints. These relate to such issues as competence, experience, cash slow, other commitments, time available, access to resources and many other variables. Any loan performance will also depend upon the ability to avoid or mitigate the impacts of external constraints including interest rates, inflation, exchange rates, taxation regime and levels of taxation and accounting regulations. It should be more than apparent from this simple analysis that "throwing money at the problem" is going to have close-to-unpredictable results.

Organic growth

As companies manage to allocate their resources, modify techniques and adjust technologies they can often achieve significant reductions in operational and unit costs of output. The process-bound advance can be considered to be a process of an evolutionary organic growth in productivity. Because of the factors reviewed in this article it can be appreciated that this organic growth will be a steady process based on access to increasing amounts of useful data (explicit knowledge) and cumulative experience of those involved in the physical processes of production whose levels of competence in applying specific technologies, or their technique, attains high levels with "time on the job" (skill). The rate of organic growth can vary between economic units even within the same sector and applying the same technologies with each attaining quite different productivity levels. The reason for this is usually related to the management competence in applying decision analysis techniques and in their relationships with the people who work in the economic unit.

In very broad terms, and simplifying this topic to some extent, the box on the right compares the likelihood of three companies with different levels of competence in decision analysis, access to explicit knowledge and with a team tacit knowledge. In case "a", an inadequate capabilities in decision analysis, poor access and use of explicit knowledge and poorly developed tacit knowledge is likely to result in failure to deliver decisions. In case "b" intermediate competence in decision analysis, quality of explicit knowledge and levels of tacit knowledge is likely to result in a highly variable ability to implement decisions successfully. In case "c" where decision analysis is applied competently, there will be a raised ability to refine and select the explicit knowledge required, including the state-of-the-art performance associated with existing tacit knowledge. In this case the likelihood of delivering on a decision within budget and on time is high.

In terms of risk it is evident that this declines with more competence in decision analysis, better quality explicit and high level tacit knowledge. Any other circumstance is associated with increased risk.

The macroeconomy

Enough has been reviewed here to make clear that at the macroeconomic level the term "average conditions" mean very little. This is because of the very different circumstances each economic unit finds themselves with respect to the factors related to the level of competence applied to decision analysis to take decisions and the access to explicit knowledge and understanding and dimensioning of available tacit knowledge. It is painfully obvious that any centralized intervention in interest rates, for example, will introduce strong differentials into the ability or willingness of different companies to use loans to invest. Where centralized interest rates are below 7% but above 4% the risks associated with the loans is less than at higher interest rates and companies and individuals are encouraged to save money to accumulate an increasing nominal sum as a result of interest rates earned. Higher interest rates discourage investment and savings will be encouraged. Under quantitative easing, interest rates have been reduced to close to zero. This has resulted in a destruction of any incentives to save and in a diversion of "cheap money" by banks into assets. As a result economic units have neither savings nor reasonable interest rates against, since the banks add at least 6% to the base rate, with which to invest because the diversion into assets depresses the market. In all centralized interest rate scenarios the notion of managing aggregate demand through interest rates linked to more debt (money volume) has no relationship to the organic growth potential of the population of economic units. The arbitrary manipulation of interest rates only contributes to the generation of some fortunate winners, a majority of losers and a group who remain in a neutral policy impact state.

Real economic growth

It is self-evident that "throwing money" at the issue of provision of production or services will not be successful except in a few exceptional circumstances and many taking up the money will not deliver within budget or on time, if at all. The latest Covid-19 response has provided ample examples of these sort of outcomes. Where companies either apply endogenous money or a limited amount of borrowed exogenous money and they have sound decision analysis and therefore can manage the relevant facts concerning explicit and tacit knowledge, growth will usually be steady and successful. The result is real economic growth as a result of moderated or even reduced output prices while securing higher revenues as a result of market penetration made possible through higher productivity. This, it should be emphasized has nothing to do with "demand" but is directly related to unit price reductions or work force pay rises that result in higher purchasing power for the same nominal sum of money, leading to increased consumption.

