IntroductionIn the light of the causes of the 2008 crisis, the ongoing deterioration of the UK economy under quantitative easing and the very high differentials in advantages gained from policy by different sections of the community, there is a need to understand how we have arrived at this point. This is not just a UK phenomenon, it is global. Therefore it is as well to try and identify the mix of sound or dubious policy practice. In particular, with the call for a new Bretton Woods it would be useful to understand why this went wrong and how its promise misled most with regard to its likely impacts on the world economy.

Some associated facts of relevanceIn 2014, the Bank of England published an interesting explanation of how banks credit accounts to create loans (debt), i.e. essentially out of thin air ( See,

"Money creation in the modern economy" ).

However, for something like over 400 years similar process had been in place, generally not well understood by the general public with such financial procedures being somewhat of a mystery. The general workings of banks tend to have remained outside the immediate concerns of the population or even companies whose primary interest has been to borrow money at a favourable rate of interest.

Imperial preference

Up until the early 20th century the British Empire and Britain were dominant “economic forces” on the world stage. For hundreds of years various versions of an "Imperial Preference" policy had operated between trading partners in the British Commonwealth to be able to gain trade surpluses and economic growth. Although containing preferential sections it was considered to by many to constitute "free trade" within that select community of nations and colonies. At the Commonwealth Conference on Economic Consultation and Co-operation in Ottawa, Ontario, Canada held in 1932, in response to the Great Depression it was agreed to implement a policy of Imperial Preference for five years. This was based on the principle of preferences for home producers first, empire producers second, and other producers last.

In the middle of depression this policy appeared to US administrators to constitute a beggar-thy-neighbour policy. It also was a demonstration of the relative lack of leverage the USA had internationally as a result of not possessing an "Empire".

Empire preference relied on the willingness of those Commonwealth partners to hold sterling as their reserves. In this way the banks could issue paper credit and loans (with no gold in sight) and this money could be used to obtain raw materials on the cheap to be used by manufacturers etc. There was a “recycling” but the balance, in terms of use of resources, very much to the advantage of the British economy.

What was not taken into account was that such transactions, as significant population rises in Commonwealth countries occurred and the normal process of economic development proceeded, was going to result in the British economy not being able to trade in sufficient volumes, in relation to the national needs of its partners, to avoid the problem of Commonwealth countries cashing in their pounds sterling for gold. There appears to have been an underlying assumption on the part of authorities and the Bank of England was that Commonwealth members would not ask to convert their pound sterling holdings into gold.

United States strategy

What could be interpreted as a fraudulent monetary scheme, by some, enabled Britain to appear to live beyond its means for quite some time. With so much capital in circulation there was effective development of many technologies and many foreign entrepreneurs saw Britain as the place to convert their inventions into future income streams.

Having understood that much of the extraordinary growth of the British economy since the eighteenth century was driven by this system, where it was assumed that the main financial costs were paper and mint operational costs (fractions of a penny per pound sterling) and the ink and time required for bank clerks to enter large loan values in pounds sterling in leather bound ledgers, one of the objectives of the USA, according to Rickards, was to get rid of the Imperial Preference and with the dollar-gold link as “the international reserve currency”, to undermine sterling and the prowess of the British economy. The alleged objective of the USA strategy was to create UK trade deficits as a result of Commonwealth counties demanding gold in exchange for their accumulating pound sterling holdings.

It is necessary to place this concept of how the British system had benefited Britain from Imperial preference to understand the said strategic objective of the USA. Their purpose, therefore, becomes one of emulation of this model to gain advantage for the the USA through the subsequent shaping of the Bretton Woods accord.

Exceptionalism in perspective

In 2015, President Obama declared,

"I believe in American exceptionalism with every fibre of my being.""

Exceptionalism relates mainly to how things are carried out and achieved. Such a declaration could have been made by a Chinese leader in the times of Adam Smith or of England during the industrial revolution or Britain in the mid 19th century when many foreign inventors went there to transform their products into world-beaters. These truly exceptional events have evolved as a result of individuals migrating to where there is sufficient spare cash for finding people and even governments to support such innovations.

