One of the most remarkable characteristics of hegemonic cycles is the slow motion inversion of the notion of Schumpeter's creative destruction into a destructive change that in its final phases is prejudicial to the majority of the onshore constituency while favouring the interests of a minority who have a command over finance and assets.

Moving outside the framework of

unelected sovereigns to oligarchs who have little interest in the interests of the majority, the only means of managing economic affairs, one would have thought, is through appropriate macreoeconomic policies focusing on the wellbeing of the majority.

There is, however, very little evidence that this in fact occurs. Economic policies are very much under the control of minority interests whose main objective is the rise in the value of their asset and financial holdings.

Considering that hegemonic cycles seem to last around 100-150 years, or 4-6 generations, there is a need to manage the social perceptions on the part of the electorate, that how the economy is being managed complies with the most advanced state of knowledge on economics and how the economy functions. This means that whatever stage of the hegemonic cycle a country is, it is necessary to have educated and moulded opinions to adjust to the changing patterns of objectives of oligarchs. Clearly, if the educational level of the masses is sound, then at any stage in a cycle, logic and human ingenuity would come up with many questions and options for managing the economy. This assumes that the constitution has elements stipulating the provision of effective ways and means for the public to share information and to contribute to public choice on such issues as policy. In reality this structure does not exist. As a result the somewhat fatalistic acceptance of the inevitability of the repetitive nature of hegemonic cycles persists. If people do come up with alternatives then these are not recorded, no action is taken and the cycle rolls on.

The diagram above shows a somewhat remarkable transition in which the whole concentration of intellectual thought and practical action passes through several basic states. These are:

These states of activity tend to subordinate the focus of attention from the dominant interests in previous periods to increasingly financial concerns. In this process the dominant tacit knowledge,or know how, driving growth also changes from technology and technical/economic productivity to increasingly financial capabilities. However, tacit knowledge linked to onshore engineering capabilities and productivity is the original source of real growth that creates the economic foundation for rising real incomes and employment. Naturally, engineers and entrepreneurs develop technology and innovations with an intent to sell their products. However, the expansion and trade phases occur over perhaps 50-60 years or more, so the originators will have passed away to be replaced by a new generation living in a world where individual corporate operations are on a larger scale. Logistics become an important dimension of required expertise, the majority of decisions become increasingly dominated by finance. At the end of this phase the preeminence of operational decisions being financial, the actual status of the onshore operations tend to become marginal considerations in selecting investments for expansion because most emerging opportunities appear offshore, for example, in low income economies. As a result further growth under a dominance of financial decision-making, the onshore economy faces declining investment and productivity, falling employment and real wages and declining consumption of onshore supply side output. On the other hand, onshore assets undergo speculative price rises, largely as a result of excessive finance being injected into asset "markets" on a speculative basis. The include land, real estate, rare art, gold and other precious metals, commodities, financial instruments, cryptocurrencies such as bitcoin and shares. Import prices become are very competitive and, in reality, much of the economic activity representing this competition has been created by national financiers who have no apparent concern about the plight of the majority of onshore wage earners. Although it is their decisions that create prejudice for the majority of the constituency, it is left to "government" to sort out any attendant problems.

Like the well-organized and financed campaign of denial concerning the negative addictive nature and health impacts of tobacco, the last 30 years has also witnessed a well-organized and financed campaign denying climate change. Both of these campaigns put back the introduction of governmental legislation and constitutional settlements to prevent many deaths in the case of tobacco as well as the more general existential crisis facing the world's population with respect to climate change and ecosystem carrying capacity. In both cases the well-funded merchants of denial involving academics and funding for university "research" by tobacco, petroleum and coal industries to administer a campaign of misrepresentation based largely on assertion and innuendo. This dishonesty was coordinated with the mainstream media, bereft of levels of intellectual honesty necessary for the operation of a democracy, enthusiastically disseminating this misrepresentation of the facts (fake news). To consolidate their position, the same industries contributed to the funding of political parties to achieve a significant inertia and an unacceptable level of government inaction worldwide.

In the field of KM (Keynesian and monetarist) policies the merchants of denial are involved in a campaign to convince the public and governments that monetary policy is designed to create "wealth" and this benefits the national economy and by implication the majority of constituents. The evidence states otherwise.

The notion that socio-economic issues need to be solved by government action has to take into consideration what created the issues in the first place as well as who pays for such solutions. Under the logic of monetarism and its variant in the form of Keynesianism, Governments have only two basic ways to raise funds to support government "public expenditure". These are taxation or raising loans. Any substantive revenue from taxation needs to be raised from the medium and high income segments because a large proportion of the population do not earn enough to pay tax. The other option is borrowing funds, essentially from the organizations that support high income earners. This of course, is not a tax but rather governments issue guarantees to pay the funds back at a profit to those supplying those funds. However these funds will be paid back through future taxation of the largely middle income earners over time. As a result, clearing up socio-economic issues created by KM policy failures, make use of "solutions" that benefit financiers. What is often not fully taken on board by those who support Keynesianism is this basic fact of its contribution to impoverishment of the majority. Just to make the point, the taxation option depletes the income and holdings of high income groups whereas the lending option depletes the income and holdings of the lower income segment of society, including a diminishing middle class. The most significant amplification of this anti-social approach to economics has been quantitative easing. To understand the degree to which monetary policy is geared against the interests of the majority is necessary to review that transactional terms faced by asset holders, a minority, and wage earners, the majority.

