Getting rid of corporation tax

Hector McNeill1

SEEL

This article explains why the focus by political parties on what are the best levels of corporation tax overlooks the positive advantages of getting rid of it altogether. The Real Incomes approach to economics is the only macroeconomic theory that countenances policies that make no use of corporation tax.

Corporation tax constrains resource allocation decision-making and creates a disincentive to the payment of compensatory wages.

An added dimension is that, constitutionally, the support of governance should come directly from the electorate rather than from organizations who have no role in the election, formation or decision-making of governments. |

Political parties make much of their propensities to alter the levels of corporation taxation deploying justifications to support their particular philosophical approaches to economics. I use the word "philosophical" because the current understanding of the role of corporate taxation has very little to do with functioning of an efficient and effective economy. IT is more concerned with bland revenue-raising. The whole notion of company decision-makers jumping through regulatory and accountancy framework hoops and constraining their allocation of resources to maximize profits while minimizing the payment of tax is an absurdity and in fact brought on by the process of government revenue-seeking.

The initial apparent surprise and then real or feined indignation of politicians concerning the fact that many companies are involved in both tax evasion and avoidance is something of a surprise in itself. This is because this has been evolving since the mid 1970s and it is driven by the negative incentives created by the current methods of government revenue-seeking, the accountancy framework and conventional macroeconomic policies (See: The profit paradox, The monetary paradox and The fiscal paradox).

In terms of constitutional economics it makes very little sense to constrain business, the very components of the economy that generate production, income and growth through an accountancy and audit framework that provides an incentive for constraining wages as a means of maximizing profits.

In constitutional terms a more transparent functional model would consider companies and economic activities to be the means of generating income and economic growth measured in terms of the incomes of corporate owners, executives and the workforce, that is, the social constituency. Then the social constituency, through participatory democratic procedures should decide the priorities for any provisions that need to be organized by the state against the knowledge that the social constituency will also have to pay for these provisions on the basis of direct contributions to government revenue through personal taxation. This model is a basic tenet of the Real Incomes Approach where corporate returns are expressed in terms of income and not profit. Since within this policy framework there is no profit category within the accountancy regulations, the contention between wages and profit no longer exists. There being no profits and no corporation tax the issue of corporate tax avoidance also no longer exists.

Beggar-thy-neighbour policies have corrupted business

An important vector in the evolution of non-payment of tax by corporations was the open competition between governments, even within Europe, to compete with one another in the provision of tax breaks and incentives to companies establishing activities with their jurisdictions. The government public relations efforts in this direction are well-produced and convincing. A good example has always been the output of the Irish Development Agency. This helped develop a mode of operation where companies saw the name of the game as playing one government off against the other and governments fell into the trap of doing "deals" to try and ensure a "presence" of large companies on their territories. This established a very unhealthy mode of "cooperation" between business and governments which today has been transformed into Public Private Partnerships. In the 1980s it became apparent that companies were less interested in the "development" aspects of such arrangements and more interested in the tax breaks and grants received. The most notorious examples include the closing down of companies in Ireland immediately after the periods of reduced taxation, provided by the Irish Development Authority2 (IDA), terminated; there was very little real organic and sustainable development. In Northern Ireland John DeLorean set up a car manufacturing plant in Dunmurry, Northern Ireland, close to Belfast. The company was to have set this up in Puerto Rico but decided on Northern Ireland when the Northern Ireland Development Agency (NIDA) offered £100 million in spite of the fact consultants had advised NIDA that it was unlikely to succeed. By 1982, the company had failed.

This questionable behaviour of governments has now become a global phenomenon with big players resulting, under globalization, in the emergence of relative disadvantages for the British economy and the prospects of the British workforce. It is worth noting that the current policy of quantitative easing, so-called, has also become a global phenomenon which has not led to effective investment for development but is intensifying the business logic that leads to the export of manufacturing and industrial jobs off-shore to low income economies.

Completely missing the point

The Organization for Economic Cooperation & Development (OECD) has been working for some 2 years on a "Base erosion & profits shifting" project (Beps) concerned with the identification of new international rules and regulations to prevent the erosion in the tax base and the transfer of profits away from jurisdictions where they are generated. In other words it is concerned with the issue of securing a transparent resolution to the issue of profit shifting between states and is therefore administration-driven.