In 1849 Prince Albert, president of the Royal Society of Arts, organized an international exhibition in the Crystal Palace on May 1, 1851.

The Great Exhibition, Crystal Palace, London 1851Some 14,000 exhibitors participated, nearly half of whom were non-British. France sent 1,760 exhibits and the United States 560. Among the American exhibits were false teeth, artificial legs, Colt’s repeating pistol, Goodyear india rubber goods, chewing tobacco, and McCormick’s reaper. Popular British exhibits included hydraulic presses, powerful steam engines, pumps, and automated cotton mules (spinning machines). More than six million visitors attended later international fairs and exhibitions that likewise were housed in glass conservatories, the immediate successors being the Cork Exhibition of 1852, the Dublin and New York City expositions of 1853, the Munich Exhibition of 1854, and the Paris Exposition of 1855. With the transformation from a British world of Imperial Preference to one of USA Preference, naturally the location of such innovations migrated from Britain to the USA. One specific advantage was the large "internal market" in the USA which could accelerate take up of new inventions. Silicon Valley grew based on largely inputs from well qualified foreign migrants, just as had been the case in Britain. Today, in spite of current appearances the new centre for innovation and exceptionalism is China who register more patents each year than any other country (without the supposed stealing of technology) and their domestic market is 4-5 times that of the USA and 3-4 times that of the EU, for mass produced goods including electronics. The distinct difference between China, on the one hand, and Britain and the USA on the other, is that current Chinese innovations are becoming increasingly "home grown" and based on the work of Chinese nationals without the involvement of significant inputs from foreign migrants. This distinction is, in itelf, execeptional. It is also worth noting that "foreign investment and entrepreurship" moved from the UK to the US in the period 1900 to 2000 and is now, motivated by Covid-19 and the falling value of the dolllar, directed towards China. This is likely to be a growing phenomenon.  CCTV Building, Beijing, China. CCTV Building, Beijing, China. |

|

|

Bretton WoodsBretton Woods was an attempt to reshape the economic development framework of the world economy following the war that ended in 1945. The USA essentially wished to apply the British Imperial Preference model as a new USA Preference model based on the dollar and extended to "collaborative nations". During the Bretton Woods negotiations there was an intense rivalry between the UK and the USA. However, much of the negotiation involved academic discussions on options for currencies when what should have been happening was for the British contingent to explain to other countries where this was going to end up. The problem is the general potential dangers were not fully taken on board.

The USA refused to accept John Maynard Keynes' far more rational and balanced proposal for the Bancor, a proposal for a more neutral international currency, less dominated by any particular national currency, which he had developed with Ernst Schumacher.

Therefore, it is alleged that amongst the strategic objectives of the USA were to use Bretton Woods to reduce the influence of Britain and pound sterling as a reserve currency on the international stage by undermining the remaining benefits of its remaining empire, through GATT operations, as part of the Bretton Woods deal, undermining Imperial Preference and with the dollar-gold link becoming the central kingpin of the new international financial system and eventually replacing sterling.

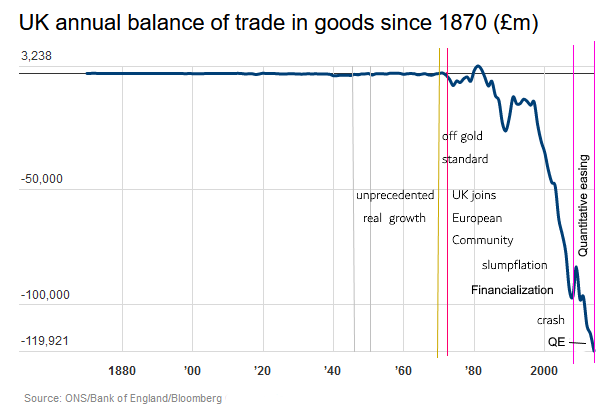

Certainly following Bretton Wood, after a delay, the UK began to develop persistent UK trade deficits.