The transactional terms facing asset holdersInjecting increments of exogenous money into the economy in excess of endogenous funds in circulation results in a significant proportion of these funds flowing into speculative asset markets as opposed to productive investment. The main beneficiaries are a minority of constituents whose economic operations reside in the Venn bubble A in the diagram on the right.

The transactional terms of this arrangement are that nominal income is directly related to rising values of transactions and therefore real incomes rise with asset prices. This is driven by monetary injections.

The transactional terms facing wage earnersOverflow of asset prices from the land, real estate and some commodity markets, eventually increment the prices and rents on housing, office and business premises, retail and industrial units, warehouses and other infrastructures causing cost-push inflation on the supply side or blue section in the diagram on the right. Most constituents receive their incomes from employment in supply side goods and services sectors and they reside in the Venn bubble B in the diagram on the right indicated by SSP. The increasing diversion of exogenous injected funds into offshore investment, combined with the diversion into asset markets results in falling investment and productivity in the onshore supply side sectors causing employee nominal incomes to freeze resulting in a fall in real incomes.

The transactional terms of this arrangement are that nominal income is directly related to supply side turnover which stagnates and therefore real incomes eventually fall. This is driven by monetary injections.

Currency purchasing power and money injectionsAlthough monetary policy logic states that increased money volumes result in inflation or unit price rises, the attention of the public and politicians is mainly on the unit prices of goods and services rather than assets. On the other hand, asset holders benefit from monetary injections because this helps raise the funding flowing into asset markets and therefore their asset holdings rise in value. The absolute rise in values of asset holdings are related to the purchasing power of the currency and the unit prices in goods and services needed by the wage earning segment. The lagged nature of cost-push inflation arising from monetary injections means that monetary policy can ratchet up asset prices to some considerable degree before inflationary leakage from land and real estate and some commodity markets, flow into the supply side costs. As a result the relative rise in real incomes of asset holders continues to rise while the relative status of wages is stagnation and eventually falls in real value. However, pressure on wages will rise as a direct function of rises in unit prices of goods and services so monetary authorities fix a somewhat arbitrary target rate of inflation for goods and services at 2% per annum before reacting to arrest this inflation. In the meantime asset prices can rise by very high rates along with asset holder real incomes because of the concentration of funds in high value markets that are generally inaccessible to the majority of wage-earners.

The same logic determines that in order to reduce inflation money injections should be reduced through a combination of higher interest rates, higher taxation and reduced monetary injections. However the inflation referred to is the unit prices in goods and services generated by the supply side and not the price of assets. Rentiers and asset holders are not primarily concerned with unit price rises in goods and services but rather their main interest is to see the speculative rises in asset prices to proceed as far a possible and at rates that exceed any unit prices in goods and services (inflation).

Constitutional dimensionsAs is self-evident, our constitutional settlement does nothing to establish norms of behaviour or even expectations of anything to do with equal opportunities to participate in the benefits of KM policies because of what is a fundamentally biased operation of the economy in favour of asset holders and those who are employed and who run financial intermediation institutions. A reasonable expectation, it would seem, would be that a constitution either in terms of the free operation of social practice and behaviour or in law, should provide a practical basis for responsible levels of freedom, exercised by constituents, that does not allow the pursuit of interests by any one group affecting the ability of others to do the same. This is not how the economy operates under our current constitutional settlement.

Tacit and explicit knowledgeAs this multi-generational cycle proceeds, the topics and nature of the actions that bring about change are associated with a significant evolution in the dominant human capabilities embedded in tacit knowledge and in the information and data in the form of explicit knowledge. Academic and other educational institutions and interest groups centred around "think tanks" take up the "cause" of what they perceive to be the dominant interests of "the economy" but heavily aligned with the interests of those who are accumulating income and who can afford to support the activities of universities, fund authors and text book content, interest groups and political parties through financial contributions. As a result the economic cycle heads in the direction favoured by those who are controlling finance in a self-perpetuating and self-fulfilling process.

Any suggestion that this should not be the case is met with accusations of those making such suggestions as being people who "do not understand how the economy works" or that they are voicing "dangerous" suggestions that will destabilize the economy or country. These reactions can become quite paranoid suggesting that suggested enquiries into better alternatives have malign objectives such as the overthrow of the government and democracy in order to introduce some alternative variant labeled as ""socialist" or "Trotsky", "Communist" or even "Fascist", regime. This sort of headline is the stuff of many mainstream media playing their role as deflectors of the attention of the majority of constituents from the underlying causes of their declining wellbeing. This is where the mantra "The is no alternative!" becomes the last ditch defense of governments who in reality know no better because of the nature of advice they receive and because of their need to support the interests of the benefactors who fund them.

