Alleviating the Covid-19 economic hardships through DxCs

Hector McNeill1

SEEL

Providing enough liquidity or purchasing power for lower income segments of the population and the unemployed is a challenge, especially under Covid-19. However linking any payments to percentages of salaries or stringent unemployment benefits is an archaic process that reflects badly upon the understanding of what the problem is. Providing enough liquidity or purchasing power for lower income segments of the population and the unemployed is a challenge, especially under Covid-19. However linking any payments to percentages of salaries or stringent unemployment benefits is an archaic process that reflects badly upon the understanding of what the problem is.

In an economic crisis such as that caused by Covid-19 it makes no sense to straddle people with debt, or even advance government funds also raised on debt. Banks need to be taken out of this equation because of the perceived risks causing them to not advance monies where they are needed such as for real investment to raise productivity.

Digital community exchange currencies appear to provide a medium term solution for those most in need but this facility should not end up as modern monetary theory on steroids. |

Most economists and policy makers were trained and have worked in the monetary banking-based finance bubble, that was established centuries ago but which in the last 50 years has led to increasing amount of exogenous fiat currency becoming the basis for "economic growth". The most extreme version of this process is quantitative easing (QE) and close to zero interest rates that has destroyed savings. Savings were the foundation of enlightened capitalism through economies in endogenous money and the use of these funds to invest in real growth through judicious investments that brought advantages in the form of higher productivity, wages and therefore growth in real incomes.

One of the more recent examples of this form of economic growth was experienced between 1945 and 1975 in this country before the slumpflation crisis. Although this successful period was put down to the benefits of Keynesianism, no Keynesian policies were applied during that period. This was confirmed by Robin Matthews' detailed research on this period of steady UK growth.

A similar state of affairs prevailed in the USA as a recent RAND Corporation study has shown.

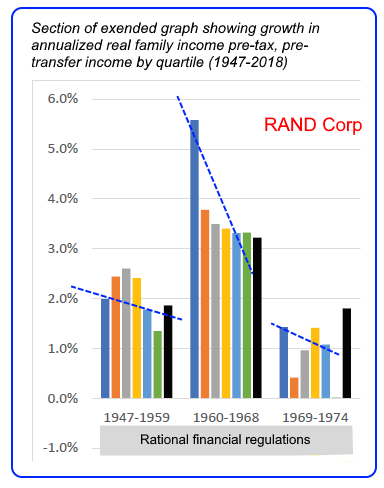

The Rand Corporation report provided an extended graph covering real incomes growth in different income groups between 1947 and 2018. This graph has been split into two distinct periods as shown on the left and the right. A rational period of macroeconmic policies, during which financial regulations helped curb the excesses of the financial intermediation sectors, resulted in increasing equality or a reduction in disparity of income growth as shown by the blue dashed lines in the graph on the left. These lines connect the income growth rates of the lowest income quartile and highest income quartile. So a downward sloping line indicates that the growth rates of real incomes for lower income segments were higher than the growth rates for the higher income segments. This indicates a movement towards a balancing up of income distribution.

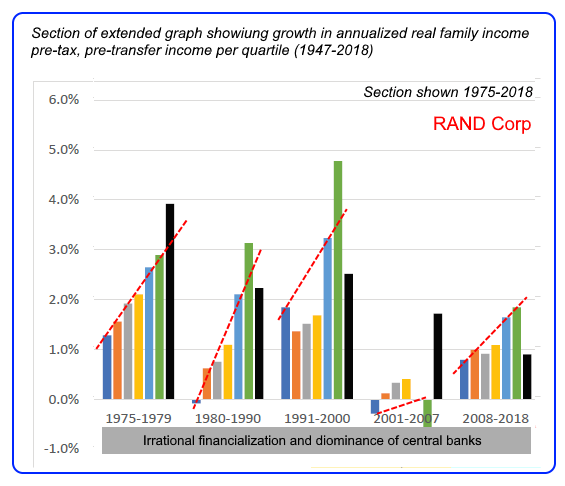

All of this beneficial process went wrong as financialization took hold as can be seen in the graph on the right where the relative growth rates of low and high income quartiles went into reverse shown by the rising red dashed lines.