Contemporary analysisRobert Triffin (1911-1993), while not being able to make use of the demise of the British Imperial Preference as a case study, because it had not taken place at that stage, explained in 1959 that the dollar, as a national currency, was unsuitable as an international reserve currency because of the significant benefits bestowed on the country concerned as well as the practical difficulties of managing domestic needs with the needs for the reserve currency of other countries. He predicted that this setup would fail. Basically the size of the USA economy, in spite of its relatively large and expanding size, would be unable to embrace the potential growth needs of the world economy. For example, as the lead reserve currency, the entire world would need dollars to finance world trade.

What is somewhat amazing is that in these largely closed discussions, few appeared to appreciate the full extent of the benefits Bretton Woods was bestowing on the future power of the USA. In 1959 Triffin's opinions were ignored, the actual risks facing the USA were not fully understood. The best summation of this new Imperial Preference model but applied to the notion of the dollar as an international reserve currency was made by Barry Eichengreen who explained,

"It costs only a few cents for the Bureau of Engraving and Printing to produce a $100 bill, but other countries had to pony up $100 of actual goods in order to obtain one." |

The rise of the American EmpireWith the USA seeing unprecedented economic growth "on the cheap", based on the dollar international reserve currency status. By 1965 the USA, based on Eichengreen's notion of the resources used for countries to "pony up" products the USA ended up consuming" 65% of global resources.

This was a fact not lost on the earliest seminars, work and reports concerned with planetary survival carried out at in the series "Population and Food Supplies" initiated by Cambridge University in 1966-67 and taken up by Stanford University in 1968-69 and then MIT with the publication of the Club of Rome , "The Limits of Growth" in 1972.

Increasingly countries accumulated dollar reserves believing in the US commitment to convertibility into gold. This of course was the same situation Commonwealth countries had experienced with respect to the British pound but on a global scale.

The unstable craft in an increasingly choppy seaHowever, by 1971, just 25 years following its creation, the Gold Standard was under pressure because increasing numbers of countries were cashing in their dollars for gold. To try and stop this drain on gold reserves, in 1971 delegations headed by U.S. Treasury Undersecretary Paul Volcker and Federal Reserve Board member Dewey Daane of the Richmond Federal Reserve Bank, did the rounds trying to dissuade European counties, such as The Netherlands, from cashing in their dollars for gold. In private conversations, while never admitting the USA did not want to honour its obligations, the offending bank governors, such as Jelle Zijlstra president of the Dutch central bank, was accused by Volcker of "rocking the boat". Zijlstra observed that,

"If the boat is rocking because we present $250 million for conversion into gold or something that can be considered an equal asset, then the boat has already perished." |

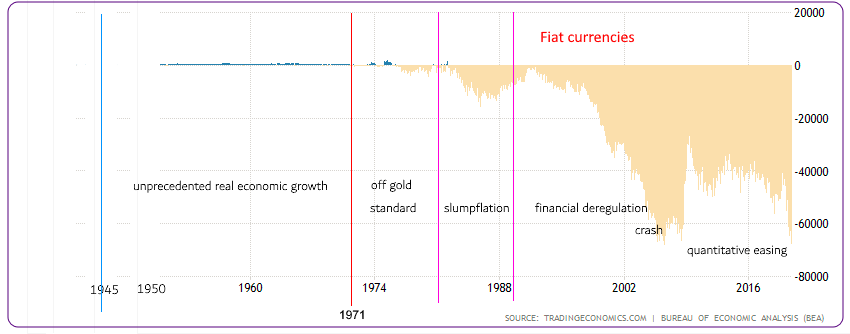

However, Triffin's predictions proved to be correct because with global economic growth the USA was not able to settle the accounts between countries on the basis of a Gold Standard. As a result, when the USA faced this crisis in the run up to 1971, with several countries requesting settlement of dollars held in exchange for gold. As a result, the Gold Standard collapsed when Nixon removed this obligation. Up until 1971 the USA's competitive position meant the trade balance had remained in equilibrium but the implications of coming off the Gold Standard became serious as, coincidentally, increasing numbers of countries, such as Japan in several goods and in particular consumer electronics, were beginning to produce more competitive products than the USA so the trade balance of the USA rapidly became negative in the 1980s and the locking in of dollar and other currencies to a standard collapsed, the USA began to lose what had been a competitive advantages in some industries. Now with no benchmark in a sea of floating fiat currencies the USA and the UK rapidly lost their global "competitive positions" in industry and manufacturing.