A simple logicOver the whole hegemonic cycle there is a transition from a relatively stable Say Model, within the supply side of the economy, which represents an equilibrium between production, wages, investment, productivity and consumption, and the situation towards the end of a hegemonic cycle, of an injection of massive amount of money into the economy. Research and development of RIO (Real incomes objective) theory and policy distinguishes these money flows as:

- Endogenous money - supply side cash flow that supports the Say Model

- Exogenous money - injected money which is largely unconnected to endogenous money

The rate at which technological productivity declines and countries begin to lose their productivity advantages in the production of goods is roughly proportional to the rate of expansion in exogenous money. The correlation between exogenous money volumes and levels of investment in the onshore supply side is negative resulting in lower productivity and lower real wages. Again, the supreme recent medium term case study of this experience of the United Kingdom has been the impact of quantitative easing.

Nothing is inevitable

Nothing is inevitableAt any particular time, the differences in productivity in state of the art technologies measured across a sector, are significant. Therefore without innovation but rather technology transfer within a Say Model of the economy the

real rate of economic growth has the potential to outstrip anything achieved under QE, for example. In addition, the productivity increases arising from the learning curve driven by rising production and sales volumes is a constant and a means to maintain the levels of income and wages in real terms. Last year, one of the articles posted under the banner of RIO research, entitled, "

A constitutional economic policy - Part 7, Designing a sustainable future - Step 1" identified a range of significant extremely low cost and high short term return "investments", that do not need massive influxes of finance. These included:

- SFI - shop floor innovation; <6 months-incremental

- SCAD - Short concept to application development; <12 months-spaced

- MCAD - medium concept to application development; <24 months-spaced

- SOAT - state-of-the-art; 1-60 months-blocky

- SRAD - research and development (speculative); 24 to 120 months-more spaced

What is notable in the recent discussions in th UK, for example surrounding applied research and development is a over-preoccupation with the area with the lowest short to medium term payback (SRAD - or speculative research and development). Whereas Dominic Cummings, a special adviser to the government, provided many justifiable reasons for the formation of ARIA (Advanced Research and Invention Agency). However, what he was in reality attempting to address were gaps in the advance of technology in the United Kingdom which are directly linked to a historic lack of applied nature of research in this country which has caused increasing gaps in productivity under the dominant policy framework of monetarism. As a result ARIA is being fashioned as a highly academic organization designed to tackle the least urgent SRAD investments. What is missed here is that by getting one's hand dirty doing things across the options SFI, SCAD, MCAD and SOAT innovation accelerates and the critical basic R&D requirements of importance to SRAD become exposed.

Much of the parliamentary committee dialogue with Dominic Cummings also related to the amount of money the UK spend on research and development and in response to a question to Rebecca Long-Bailey concerning the percentage of GNP spent on R&D, Cummings suggested this percentage approach linked to GNP was not useful. This seems to relate to his currently correct notion that it is difficult to generate cost-benefit assessments of possible results of basic research initiatives. However, this misses the point that there is a systemic problem in the current structural relationship between supply side production and innovation. If a country's supply side production base constantly prioritizes investments such as those listed above, the significance of types of advance in knowledge in terms of potential practice becomes more obvious. This is because it is assessed in the context of an advancing tacit and explicit knowledge which can result in more realistic estimates of potential benefits of advances in knowledge in specific domains. It is this resistance to, or ignorance of, the significance of shop floor innovation through to state-of-the-art dissemination that condemns the UK to this wholly academic approach to technology innovation. Hours of parliamentary analysis would be better spent on how industry, manufacturing and services operate and how macroecomomic policy needs to begin to take up elements that include a continual process of technological innovation as an important national resource. However KM theory and practice contains no technological or even microeconomic foundations at all. Therefore derived macroeconomic policies provide no basis for addressing a vital national issue which incidentally would change the inevitability of the drift in priorities under hegemonic cycles.

