Ludwig von Mises' calculation and knowledge problem revisited

Hector McNeill1

SEEL

In 1920 Ludwig von Mises was one of the few asking how a socialist pricing system would work in practice. Mises reasoned in his essay, In 1920 Ludwig von Mises was one of the few asking how a socialist pricing system would work in practice. Mises reasoned in his essay,

"Economic Calculation in the Socialist Commonwealth"

that the socialist system was unlikely to operate effectively because it could not distinguish more or less valuable uses of social resources, and predicted the system would end in chaos. von Mises summarized this as a "calculation and knowledge problem" in relation to socialist policies.

His argument has held up over time.

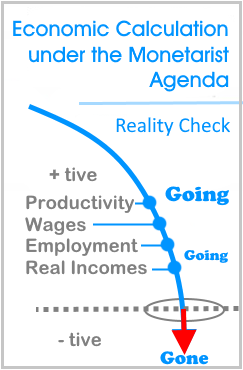

However, the same argument can now be leveled at the current operation of monetarism and central bank policies which face exactly the same calculation and knowledge problem and for this reason the current form of monetarism is creating chaos.

|

Ludwig von Mises' essay, "Economic Calculation in the Socialist Commonwealth" 2 was written just over a century ago. In the meantime many would claim the demise of the Soviet Union some 70 years later, proved his point. However, the intervening "socialism" of post-war Britain was not chaotic but between 1945 and 1965 the economy grew well, real incomes and productivity rose and income disparity declined. On the other hand, what of China? This increasingly "successful" economy represents a version" of socialism not contemplated by von Mises.

I must admit that reading this essay, just this week, it is a disappointing read since what is stated, most would agree, constitutes parts of economics course content. However, at the time of its publication it probably made quite an impact.

Apparatchik: were professional functionaries of the Communist Party of the Soviet Union holding positions of administrative, analytical or political responsibility; higher positions were referred to as nomenklatura |

|

|

Mises does not refer to the "party corruption" that sits on top of any political system with party apparatchiks and leading party members benefiting from better income and life style that those they purport to "represent". As a result Mises does not mention the possible quite serious constitutional problems associated with powerful private interests gaining control of political parties. This is effected through funding of parties and control of the media in order to bring about policies to favour their interests. Thus, such people operate on the same basis as the "socialist"system apparatchiks and the party leadership and ministers in government acting as the nomenklatura acting on behalf of their benefactors.

Therefore Mises probably could not have imagined the transitions that occurred after publication although he died in 1973 just after Bretton Woods failed and before the slumpflation crisis. Following this crisis there were major changes in finance, monetary policies and banking creating a set of circumstances that witnessed an transition to an environment bedeviled by serious "calculation and knowledge problems" facing international finance and monetary policy.

Indeed, von Mises does refer to the dangers of creating a single central bank under a socialist regime where he states,

| "Once the banks merge into a single bank, their essence is wholly transformed; they are then in a position to issue credit without any limitation" |

He also makes a very important observation concerning banking under socialism but describes the state of affairs that has emerged under the current regime of continuous relaxations of financial regulations.

| "If all banks are nationalized and amalgamated into a single central bank, then its administrative board becomes "the supreme economic authority, the chief administrative organ of the whole economy"" |

It does not take much reflection to realize that the Bretton Woods agreement collapsed because of a major calculation and knowledge problem on the part of the collaborating countries while the specific actions being taken by the USA in balancing up gold with dollar issuance were unknown until it was too late in 1971. Bretton Woods appears to have been a platform for the USA to get rich quickly while producing less and less. Their "competitive advantage" was the fact they could print the money. For example, as the lead reserve currency, the entire world would need dollars to finance world trade. What is somewhat amazing is that in these largely closed discussions, few appeared to appreciate the full extent of the benefits Bretton Woods was bestowing on the future power of the USA. The best summation of this new Imperial Preference model but applied to the notion of the dollar as an international reserve currency was made by Barry Eichengreen who explained,

"It costs only a few cents for the Bureau of Engraving and Printing to produce a $100 bill, but other countries had to pony up $100 of actual goods in order to obtain one." |

The development of options and derivatives created a grey market which, for governments and central banks, represented a calculation and knowledge problem concerning its size, reaching multiple of GNPs and precarious state, exacerbated by fraudulent activities. Quantitative easing post-2008 has an even greater calculation and knowledge problem associated with a failure to track the differential volumes of money flows into offshore investment and assets at the expense of the productive economy. As we know the outcome of the domination of macroeconomics by monetarism has been falling productivity and wages, employment stagnating with declining real incomes.

1 Hector McNeill is director of SEEL-Systems Engineering Economics Lab

2 Copies of "Economic Calculation in the Socialist Commonwealth" can be downloaded from the Mises Institute website here

All content on this site is subject to Copyright

All copyright is held by © Hector Wetherell McNeill (1975-2021) unless otherwise indicated

|

|

|

|

|