Freedom of choice

Constitutionally, politicians talk about freedom, democracy and the rule of law but few stop to think that the law and regulation surrounding macroeconomic policy frameworks and the policy instruments applied, suppress the freedom of choice of social and economic constituents. On the side of a saver, they should be allowed to invest in those activities which for various reasons, including ethical, they would like to support. The interest rate should be decided as a result of the private negotiation between the saver and the lender. There should not be an imposed condition that constrains this liberty. On the part of savings and loan groups, it is quite feasible for there to be several interest rates according to group preferences in helping develop specific types of activity. Such interest rates should be decided by these groups. In term of banks, rather than have a base rate bank increment on interest rates it would be preferable for banks to be required to improve their due diligence so as to have better oversight of the decision analysis details that produced investment decisions and plans. This business should, of course, be carried out as a separate investment banking activity which cannot use retail customer funds to supply loans to commercial companies. Today, information technology permits the replacement of expensive IPOs with popular funding vehicles that are directly linked to individuals who wish to invest in companies directly.

Macroeconomic policies relying on issuance of exogenous money assume the real economy is a sponge. The real economy has specific and limited time-based absorptive capacity. |

Exogenous funds to generate "demand"

There are several modes of generating exogenous money. The most conventional is by raising debt. Others include the notion of governments controlling the legal currency "printing press" or mint, can therefore substitute the central bank and issue money to pay for any specific requirement. Modern monetary theory appears to be cast in this mould.

There will always exist an inertia within the real economy that dictates the feasible rates of real growth based on the evolution in state-of-the-art-technology, techniques, refinement of knowledge and innovation and the rate at which abilities associated with these factors diffuse through the economy. Attempting to accelerate this "rate of real growth" by spending more money, ignores the fact that the relevant resources required to satisfy the "need", some might call this "demand", either in terms of explicit or tacit knowledge or natural resources are limited and on the environmental side attention needs to be given to sustainability. Allocating money to an ever increasing front will face a significant problem of the absorptive capacity of the economy. Absorptive capacity is the probability that an organization has the capacity and competence to carry out all aspects of a investment design through to full implementation with success's and subject to the satisfaction of all normal investment and performance criteria. Amongst the most important performance criteria is our ability to reverse climatic impacts of unsustainable production and consumption practices, to reduce income disparities. These by their nature require major changes in social and economic practice which aim to maintain or increase the carrying capacity of the environment. At the moment this has a negative correlation with demand led growth, largely based on exogenous "demand-led growth". The marginal returns to exogenous money within the real economy, clearly has limits, as quantitative easing has demonstrated. The more practical options for those wishing to accumulate a return in terms of return on their activities is to become less active and to invest in assets.

Unresolved constitutional economic questions

At the moment the role of the constituency made up of the four nations of the United Kingdom have essentially no role in moulding macroeconomic policy since the tenets, dogma and logic of policy lies within the territory of Keynesianism, monetarism, supply side economics and, it would seem, possible flirtations with modern monetary theory. Unfortunately, these are all aggregate demand model based and have a role for exogenous money. The disastrous consequences of quantitative easing should be enough for the constituency to question this policy of exogenous money that has been so destructive. The reality appears to be that political parties take their cues from influential lobbies and in particular those who control the money supply in the form of financial intermediaries and banks who appear to be growing by the day as a direct result of QE. Under the so-called, modern monetary theory, who will decide on the assignments of such funds. At the moment the majority of constituents are not in the loop and the financial sector, whose power and policy influence has grown under the policies of exogenous monetary growth, will wish to keep it that way. MMT is certainly seductive in being an "easy way" to solve problems including poverty, unemployment, basic incomes and much more. This is why it has appealed to those who see an increased role for the state in economic affairs. At the moment the state is aligned strongly with the financial sector interests and this would intensify under MMT resulting in probably even more income disparity. Governance by financial sector decree will intensify. If a growing proportion of a naive "left wing" and some "alternative economists" having been seduced by, and are now actively advocating MMT and other economists and interest groups, which some call "Neo-Liberals", continuing to advocate the failed ADM model, it should become obvious that nothing will change; it is more likely to get worse. We are witnessing an advancing completion of the "take-over" of the bastions of economic thought and practice, such as they are, by financialization.

The most obvious outcomes are that the constituency will continue to be increasingly marginalized from any sight of the decision analyses behind the government advocacy influencing public choice. The economic results will continue to be poor and there will continue to be an erosion in important constitutional issues of public choice and the freedom and wellbeing of the people of this country.

1 Hector McNeill is the Director of SEEL-Systems Engineering Economics Lab.

All content on this site is subject to Copyright

All copyright is held by © Hector Wetherell McNeill (1975-2020) unless otherwise indicated

|

|

|

|