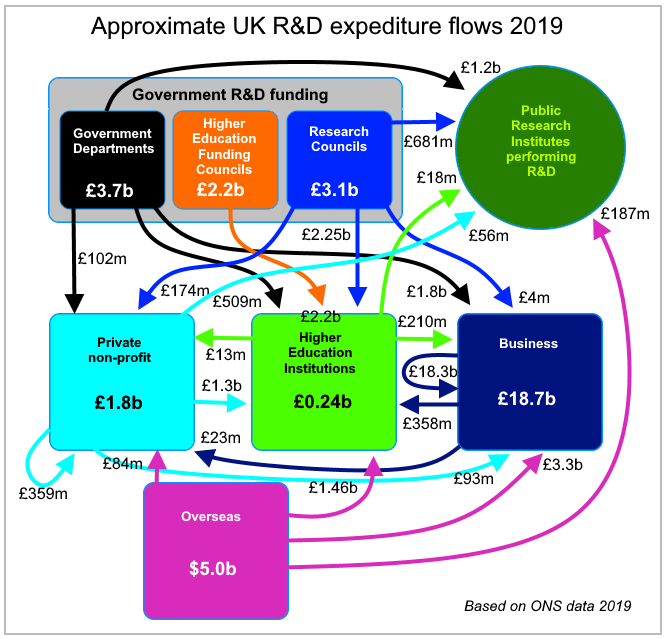

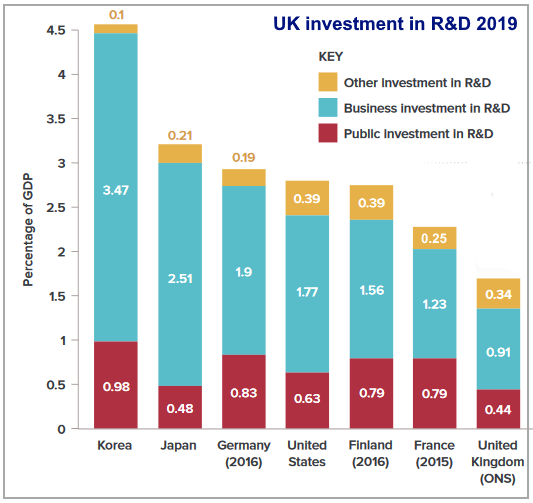

Rather than aiming to double R&D expenditure in the UK a Say economy would make technological innovation a centrepiece of innovation efforts by providing appropriate incentives to promote innovation but also to do so in a way that gains a permanent traction. A reclassification of what makes up applied research and development activities towards an emphasis on a proactively innovative economy could easily drive the percentage of GNP being spent on applied research and development surpassing world leaders such as Korea which is around 4.5% with the majority made up by business innovation, more than twice the level of the UK in absolute terms, with a slightly lower per capita income. As previously mentioned, under the Say model, economic growth arising from endogneous savings by companies starts out with companies already economizing and raising productivity having gained sufficient tacit knowledge to do so. The internal corporate culture makes the likelihood of investment more likely to contribute to further rises in productivity.

We know that some

70% of economic growth arises from learning and innovation and that the actual locations of innovation are in the act of production so it is more than apparent that economies whose businesses invest more in performance related investment will continue to be competitive. But this growth is generated by the application of the innovation it does not arise from concepts yet to be applied or to basic research findings or the contents of in peer reviewed papers.

Manufacturers, industries and service companies need to terminate the habit of purchasing plant and technologies as black boxes to be operated without a full understanding on how the black boxes can be improved or giving more consideration to the personnel training required to operate efficiently. This is why companies with identical state-of-the-art technologies can end up with markedly different levels of productivity and efficiency in the production of the same types of product or services. At the same time this fact presents the opportunity for policy to support extension services to encourage companies to migrate to better practice and levels of productivity. Capital equipment suppliers need to welcome feedback on additional needs or suggested improvements. SMEs who often consider themselves to be too small to dedicate personnel to such evaluations need to be encouraged to support shop floor operatives to come up with suggestions. The dreadful employment relations in many labour-intensive production facilities in the United Kingdom where employment depends upon punctuality and doing as ordered even when orders are illogical, needs to be replaced by giving space for operatives to develop competence in conducting given tasks rather than dismissing people who have not have time to develop their abilities. The zero-hours and immigrant labour environments in the UK survive by paying very low wages as opposed to relying on managing improvements, innovation and productivity leading to both higher margins and wages and therefore onshore consumption and demand.

Avoiding technological decay Technological decay is the result of exogenous monetary injections overwhelming the absorptive capacity of the economy and ending up with essentially excess funds flowing into assets. This happens to the degree that intermediaries such as banks and investment funds, develop a desire to minimize risk as opposed to carrying out somewhat more complex due diligence to undertake detailed assessment of more complex investments involving something as messy as technology. Asset market prices are driven up by increasing injections of funds and transactions. As long as government and the central bank proceed with monetary injection, profits and high rates of real income on the part of asset holders is almost guaranteed with very little intellectual effort. As this process proceeds investing in any technologies that do not provide an immediate windfall gain tend to be avoided so preference is given to investments where the cost gains of offshore operations result in a relatively high gain and low risk. In terms of the onshore economy a technological decay sets in as a result of onshore supply side activities being perceived to be higher risk and not offering adequate room for "expansion".

Time out - what have we gathered so far?

The hegemonic phases are given and as described above:

- We are in the financial speculative phase

- This has been exacerbated by quantitative easing which has resulted in:

- investment being drained from the supply side

- declines in supply side wages

- loss of employment

- rises in asset price inflation

- land and real estate inflation causing cost-push supply side inflation

- decline in currency purchasing power

There has been much talk about why the United Kingdom is falling behind such countries as China in a range of high technology and basic manufacturing activities. This conversation has drifted into the realm of basic research and development (SRAD) largely promoted by research organizations and universities. However, the immediate problems facing the United Kingdom relate more directly to a failure to take advantage of more applied developments such as SFI and SOA which have an immediate impact of national productivity and should be taking place across all sectors in the supply side. It is worth emphasizing that China only spends 2.23% of its GNP on R&D while the main gain in terms of productivity and now a world leadership in patent registrations are mainly based on SFI and SOA and home grown practical innovations.

Notice that the "build back better" and infrastructural investment" and other employment-creating mantras all ignore the central problem which is set out below.

So what is the problem?The 1929 Crash and Great Depression, the 1970s slumpflation crisis and the 2008 financial crisis are all considered to have been caused by different conditions. To some extent, this is true. But none of the monetarist and Keynesian policy instruments were successful in solving the "problem" and this is because the problem was never clearly identified. It was variously identified as "unemployment" as the obvious symptom of the Great Depression leading to John Maynard Keynes proposing a way to kick start recovery as defined by falling unemployment through the injection of money into the economy based on government loans and direct government expenditure on public works (today referred to as infrastructure). In the late 1970s the problem was identified as inflation combined with unemployment leading to a wrong causal diagnosis and the raising of interest rates to depress the economy and thereby inflation while also raising unemployment and income disparity and widespread foreclosures causing many sound mortgagees to lose their homes without compensation from government. In 2008 the problem was identified as lack of liquidity in the financial services sector cause by bad decision making, fraudulent deals and excessive speculation by the same financial intermediation sector.