Unanswered questionA question that was never raised at the time was why in fact the USA was running out of gold. The whole notion of the gold standard required conversions into gold to maintain trade balance and stability in relative exchange rates. The reason why small amounts of gold conversion was causing delegations from the USA trying to dissuade countries from cashing in their gold was that the USA had been issuing too many dollars without building their gold reserves. Whereas such situations can be transitory and based on timing of administrative decision cycles, it appeared that this had become systemic and the inevitable result of an intentional "strategy" or inadvertent result of poor management discipline. In other words it appears that they had been behaving the way that gave credence to an intentional strategy based on a known or imagined behaviour of the Bank of England during the colonial period to gain national "advantage" at the cost of the rest of the world. By countries requesting gold, this only exposed this failure of the USA to uphold its obligation under the gold-standard and as providers of the international reserve currency. The very strategy it is alleged was being applied to undermine British power had backfired.

From a national strategy to mutual suicide pactIn basic terms, the US strategy to undermine the power of Britain in a desire to become the world's dominant force backfired to become a pathetic mutual suicide pact under Bretton Woods. Both the UK and USA, in reality maintained some competitive industries so that when the slide began in 1971 the UK's balance of payment dived first to be followed a decade or so later by the USA.

By the mid 1980s in the middle of the slumpflation crisis Japan and several other countries were producing competitive products and UK and US corporations were causing declines in their national competitive positions by opting for offshore production, largely in South East Asia. As can be observed the USA decline was put off by the slumpflation crisis linked to the rapid rise in international petroleum prices creating the notion of "recycling fiat dollars" from the Middle East with the US being quick to introduce the quotation of international petroleum prices in dollars ("petrodollar") creating a multi-billion dollar trading activity benefiting specifically US traders (Nymex) and economy.

One of the slightly odd decisions made by the UK was to abandon the Commonwealth country interests in joining the European Community (EU) in 1973 largely on the basis that this would be the largest single global market.

The Petrodollar

The PetrodollarThe massive increases in the price of petroleum led to the decision to quote and trade petroleum in dollars. This was because the trade deficit was rising rapidly in the USA and switching to the petrodollar gave the US breathing space to circulate dollars based on an imported item of significance. This was to avoid the Triffin trap. However within a decade, the loss of position of USA economy turnover compared with that of global currency needs meant this tactic lost effect and US trade deficits rose sharply.

US Trade deficit 1945-2020

The principal Bretton Woods institutions

The principal Bretton Woods institutions

The IMF and World Bank operate with with significant decisions being overseen and vetted by the US State Department. The typical outsized WB loans combined with insufficient absorptive capacity of most low income countries led to waste and opportunities for corruption. By the 1990s the performance of World Bank loan portfolio came under closer scrutiny and results circulated in an internal report. This showed that something like 35% of loans were failing. In the case of agriculture, the figure was 45%. Some loans were authorized to pay off outstanding loans. The WB regulation (Operational Procedure) that all loans were required to be subject to economic rates of return estimates before receiving approval was shown to have been abandoned with only around 20% of approved loans having had Cost-Benefit Analyses. In another report by the WB Evaluation Group, in spite of the "reorganization" that took place in the mid-1990s only confirmed in 2010 that the state of affairs remained the same.

The result of over 75 years of development under the Bretton Woods framework instituional guidance, we find a world characterized by rising income disparity, declining production and consumption sustainability and an accelerating climate crisis. No one can deny the overall rise in income levels worldwide but the efficiency of this process has been lamentable.

The WB has published such analytical reports and yet the flow of authorized projects without effective economic appraisals has continued to a grand total exceeding $400 billion over the last decade. It is odd that such reports can be published and yet nothing is done to correct the situation. This required decision by senior management. However the senior managers are themselves compromised by having to work closely with a WB Board made up of government representatives and politicians from Member States. Most of these individuals do not want close audits or economic appraisals that might cast doubt on the efficacy of their preferred projects. As a result, senior management is aware of the fact staff are not completing economic rates of return analyses as required, but allow this to continue to make their own life easier in the political sphere.

