Having taken its form many centuries before universal suffrage, it is not a surprise that the operation of monetary affairs continues to operate over a society still marked by social and economic division. There continue to be a dynamic balance between the way the interests of the advocates of monetary policy are protected while leaving politicians and governments to maintain the conditions of the majority at sufficiently tolerable levels so as to avoid political instability and strife motivated by generally poor economic and social conditions.

As

financialization has advanced as fiat currency-based policies have become dominant since 1971. A period of significant advance in the distribution of incomes and a rises in productivity and real incomes which had advanced between 1945 and 1965, came to a gradual slowdown and halt.

Monetary policy has increasingly used asset prices as an indicator of economic performance while stating that a target rate of 2% inflation constitutes "price stability". However, while 2% inflation represents a currency devaluation of 18% each decade. Monetary policy has maintained a rise in value of assets well in excess of 2% each year through fare higher rates of inflation in asset markets. As a result, the asset-based wealth of a faction of the constituency has constantly risen in value while the majority of the constituency, consisting of wage earners, have seen their real incomes stagnate or decline. Any stability or rises in employment have been counter-balanced by falls in real wages.

The next stage of this process which advanced significantly between the mid 1980s and 2008 was a boom in debt motivated by consumers wishing to maintain their real incomes by using the collateral of their houses, as last resort guarantees, for banks. The notion of "equity release" also developed to place the constituents in an ever increasing debt leverage position related more to the house value as an asset rather than the ability to repay with declining real wages. There has developed a significant debt "over hang" with the inheritance of such individuals being discounted for the debt they still owe on the occasion of their death.

The actual growth in earned real incomes has further stagnated whereas personal debt exposure has increased and increasing amounts of the profits gained by financial intermediaries has been converted into asset holdings. As a result the precariousness existence of wage earners has continued to increase over the last 50 years whereas the wealth of financial intermediaries has increased without incurring much exposure to risk.

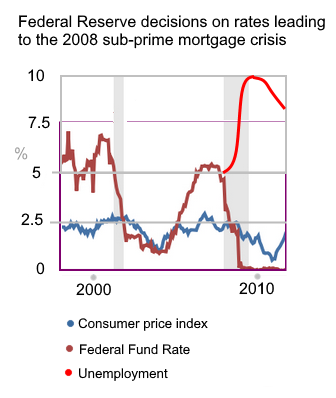

Risks arose significantly between 1990 and 2008 as a result of derivatives becoming a significant bank asset and because of fraud in the ratings assigned to derivatives by rating agencies with interests shared with the banks and intermediaries who had created the derivatives concerned. The Black & Schole's hedging model from the early 1970s introduced a trend that ended up driving markets up as a result of increased activity but this created a mentality that monetary policy could always drive asset prices upwards. This was clearly a basis for the risk of over exposure. The eventual risk associated with this trend can be traced, in art, to fraudulent practices including the advancing loans to low income families with very low or even zero deposits and virtually no due diligence concerning checks on their ability to pay. Most of these mortgages were rolled up into toxic derivatives and sold quickly carrying good or even AAA ratings to unsuspecting banks. When the Federal Reserve raised interest rates during 2004 through 2007, they did so with no understanding of the size of the grey derivatives market risks involved, in spite of the fact that this market was already bigger than the GDP of the country, as was the case in the UK. This led to a squeeze on these mortgage holders, all of the linked derivative assets values began to unravel leading to the sub-prime mortgage crisis. Within a very short time US unemployment rose from 5% to 10% and millions lost their homes and in the UK unemployment rose from around 4% to 8.5% over the same time frame.

Ethics of policy making decisionsGovernments, constituents are led to believe, have an obligation to defend the interests of constituents though adequate laws, just settlements and a process of macroeconomic management that affords all the freedom to pursue their objectives while not preventing others from doing the same. This is only possible when policy does not introduce such a skewed impact as the last 50 years of monetary policies. The ethical question here is of importance because, are we expected to believe that the outcome of monetary policy was "unexpected"? If so, what aspects of the decision logic were wrong? Central banks never admit to the fact that their decision analysis models could be wrong but the outcomes of decisions demonstrate to all that they are. If the outcomes that occur are expected by those taking such decisions, and is therefore founded on a correct logic, why was the intent and the likely outcomes not made more explicit?

Based on the track record of policy statements and outcomes, the reasons are quite simple. The constituency is not expected to have any say in any decision relating to monetary policy and for this reason the more relevant details, for the majority, are not set out and are never explained. On the other hand, the motivation behind monetary decisions comes from the interests of a very small minority of constituents who have some power over the decision making process.

All of these circumstances raise ethical questions concerning the efficacy of the assumed intent and competence of government decisions with regard to the interests of the majority.