A way out of crisis?In 1975 investigations on the slumpflation crisis with the objective of making policy proposals ended up with different propositions, supply side economics and the real incomes approach to economics.

1. Supply Side EconomicsRobert Mundell and Arthur Laffer contributed to one option referred to as "supply side economics" which was essentially a fiscal variant in which the marginal tax rates were reduced in the hope that this would release funds into R&D and investment to improve productivity and therefore absorb inflation while also creating more opportunities for employment. In practice, under the Reagan administration this was applied but it was combined with very high interest rates causing investment loans to be expensive. Income disparity rose, as a result of the overall depressive impact causing widespread foreclosures on family homes and farms. Inflation did decline but at a high social cost. Government programmes were pared back because of a massive decline in government revenues to generate one of the highest government deficits in history. In reality this policy was a failure but the frustration of the financial services sector resulted in deregulation of financial affairs which was accelerated under the Clinton administration. This contributed to the yet to occur 2008 financial crisis.

2. Real Incomes Approach to EconomicsThe other investigation on the slumpflation crisis, which I pursued, set out with the specific objective of avoiding the predictable prejudice suffered by the majority of constituents under the prevailing Keynesian and monetarist approaches. Clearly, prejudice results from a misalignment of policy instruments with the specific interests of constituents. However, constituents can be divided into two types as social and economic constituents. Social constituents are those concerned with individual and family wellbeing and advancement with adults being voters. Economic constituents are the economic concerns of social constituents of working age in any position in companies or as self-employed as income earners. In this context therefore there was a need to accommodate these dual interests of all constituents through the organization and operation of the society and the economy. This is, therefore, advancing a perspective of constitutional economics but designed to avoid policy-induced prejudice on any constituent. This approach is therefore akin to the approach of John Rawls' (1921–2002) concept of justice as fairness. The Real Income approach led to a pragmatic and practical approach to pubic choice to be based on commonly agreed elements recognized by all constituents to be individually beneficial and which, in constitutional terms, would therefore impose a certain discipline on society concerning the economic organization of society. Therefore the policy indicator quest became one of finding the indicator that is understood and valued by all. This is a fundamentally important basis for establishing an intelligible reference to underpin the initiation of a national forum on policy to identify propositions that can be supported by all. Inflation and unemployment are not such indicators because they do not affect all in the same way. Inflation in asset values is definitely not the same thing as inflation in goods and services. Unemployment only effects certain segments of society and whereas many will agree unemployment is not a good state of affairs it is a relative measure with people assigning different levels of concern in relation to it.

Within a year of initiating this development work, in 1976, I identified real incomes as the most important measure of common interest to all as well as being a good indicator for guiding macroeconomic policy. At that time, real incomes was a general statistic applied to aggregate nominal incomes by applying a correction for inflation; a somewhat abstract statistic. However, the significant context of real income is the specific purchasing power of each constituent and of which each person is wholly aware. This becomes a measure of more immediate interest to each constituent and indeed, each voter. By moving away from nominal incomes and distorted consumer price indices, the public become more conversant with their purchasing power. The strength of the currency, its purchasing power, becomes an important consideration. With this individual ranking of personal priorities, people's perspectives on economic policy options also change to something that is of a more practical, demanding more transparency from policy makers.

By focusing on real income a fuzzy lack of relationship between nominal incomes, currency value and inflation is dissipated because constituents are less fooled into confusing nominal incomes with purchasing power. I also considered real incomes to be an essential indicator because it provides a way to link personal real incomes earned within the supply side microeconomic environment which in aggregate makes up the macroeconomy. Real incomes are a common interest of shareholders, factory floor operatives and financial service company executives. The problem appears where decisions have to be made on the "division" of real incomes generated between different economic constituents be they executives, shareholders or wage-earners. In political terms and in terms of constitutional economics justice and law as upholding fairness and transparency becomes the king pin of policy success. However, rather than rest on the "market" to distribute real incomes it was evident that with differentials in wealth there are associated differentials in decision making power so a policy legislative framework is required to impose fairness in distribution of real incomes. This, however, is not based on some arbitrary "reallocation" or "compensation". It is around this possible quandary this development work took an interesting turn. Rather than defaulting to subsidy or various means of government making up shortfalls in real incomes, he addressed one of the most significant gaps in Keynesian and monetarist models. This was the absence of considerations of the contributions of learning, technological innovation and competitive unit pricing which are completely absent from Keynesian and monetarist theory and policy practice. This is one of the main reasons his work, originally referred to as "The Real Incomes Approach to Economics" and more recently linked to the slogan "RIO-Real Incomes Objective", is considered by some to be some socialist ideal and therefore suspect by those hostile to anything based on social equity because this being considered to be unrealistic or unworkable because these states have never existed. However, this condition has not been allowed to develop because of a major flaw in macroeconomic policies based on monetarism and Keynesianism that the interaction of policy objectives, instruments and constituent decision making involve a zero-sum approach to economics. As a result all conventional policies have always generated winners, losers and some who remain in a policy-neutral impact state. The general bias in macroeconomic policies results in the real incomes of asset holders rising while for the majority real incomes stagnate or decline.

