Covid-19's economic policy audit

Hector McNeill1

SEEL

The simultaneous decline in supplies from China and demand in the West caused by the impacts of Covid-19 have exposed a range of weaknesses in conventional macroeconomic policies. Although it should be noted that the current policy decisions have transitioned from what was conventional, just a decade ago. The new wild card is Quantitative Easing (QE) which has been destructive. The recent reactions by central banks to the emerging Covid-19-linked economic crisis has been more QE. This is a very short term solution to support existential issues on the part of people without substantive financial savings, a legacy of QE itself.

This is not a solution because the transition to globalization over the last 50 years has liquidated the former safeguards in the form of maintaining of strategic reserves of commodities, the maintenance of capabilities and knowhow in strategically important industries and constant focus on applied research and development on prioritized leading edge requirements to address emerging gaps and needs of the constituency.

This article reviews some of the lessons taking form with the Covid-19 as an audit on the state of economic policy.

|

It is now 30 years since I was involved organizing a survey, funded by the UK government, to assess the interest in companies in Hampshire, in establishing a Task Force to review the possibility of reversing the trends in development involving the increase in offshore production in what was to become known as "globalization". At that time it was already apparent that this was leading to a decline in employment and yet the state of robotics at that time was such that a considerable amount of assembly activities could remain onshore. One hundred companies were surveyed, only one showed any interest. When I visited this company the person who turned up at the meeting did not know about the survey and had difficulty in understanding the concepts involved and was unsure as to why the company had sent back a positive response. Even the coffee wasn't that good.

Black–Scholes options pricing model

SEEL-Systems Engineering Economics Lab |

|

|

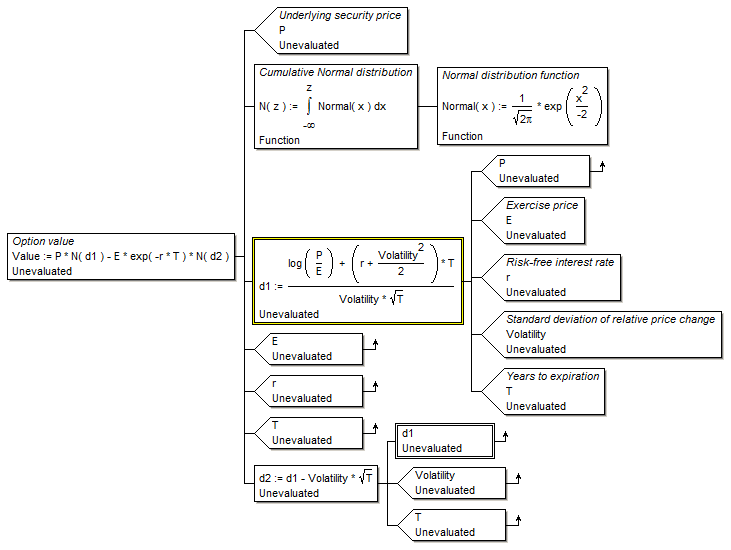

What was less apparent, at that time, was the rapid transition from engineering-based productivity to financial productivity and which today is referred to as the effect of "financialization". This was accelerating (see Financialization). Ten years later the writing was on the wall when some mutual building societies, Such as Northern Rock, became banks and began to sell securities, essentially mortgages rolled up as derivatives to raise funds on the international financial markets rather than rely on mutual member contributions. The lack of resilience was always evident but the financial fraternity had become wedded to the Black & Schole's options pricing model developed in the 1970s which greatly expanded confidence in financialization based on a false notion of lower risk transactions and option holdings as hedges. The lack of resilience was exposed a decade later with the sub-prime mortgage crisis triggering a financial crisis in 2008 during which Northen Rock collapsed. What was less apparent, at that time, was the rapid transition from engineering-based productivity to financial productivity and which today is referred to as the effect of "financialization". This was accelerating (see Financialization). Ten years later the writing was on the wall when some mutual building societies, Such as Northern Rock, became banks and began to sell securities, essentially mortgages rolled up as derivatives to raise funds on the international financial markets rather than rely on mutual member contributions. The lack of resilience was always evident but the financial fraternity had become wedded to the Black & Schole's options pricing model developed in the 1970s which greatly expanded confidence in financialization based on a false notion of lower risk transactions and option holdings as hedges. The lack of resilience was exposed a decade later with the sub-prime mortgage crisis triggering a financial crisis in 2008 during which Northen Rock collapsed.

Misunderstanding of critical path concepts

One of the basic approaches to project planning for investment is "critical paths" and "floats". Critical paths are the sequences of activities that constitute the longest chain in the production process. Floats are allowances for specific activities in the chain to provide some "space" for possible variations in times taken to complete activities. For particularly important projects there was often a "strategic reserve" associated with particularly complex activities consisting of stores of products that might be lacking if there were delays in production/supply. But the cost of carrying strategic reserves was eliminated by what became just in time (JIT) production and supply chains. At the time many experienced engineers cautioned of this level of "optimization" in terms of logistics hid a substantial risk and cost associated that with any production problems the whole JIT system ceases to function with economic and financial implications. The "guarantee" that this would not happen was that JIT supply contracts were quite strict. This did not address the lack of resilience since the risk to the system could some from many events which could not be covered by contracts.