The denial of reasonable expectations turns dreams into nightmares

An IMF Global Financial Stability Report (October 2014) pointed out that low interest rate policies under quantitative easing were exacerbating instability by creating a global imbalance with too much risk taking in asset positions as opposed to investment for growth according to José Viñals a financial counselor of the IMF in Washington. Risks to global stability were stated to no longer come from conventional but from the so-called shadow banking or grey financial market in which hedge funds, financial market funds and investment banks participate and who are not dependent upon savings deposited from the public.

The IMF had analyzed 300 large banks that hold something like 40% of total bank assets in developed economy all of which lacked adequate critical mass to provide credit for investment for recovery. In the Euro Zone this precariousness affected 70% of the banking system. There has been a massive rise in financial transactions within the grey financial markets where low interest rates are providing a direct incentive for investors taking higher risks in asset investments leading to significant liquidity risks on par with 2007 compromising the current state of global financial stability.

"The dreams of reason produce monsters...", from Francisco Goya's Capichos ©Museo del Prado, Madrid. |

The IMF Report considered the prolonged period of very low interest rates to be building up a high risk status for the economy and the likelihood of a new financial crisis by encouraging excessive risk taking on global markets. The IMF Report went further in classifying the character of the growth in financial positions to be speculation. To clarify this point, work at SEEL has identified the massive transfer of funds into assets as the main problem draining funds from supply side productive investment. Assets under conditions of low interest rates and quantitative easing is an easy way to make money by simply directing more money into these markets to raise prices.

It is now twelve years since the disastrous WB performance report and seven years since that IMF report and no substantive action has been taken. Quantitative easing has continued with a vengeance, promoting global income disparity, debt, falling sustainability an accelerating climate change.

The price of gold

The price of goldThe switch from a gold-backed monetary system to a fiat system did raise questions on the likely rise in the price of gold as a safe asset as fiat currencies inflate and lose their purhasing power. Concern about this was reflected in a communication between the London Gold Pool and the Federal Reserve in the USA in 1974. This pointed to the ability of futures trading in gold to create "paper gold" where the price could be manipulated downwards and maintained so as to "stabilize" the gold price. This, in fact, is what has happened. The occasional regulatory cases against big banks for gold price manipulation result in minimimal fines, easily covered by the next period's gold price manipulations. Indeed such abuse, including the widespread fraud leading to the 2007 collapse, is closely related to the extremely lax "light touch" financial regulations where sanctions, in the form of fines, are so tiny, compared with the gains secured through fraud, that they pass for no more than a minor additional cost of doing business.

The price of BitCoin

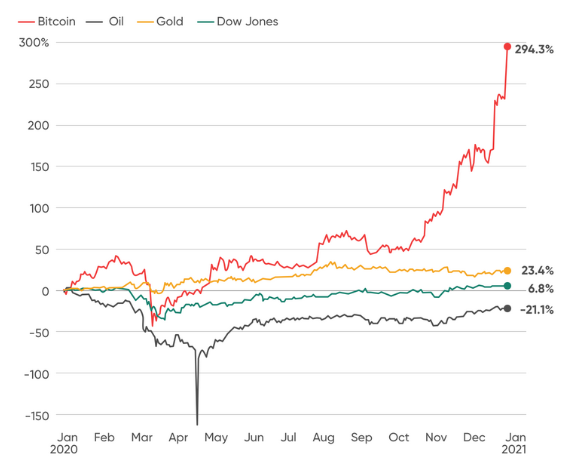

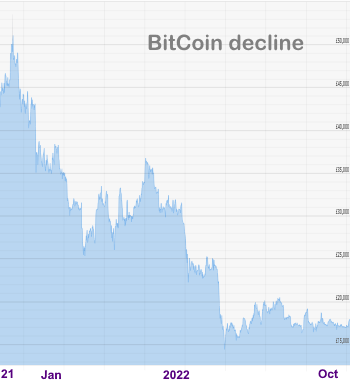

It is notable that recently, the accelerating detereoriation in currency purchasing power and Bitcoin's distributed characteristics and inability of central banks to control its price, has resulted in Bitcoin initially becoming the indicator of fiat currency values (see graph on left). However, larger institutions are now attempting to control the price of Bitcoin through large transactions. The Bank of England officials and the European Central Bank's Christine Lagarde have, of course, warned people about the risks involved in cryptocurrency investment while avoiding any discussions on the impact of central bank policies on the continued currency devaluation, speculative encapsulated markets and rising income disparity.