So how can we avoid catastrophe?By keeping real incomes in focus also raises the significance of the onshore:

- purchasing power of the currency

- wages

- productivity in the production of goods and services

The purchasing power of the currency is linked to the productivity of production of goods and services and wages that are paid to those employed in these activities. Reference has already been made to the significant gains in productivity that can be secured by simply bringing about a transition of practice towards best practice and away from poor or average practice. The risks involved are few because best practice is demonstrably feasible in those activities attaining this level of performance. The productivity frontier is always advancing as a result of learning and incremental innovations and sometimes major innovations. In fact across many sector the difference between poor and best practice can sometimes represent a gain in productivity of 500%. However, it is important to look at production systems and not just components. For example, many IT system can increase information management tasks by over 1000% but once integrated into a production system with equipment, operatives and logistics infrastructures this gain can be reduced to a production system gain of 1% or 2%. However, a systems approach can help understand the relative contributions of system components to productivity leading to a convergence on a growth rate in productivity of a constant 2%-5% per annum. This is a rise in productivity of 18%-62% each decade. What can be achieved within this range depend upon the sector and specific processes that make up the tasks of different economic units. The important point to understand is that it is possible for companies to grow at this rate by managing productivity rises to raise the savings required for investment without resorting to external funding. In an expansion scenario it is preferable to seek equity and equity that is not based on loans. It is notable that in the period of unprecedented economic growth in the UK between 1945 and 1965 real incomes rose across the board the use of exogenous funds and expansion of money supply was moderate. As a result, productivity advanced in parallel with rises in nominal wages leading to rising profits, stable prices and rises in real incomes. This was close-to Say Model of the economy. As we have seen with the rise in exogenous funds and financialization the balance in the Say Model of all consumption being based on the funds received as income, has broken down as a result of excess funds flowing into assets and offshore. These investments have been in activities for the production of goods previously produced onshore resulting in a loss of onshore employment.

Today, in spite of relatively low onshore investment, process productivity and innovation continue to advance with profits as a share of GNP outstripping the growth in wages as a share of GNP. As a result there is an impoverishment of wage earners.

Inflation and currency devaluation a permanent feature of conventional policy impactsTurning to the conventional macroeconomic instruments of money volumes and interest rates and taxation it is evident that these have no impact on productivity, unit prices or wages or, for that matter employment or inflation. There is already inflation as a relatively permanent feature under monetarism and Keynesianism in asset prices. The land and housing components of speculative asset markets cause a permanent pressure on supply side production costs or cost of living of wage earners. Permitting inflation in the prices of goods and services to rise to a "target" of 2% or a devaluation of the currency of 18% each decade is a cynical and arbitrary indicator of when interest or tax rates should be raised to avoid this erosion in currency value impacting the real value of assets. As long as inflation is below 2% but currency value continues to erode policy makers are not concerned with the purchasing power of stagnated wages for families to pay for essentials. Under such circumstances they will continue to inject exogenous funds into the economy to maintain the growth in asset values.

Bringing things back into equilibriumThe real incomes approach (RIO-Real Incomes Objective) represents an attempt to return to the Say equilibrium and growth approach based on the Production Accessibility and Consumption Model (PACM) which mirrors Say's 1803 treatise title,

"The Production, Distribution and Consmptioon of Wealth". This model is used to construct a transparent economic policy with appropriate instruments to enable the real incomes of executives, shareholders and wage earners to all rise simultaneously. This possible if there is a constitutional decision to base macroeconomic policy on the promotion of productivity and upon fairness where advantages are not provided to any particular group. My own approach to this question is not to revert to an "anti-capitalist" rhetoric but rather to pare back the elements of economic operations to the basic essentials of competitive pricing based on a growing flexibility through rising productivity. The core of this model is to provide incentives to companies to invest in productivity gains by providing close to immediate real time payback for gains in productivity reflected in changes in unit output prices. This can be achieved by using two policy instruments, first identified in 1976 by the real incomes work:

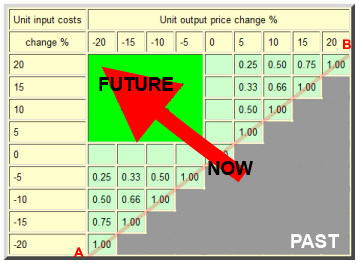

The strategic productivity boundary AB

The light green cells show the values of price performance ratios (PPRs) based on the changes in aggregate unit costs (vertical axis) and unit output prices (horizontal axis).

With time the strategic productivity frontier indicated by the movement from a PPR above unit to one below unity is indicated by the border of PPR=1.00 marked by the boundary AB. The past is to the bottom right and the future is towards the top left.