During the Second World War the critical path method was in fact applied, but not under that name, by the Ministry of Supply established in 1939. From the experience of warfare and the lack of supplies resulted in the need for food rationing and strategic stores and reserves became a foundation of supporting the resilience of the system.

As a result of the war having demonstrated the danger of not maintaining a strategic vision, the notion of strategic reserves was projected to encompass policies to promote rises in food production in the United Kingdom, supported by guaranteed farm gate prices, this was supported by operations research techniques to optimize on far allocations through NAAS (National Agricultural Advisory Service) the maintenance of a critical mass of industrial plants to maintain and develop the country's capabilities in "vital industries" and the orientation of government funds towards strategic applied research and development prioritized towards leading edge requirements to address emerging gaps and needs of the constituency.

With financialization, those designing the supply chain configurations became financial experts as opposed to engineers. With the corporations transitioning increasingly to shareholder value concepts the issue of costs of operation became a priority focus. So the notion of strategic reserves became associated with inefficiency and floats were eliminated to support perilously tight JIT schedules.

During the last 20 years, and more emphatically during the decade of QE, the shareholder value, as reflected in the price of shares, has undergone a dangerous transition where share prices no longer reflect corporate production quality, capabilities or future prospects. Share prices, in many cases, only reflect financial dealing based on share buy backs using cheap money available under QE. A considerable amount of QE funding has been routed into assets such as land, real estate and shares as opposed to being routed to where it is needed, the transactional economy for investment in improved technology and techniques to justify rising wages based on gains in productivity (see QE impacts). In fact real wages have declined for almost 30 years. Needless to say private and corporate debt is now higher than it was in 2008. This scenario points to all of the past guarantees for safeguarding an economic system's resilience, such as strategic reserves and maintenance of critical industrial capabilities. Share prices no longer maintain a relationship to the actual productive returns. Onshore productivity and corporate prospects, have evaporated under financialization and its driving force in the form of QE.

Covid-19 has created the very scenario as to why strategic planning, of the sort reviewed, should be an essential component of a healthy mixed economy whose hallmark characteristic is resilience or the ability to weather disruptions of this sort. Those who have promoted financialization both through assertion and policies are those who, in general, do not profess any faith in public services or certain economic activities being in public hands, such as the National Health Service. They prefer to place such activities into the hands of private companies whose general comportment has been described above. Indeed, while QE has helped hollow out the contribution of the corporate sector to the economy and generated a significant level of private debt, a parallel policy of defunding public services, including the National Health Service, has continued under a policy of "austerity". As a result, the same notion of strategic reserves relating to human resources such as nurses, doctors and police and now it would seem, respirators, has been abandoned as a rational tactic to maintain resilience of the economy.

Critically, the last 30 years has witnessed a redistribution of wealth to the executive levels of companies with around 40% of the working population having such low disposable incomes that they do not have any cash reserves. Therefore, even short periods of social distancing, to see the requisite periods of isolation through, will result in families being unable to pay their rents, mortgages and feed themselves. Although China will "come back on line" in the coming weeks the rest of the world is being impacted by Covid-19 which will result in a significant dip in demand. As a result, any recovery will be delayed. Many companies, given their excessive debts will fail and with this unemployment for many will become a semi-permanent feature.

The government response have been insignificant. The Bank of England has lowered interest rates, just another step in the failed QE policy. As always the Bank has used QE to provide the commercial banks with more business as the intermediaries in augmenting the debt of already relatively impoverished segments of the constituency to "help" them get through this crisis. This raises the age old question of the options of QE-for-the-people or helicopter money. In reality, it doesn't make any sense to hand people money, in an existential crisis, on the basis of a loan. It makes more sense to by-pass the banks and hand a budgeted amount to each family and, of course, this will create a level of demand so these funds will to some extent help the cash flow of building societies, landlords, utility companies and shops survive and help maintain core staff in employment in those sectors. The estimate of the corporate sector income arising from this cash donation over say three to four months should then be used, after recovery from Covid-19, to be recouped from these companies as a low Covid levy paid back over an agreed period without interest. To coordinate this the public could be issued with pre-charged debit cards in order to track the value of payment to different companies.

The chaos precipitated by Covid-19 is an unusual, as it was an unexpected, event but it has imposed upon the public's collective view of our governance and policies pursued in this country, a growing realization of this health crisis is being exacerbated as a result of incompetence in policy making and economic management. We don't know if the rise in cases will overwhelm the NHS that already faces a significant human resources deficit and this will result in a wider recognition of the cause being the inappropriate policies this service has endured during the last 30 years. At the end of 2019 thousands of people were dying, associated with delays in Accident and Emergency services caused by depleted human and other resources. Nothing has changed since then and this does not hold out much hope for the handling of Covid-19. It is to be hoped that this will be avoided. However, no matter how we get through this, Covid-19's economic policy audit will be harsh.

1 Hector McNeill is the Director of SEEL-Systems Engineering Economics Lab.

|

|

|

|