As in the cases of gold price, manipulation by some very large operators have brought the price of cryptocurrencies down during 2022, in order to kill off this central bank independent currency option (see right). The lax talk of this being "market forces" avoids the fact that such changes are market manipulations by financial intermediaries with a specific political intent of keeping governments and monetary policies on side.

Extra-constitutional impactsThe notion of a democratic constitutional economics that responds to the needs of the state, communities and the individuals through a process of participatory democracy and public choice, is but a romantic notion. Market manipulation and the media are used to ensure that governments take policy actions that support the financial asset sector. This is possible because of the massive size of hedge funds who control financial assets whose total value exceed national economy turnovers. As policy options remain limited to monetary and fiscal policies as opposed to sensible industrial and manufacturing policies that provide good returns, this extra-constitutional manipulation of government policies will continue. As a result supply side productivty will continue to decline along with real incomes for the majority of constituents will fall, while physical and financial asset holders and traders, a factional minority, will continue to concentrate their wealth. The majority are not represented because governments are beholden to "market forces" which far from an expression of fee markets are the result of manipulation under the control of a small minority of constituents.

The Bretton Woods momentIt is necessary to open up the discussion on the topic of a new Bretton Woods by exposing what went wrong and whether or not national strategies corrupted the system. It seems to be certain that basing a new system on any particular national currency is a certain losing proposition. Statistics and careful analysis will be able to establish the actual truth behind real or imagined strategies of printing excessive paper while not converting national excesses to gold. 1971 was a watershed moment in the trust the international community had in an "international system" which has slowly broken down further as a result of the fiat currency system and rampant financialization culminating in quantitative easing proposed as a solution to the 2008 financial crisis.

Policy makers have been failing now for 50 years because they are unable to rid themselves of the notion that economic management depends on monetary policies when the real problem is what has been ignored for the last 75 years of sustaining the real incomes of the majority through raised productivity and stable employment sustaining or raising real incomes. Schumpeter's view of profits as being "...

the guarantee of future employment and sustained operations" is very far from the outcomes of prevailing policies.

Any attempts at change will have to take place in a forum where no one will accept the notion of any particular country holding any advantages over others. There is also likely to be resistance to central banks having the final word. With China overtaking the USA as the largest economy and manufacturer in the world and the proportion of the world's population to be found in the BRICS countries approaching 50%, any realistic future "negotiations" require changes in both economic theory and practice which reflect this emerging reality.

1 Hector McNeill is the Director of SEEL-Systems Engineering Economics Lab.

2 Monetarists are never able to provide a clear explanation of the functional mechanism of how money volumes influence inflation. Milton Friedman a leading proponent of this approach was equally unable and during the 1970s his default explanation was that "

it happens in the long run"; this is not an explanation of the mechanism. But we now have the benefit of hindsight based on accumulating evidence. We are now beyond the long run after Friedman made this statement by some 30 years and it has turned out not to be the case. 64 years ago Friedman also stated that as money volumes rise so does velocity (V) and, once again, this is not the case under QE.

It is instructive to observe that hindsight and a trail of evidence has proven the Real Incomes position established in 1976. This is that inflation is not caused by money volumes but by individual price-setting of companies, usually in response to rising costs leaking from speculative encapsulated markets such as land and real estate and some commodities where inflation is taking place as a result of excessive speculation fed by excessive fund injection into the economy.

Updated to reflect current state of understanding of events: 27th October 2022.

All content on this site is subject to Copyright

All copyright is held by © Hector Wetherell McNeill (1975-2022) unless otherwise indicated