Source: McNeill, H. W., "The price performance ratio", Real Incomes Organization, 1981; McNeill, H. W., "A Real Incomes Approach to Economics", Monograph, Rio de Janeiro, 1976. |

|

|

- The PPR or price performance ratio

- The PPL or price performance levy

The price performance ratio is the percentage change in output unit prices divided by the percentage change in input aggregate unit costs in any production period. This simple ratio indicates whether an economic unit is promoting, passing on or absorbing inflation or currency devaluation and purchasing power. The relationships here are simple. A PPR of less than unity (<1.00) reduces inflation and enhances the purchasing power of the currency. A PPR of unity (1.00) passes on inflation in unit output prices at the rate of input inflation. A PPR greater than unity (>1.00) increases inflation and depreciates the purchasing power of the currency. Real incomes can be promoted by keeping PPRs of less than unity. In strategic terms, for the whole economy it is beneficial to plan for the economy to move towards lower PPRs as shown in the diagram on the right.

Clearly, from the standpoint of a national strategy, this analysis is useful to understand, on a sector basis, strategic productivity objectives.

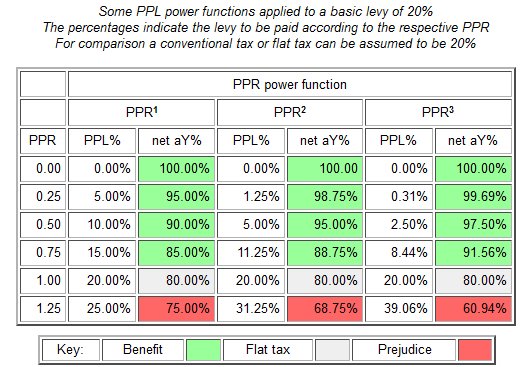

Experience with all conventional macroeconomic policies, including supply side economics, was the fact that while sometimes there are momentary movements of productivity in a beneficial direction, there is always a failure to gain sustained traction. Therefore to maintain traction, where traction signifies the improvement in a policy objective to a status desired or in a dynamic circumstance to maintain movement towards a desired permanent state or telesis. Where telesis if the steady progress towards and objective through the intelligent use of resources. The requirement is that objectives keep advancing and therefore so should the process as a permanent feature of the economy. To achieve this use can be made of the price performance levy. This is a withholding levy which is varied according to the PPR of a company. Notice that this is not an arbitrary fixed level like corporate taxation but rather an incentive which good managers and work forces can manage so as to pay no levy at all. The levy is paid as a function of the PPR of a company in a performance period. Starting with a base rate, any company with a PPR of less that unity will receive discounts on the base rate with the possibility to eliminating it altogether. Companies with PPRs that exceed unity pay higher levies according to the level of the PPR. The way companies lower the PPR and pay less levy is by strategic investments which, of course raise unit costs, and the outcome depends on the unit prices charged. Naturally this will only work out well if investments are bone fide and in fact raise productivity.

Example of power functions for Price Performance Levy

This table compares three PPLs that use a power function to discount or apply surcharges to the basic levy which starts at 20%.

The column headed PPL% is the actual levy paid according to the power formula in the header.

The green cells indicate income net of PPL indicating reductions and the red cells indicate the income net of PPL in those cases where the PPR exceeds unity or specifically a PPR of 1.25 resulting in a levy surcharge.

Source: McNeill, H. W., "The price performance levy", Real Incomes Organization, 1981; McNeill, H. W., "A Real Incomes Approach to Economics", Monograph, Rio de Janeiro, 1976. |

|

|

The unusual aspect of this policy and its instruments is well worth noting. It not only sets out a clear model of a macroeconomic productivity strategy, it also provides economic units with clear business rules that help them become increasingly competitive. This is something that arbitrary centrally-imposed interventions in interest rates and fixed tax rates cannot achieve nor can arbitrary exogenous monetary injections, which only add to the instability. One of the unique qualities of this approach is that companies that comply with policy objectives become increasingly competitive.

Growth, employment, wages and consumptionThe emphasis on price moderation leads to a higher rate of market penetration of output and compensation for lower per unit nominal margins through higher total real incomes from sales. Even without raising nominal incomes or wages the deflationary trend in the unit prices of goods and services will result in rising purchasing power of the currency and therefore raise real wages. For the economy, this represents real growth which aligns with the Say Model's modality for growth. All of this assumes the maintenance of a close-to Say Model where the levels of consumption, whose value constitutes the payment of wages by the supply side, represent the "demand". As a result, employment, production, margins and consumption are all managed on the basis of free decision making on the part of companies within a policy framework that is designed to maintain the dynamic equilibrium required to avoid over or underproduction. The adjustments to any such disequilibrium rely, as stated by Jean-Baptiste Say, on the reactions, adaptability and decisions of entrepreneurs.

What is the medium to long term potential for onshore productivity gains?As has been indicated the introduction of SOA best practice can help raise the productivity of whole production systems by up to 500% it is a matter of having commercially neutral extension systems that help companies adopt the most appropriate systems as opposed to gaining commission sales on specific products. The ongoing impacts of the learning curve on tacit knowledge (individual operational competence and understanding) and on accumulated decision analysis data (explicit knowledge) helps to continue the process of refinement, even of "best practice". The potential for rises in productivity varies with sector. However, unless labour is engaged in the design and production of goods and services all of this pontential is absent and the opportunities for raising onshore real incomes are lost. Therefore labour status depends upon resuscitating supply side onshore manufacturing and industry. It needs to be understood that in spite of the hype much of what is imported from countries such as China is still of a poor but rapidly improving quality. There are many opportunities to compete since technology is facilitating engagement of medium to higher income work forces, even in China. The UK investment in R&D (1.7%) is only slightly below that of China (2.2%) and China invests a lot more in SFI, SCAD and MRAD which is not recorded but all of which are lower risk than the UK'S fixation with SRAD which is high risk.