As all acknowledge now, the last 50 years has been a disaster with respect to the question of income disparity with falling real investment, declining real incomes and almost no real economic growth and rising debt. The decline in real economic growth is also related to the purchasing power of disposable incomes declining so real consumption has stalled, and with this, what monetarists refer to as "demand". Consumption levels are completely dependent on the flow of endogenous funds in the economy. These are the funds circulating within the supply side. Monetarism, so dependent on money issuance based on debt as exogenous funds has created an asset bubble with only reduced funds passing into endogenous cash flows associated with debt or raised costs associated with rent and property purchase prices.

Debt maniaAs a result politicians and many economists see exogenous money or debt as the motor for economic growth and "prosperity". Our most recent 50 years of experience is a case study that demonstrates that this is patently untrue. Most investment does not gain high returns, so debt is something to be avoided. The period 1947 through 1975 was one where savings and equity were of significance in driving investment and economic growth and any loans were based on fractional reserve banking with reasonable high capital reserves held by banks. With quantitative easing, savings have been destroyed and with this the more rational source of growth funds in the economy making individuals and companies more reliant on debt. Even at low interest rates this has not worked because of the diversion of money supply into assets and share buy backs.

Covid-19Because of the "monetarist debt-based mindset" the government only sees debt as the only way of raising funds to "help people" who are unemployed as a result of Covid-19 shutdowns.

ROC Vouchers ROC Vouchers

The Republic of China (Taiwan) distributed vouchers to all citizens born before 31st March 2009 as well as to selected foreign residents married to citizens. The objective was to help stimulate the economy following the financial crisis in 2008. These vouchers were available as from up to a specific date and had to be spent within 6 months. They could not be deposited in banks or spent on gambling/lottery tickets or prepaid cards. The amount distributed was around $86 billion New Taiwan Dollars, roughly $2.8 billion USD. It was estimated that based on the multiplier income impulse, the rise in GDP attributable to this voucher initiative was around 0.75%.  |

|

|

Government is becoming increasingly reluctant to provide funds to support people out of work as a direct result of Covid-19 and companies in a depressed market have fewer funds to support staff or opportunities for growth and to earn income.

Employees are not profit centres so there is no possibility of "management decisions" to result in future profits to contributing to paying back any debts either directly or through taxation and future bouts of "austerity". This might make sense if macroeconomic policies, like those between 1947 and 1975, can assure people that their real incomes will rise.

Digital exchange currencies

Digital exchange currenciesThis is where DxCs come in. DxCs are not debt-based because banks and other financial intermediaries are not in the supply chain. They are simply electronic additions made to individual DxC ledgers identical to the very process used by banks to "create money". This convenient process has been jealously guarded and defended by the banking monopoly over the centuries.

Digital community exchange currencies or DxCs are tokens or vouchers that are accepted in payment for specific requirements. Today, block chain technology makes they secure and better that paper-based equivalents (see box right). However, they can boost the economy through the multiplier effect (See

Real Growth Multiplier). They work like any supermarket bonus point systems and only need an electronic card similar to a credit or debit card to operate and a block chain accounting system that permit real time online confirmation of the amount of money in an individual's "account". This avoids the expensive option of an App on expensive smart mobile phones

Recently, China, which this week passed the USA economy as the largest in the world, is boosting demand and the multiplier effect by surcharging its V-shaped recovery into real growth by issuing DxCs to the value of 10 million Yuan (about £1.2 million) to 50,000 consumers, as an experiment. The objective is to descend a learning curve on how this sort of initiative can be managed; but they would seem to be on the right track. Based on China's very practical approach to digital technology development and desire for real economic growth it is likely that this experiment will be transformed into a wider scale policy framework to boost domestic consumption and real incomes without debt.

SEEL is reviewing DxC options for the UK with a view to avoiding mishaps and abuse of such a system. I will post their findings when they are released.

1 Hector McNeill is the Director of SEEL-Systems Engineering Economics Lab.

2 OQSI-Open Quality Standards Initiative.

2 SEEL-Systems Engineering Economics Lab.

All content on this site is subject to Copyright

All copyright is held by © Hector Wetherell McNeill (1975-2020) unless otherwise indicated