Tyranny: Government by a ruler or small group of people who have unlimited power over the people in their country or state and use it unfairly and/or cruelly... |

|

|

Ethical decisions by government, in a constitutional democracy, should be weighted in the interests of the majority while safeguarding the interests of minorities, against harm from majority-imposed decisions. As the track record demonstrates we have evidence of minority interests upheld while inadequate action is taken to safeguard the majority against harm from minority-imposed decisions. Based on the correct definition of the term, this represents arbitrary decisions and a tyranny.

The upholding and safeguarding of the freedom of the individual is of paramount importance. However, the outcome of monetary policy, especially since the introduction of quantitative easing (QE), has been that a minority factional interests have influenced policy to the extend that the outcome has prejudiced not just the majority of wage earners but also has depleted business investment, productivity and real incomes and stagnant wages leading to depressed consumption.

Fundamental abuse of notions of human rightsThe abuse of property rights

Property is an asset owned by someone as a possession. Although usually applied to real estate and land it also includes any asset holding including money.

Monetary policy tends to safeguard the value and continued possession of land, real estate and other assets such as precious metals and shares while arbitrarily abusing the value of money in the form of savings. This is very little different from sequestration or robbery in the sense of causing a loss in value of property held in the form of money while safeguarding other assets. Lower income individuals tend to rely on savings as a way to acquire goods and services or, indeed, other assets, which they cannot afford on the basis of disposable income.

Monetary policy maintains a target of 2% monetary inflation reducing purchasing power by 18% each decade and there is an expectation that rather than saving, wage earners should take out bank loans that are roughly 6% over base rate or raising outgoings on such instruments by 113% over a decade in addition to the 18% caused by inflation. |

|

|

Here we need to look at the logic applied to take monetary decisions. The ethical question here is why does government permit this level of constitutional and economic abuse? There appears to be an unwritten human rights code that provides asset holders with more consideration or enhanced human rights than other constituents, who do not have assets. If we include in this consideration savings, we find that under QE, people have been stripped of their savings and those living on fixed incomes from savings, have had their incomes destroyed. If being permitted to save is not a human right, at least constituents have the expectation that a government has basic notions of the community conscience, related to rational consideration for people's wellbeing. Constituents expect decisions and actions that take into consideration human needs and do not expect actions to be imposed to directly prejudice existing activities, such as saving. The fact that this has "always" been how monetary policy has operated fails to address the constitutional economic questions such abuse raises; the system clearly needs to be abandoned.

It is notable that the negative financial impacts of policy are never considered to be a justification for compensation for policy-induced losses. Voting out a government who has enacted such policies does not solve anything because the next government ends up using the same macroeconomic rule book of flawed theory and practice. In any case the decision-making rests with an "independent" Bank of England so it lies beyond any control of parliament or constituents. It is the theory and practical policy instruments and independence of the BoE that need to be changed.

QE has also undermined the normal expectations of small and medium sized companies, who employ the majority of the constituency, that market conditions will be such as to justify investment and the ability to raise productivity. As a result of QE, a wide range of important investment intents and expectations of raising productivity, has been frustrated. As a result the majority of wage earners and the majority of companies who employ and pay wages to the majority, as the source of funds for consumption in the economy, remain unsupported by economic policy. In stark contrast a small minority of asset holders have not faced such abuse but, rather, have gained significantly from the operation of QE.

In spite of this, more than apparent reality, government has resisted questioning or canceling QE. It continues to impose a continued depressed market and a declining public sector. The bizarre excuse was paying down debt. QE has itself been raising private debt and contributing to conditions that counters economic growth that could have supported government revenue-seeking activities with a faster rate of growth in revenues without the reliance on the static zero-sum spreadsheet approach of national accounts, using reductions in budget expenditures to "balance the books".

As this continues into this Covid-19 crisis, the eventual decline in purchasing power and the reliance of government on QE policy that has discouraged investment in higher productivity during the last decade. The ability of domestic production to produce at unit prices wage earners can afford, continues in a spiral, leading to business failures and falling employment and therefore incomes. The economy's feasible consumption levels decline. As we can see, the "lack of demand" cannot be corrected through more QE; QE is the cause. This hollowing out of the economy has progressed steadily since 1990s and has accelerated during the last 12 years, intensified by QE and cut backs in public services in the name of paying off debt. Clearly the wrong policy when productivity-linked investment was always the requirment. This was apparent long before Covid-19 arrived on the scene. With, or without, Covid-19 this was the always wrong policy for an economy whose constituents needed sustainable growth to maintain wellbeing.

1 Hector McNeill is the Director of SEEL-Systems Engineering Economics Lab.

All content on this site is subject to Copyright

All copyright is held by © Hector Wetherell McNeill (1975-2020) unless otherwise indicated