Is this a capitalist or socialist policy?Real incomes approach has no such label since it is distinct and the current name, RIO-Real Incomes Objective, spells out its itent and value. It is a real profit and incomes policy based on sound microeconomic principles that promotes beneficial competitive pricing and, in aggregate, impacts the macroeconomy. The inability of both the Conservative and Labour parties to liberate themselves from the stifling and flawed aggregate demand model and the out-dated versions of monetarism and Keynesianism arises from the fact their economic advisers, MPs or ministers, were all trained following the same curricula at university. Over time this has resulted in a phenomenal growth in financialization and an unbalanced economy favouring asset holders and rentiers and prejudicing those involved, or wishing to become involved, in doing something productive on the supply side. After undergraduate and post-graduate economics training at Cambridge and Stanford universities and I initiated the work leading the RIO-Real Incomes Objective in 1975, with some urgency, when I realised with some conviction, that what I had learned provided no practical means of resolving slumpflation without imposing prejudice on the constituency of the country. He therefore sought both a theory and policy solutions that avoided the risk of such prejudice. The fiascos that followed were predictable in 1976 based on the PACM model. The Quantity Theory of Money by has been demolished by the substitute

A Real Money Theory is worth reading. This was further elaborated in his more recent,

"Why monetarism does not work"The party system is unable to escape from this cocooned limited perspective on both theory and policy and adherence to the TINA (There-is-no-Alternative) mantra largely because politicians' survival does not in fact depend on economic logic. It depends heavily on press support. The UK media remain in the hands of those who are paid by the minority of asset holders who also happen to be the financial benefactors of political parties. This closed loop closely aligns the interests of political parties with their financial benefactors leading to as strong tendency to ignore constituency needs. The results are more than apparent in a country where income disparity continues to drown.

Real economic growth can become a natural consequence of policy-compliant operations of economic units and even although there is a general technological trend towards automation of specific tasks. Say's model allows for this in the transfer of such labour to other expanding or new tasks, again, very much a function of entrepreneurial decisions. The maintenance of wages at levels which ensures, at least, an above-living income, and preferably, well above this, to generate consumption-led demand returns to the question of corporate labour relations. The history of UK labour relations is one of poor management by governments leading to confrontation and an inability to recognize the utility of the Say Model as a foundation for macroeconomic management. The question of "labour market" management was overtaken in the mid-1970s as slumpflation led to a false dawn under the name of "supply side economics" which led nowhere. The poor results led to a frustrated financial services sector pressuring to deregulate financial dealings leading to financialization, a good deal of fraudulent dealing and wage-earners those who paid the price of poor macroeconomic policies and a diversion of funds injected under an increasingly dominant monetary policy into assets, offshore investment and offshore capital accumulation to avoid taxation and away from onshore supply side production. The result was the 2008 financial crisis. Rather than cancel debts of supply side companies and individuals the government of the day introduced quantitative easing leading to an exacerbation of the state of affairs for labour and productive investment. This led to the Conservative government, for largely ideological reasons, to lower the role of the government sector to ride on the back of the "independent" Bank of England's quantitative easing to run down public services and to deplete the human resources and number of beds in the National Health Service. Police and fire services were also run down during this period. Close-to zero interest rates led to loss of income of retirees and, at the dawn of the Covid-19 epidemic, creating a state of affairs in this country where the majority of the constituents had no savings were experiencing declining real incomes and who would come to depend on a National Health Service which had been deliberately debilitated by a government's ideological fixations.

Today, the government hopes to avoid paying the price for its disastrous handling of the Covid-19 pandemic with thousands of unnecessary deaths and suffering by pointing to a successful roll-out of the vaccination programme implemented by the National Health Service. The Chancellor has offered a pay adjustment for medical staff which represents a continued fall in employee real incomes; this affront reflects the general lack of concern for the plight of wage-earners in general which is a direct result of inappropriate macroeconomic policies.

By following out-dated policies the government is depleting the potential of this country by enriching those who have no commitment to raising the status of the British economy or the wellbeing of its people. At the same time policy tramples on the conscience and livelihoods of all who understand that the cohesion and value of an economy depends upon a political system that responds to the needs of the majority; the British political economy does not achieve this and none of the political parties have, so far, come up with any credible solutions. As a result there is widespred social stress and suffering.

Fanaticism: extreme beliefs that may lead to unreasonable or violent behaviour: |

|

|

But then what can be expected when a political idol in this country is a person who declared that there is no such thing as society? The inevitable outcome is policies that ignore society and proactively erode fairness and justice. The rationale and policy justifications occur in genteel surroundings and are delivered in a sincere and convincing manner, even involving univeristy seminars and even generating peer-reviewed papers. All of this has turned out to be a case study in the ideological fanaticism of a minority damaging the interests of the majority.

All content on this site is subject to Copyright

All copyright is held by © Hector Wetherell McNeill (1975-2021) unless otherwise indicated