This has been run within a within the G20 who made use of some tax consultants and the large audit firms to assist them. The Real Incomes Approach recommends that this issue be resolved by eliminating corporate taxation, however, this is clearly the last one that such an interest group would propose. As a result these groups have dilligently created lots of studies and documents which basically justify a continuation of the core national tax systems by tinkering at the edges and patching up more obvious and therefore potentially embarrassing loop holes and leakages. The G20 task forces have generated 15 proposals3 and the OECD final package of measures for a co-ordinated reform of international tax rules which will be discussed, amongst many other things, by G20 Finance Ministers at a meeting on 8 October, in Lima, Peru.

Orders of magnitude

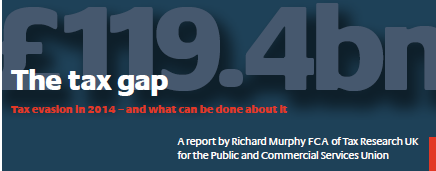

The Beps project estimate of the amounts of corporate income tax (CIT) revenue losses are estimated to be 4% to 10% of global CIT revenue or some US$ 100 billion to US$240 billion or £67 billion to £160 billion. To compare this with the current independent estimate of uncollected tax, tax avoidance and evasion in the United Kingdom4 (whose economy constitutes just 3.7% of the global GDP) is £120 billion made up of uncollected tax (£20bn), tax avoidance (£20 bn) and tax evasion (£80bn). The estimated UK large company avoidance (mainly Beps) costs the UK maybe £5 bn now and offshore (mainly individuals) some £4 to £5 billion5. This sets Beps in perspective as being of less significance, in the UK, that the other sources of distortion or concealment of the true profit status of companies within the national taxation operations are far more significant than Beps, however, an interesting detail is that personal or individual distortion or concealment of the true profit or income status is about the same as corporations. This makes Richard Murphy's report (part of the cover illustrated on the right and referenced below) is particularly significant4. An interesting detail arising from the UK Beps details is that, under a Real Incomes policy regime, it is the personal income of shareholders, owners, executives and work forces that are in fact taxed, under variants of PAYE, so as to minimize evasion/avoidance. This is a topic discussed in a forthcoming article entitled, "Beneficial work contract frameworks".

Decision analysis

This topic requires a rational decision analysis that establishes the objectives of national economic management and then reviews CIT's role in contributing to that objective. The Real Incomes Approach sees the fundamental objective of microeconomic units and of macroeconomic management to be the maintenance or growth in real incomes. As explained in the main text of this article and other articles on this site, the elimination of corporation tax goes a long way towards upholding such objectives.

1 Hector McNeill is director of SEEL-Systems Engineering Economics Lab.

2 IDA-Irish Development Authority underwent a name change to Irish Development Agency in 1994.

3 OECD Beps proposals cover: Action 1: Addressing the Tax Challenges of the Digital Economy; Action 2: Neutralizing the Effects of Hybrid Mismatch Arrangements; Action 3: Designing Effective Controlled Foreign Company Rules; Action 4: Limiting Base Erosion Involving Interest Deductions and Other Financial Payments; Action 5: Countering Harmful Tax Practices More Effectively, Taking into Account Transparency and Substance; Action 6: Preventing the Granting of Treaty Benefits in Inappropriate Circumstances; Action 7: Preventing the Artificial Avoidance of Permanent Establishment Status; Actions 8-10: Guidance on Transfer Pricing Aspects of Intangibles; Action 11: Measuring and Monitoring BEPS; Action 12: Mandatory Disclosure Rules; Action 13: Guidance on Transfer Pricing Documentation and Country-by-Country Reporting; Action 14: Making Dispute Resolution Mechanisms More Effective; Action 15: Developing a Multilateral Instrument to Modify Bilateral Tax Treaties

4 Richard Murphy's estimates available from Tax Research

4 from information supplied by Richard Murphy of Tax Research (UK).

All content on this site is subject to Copyright

All copyright is held by © Hector Wetherell McNeill (1975-2015) unless otherwise indicated

|

|

|

|